- Home

- Todays Market

- Indian Stock Market News November 13, 2017

Sensex Ends Day in Red; Metal Stocks Lose the Most Mon, 13 Nov Closing

After opening the day flat, Share markets in India witnessed selling pressure and are ended the day in red. At the closing bell, the BSE Sensex closed lower by 281 points and the NSE Nifty finished down by 97 points. The S&P BSE Mid Cap finished down by 0.1% while S&P BSE Small Cap finished up by 0.1%. Gains were largely seen in consumer durable stocks, capital good stocks and bank stocks.

Asian stock markets finished mixed as of the most recent closing prices. The Shanghai Composite gained 0.4%, while the Nikkei 225 & the Hang Seng fell 1.32% and 0.1% respectively. European markets are mostly lower today with shares in France off the most. The CAC 40 is down 0.3% while Germany's DAX is off 0.2% and London's FTSE 100 is higher by 0.1%.

Rupee was trading at Rs 65.01 against the US$ in the afternoon session. Oil prices were trading at US$ 57.30 at the time of writing.

In news from stocks in the banking sector. Axis Bank share price ended the day on a weak note after hitting a fresh 52-week high in the day as the bank unveiled capital raising plans.

The private lender's board of directors on Friday agreed raising of Rs 116 billion through the issue of preferential equity shares and convertible warrants to Bain Capital, Life Insurance Corporation of India (LIC) and others.

Axis Bank said that its board has given its approval for a proposal to raise equity capital from the market at a time when the spotlight is on worsening asset quality. The board approved plans to raise capital worth Rs 116.2 billion by issue of equity of equity linked securities on a preferential basis, by the way of a 9% stake sale to Bain Capital and other investors including LIC.

Last week, various media reports highlighted the bank was looking to raise as much as US$ 1 billion from a group of investors after an increase in bad loans. The reports have named U.S. group Bain Capital, Singapore state investor GIC and Canada Pension Plan Investment Board among potential investors.

The capital raised will bolster the capital adequacy of the Bank, thereby providing growth capital for the core business of the Bank and its subsidiaries. This will also help resolve some of the NPA (non performing assets) issues the bank has been facing recently.

India near bottom of global NPA list

India is going through a severe bad loan problem. Major banks have reported poor numbers in the recent earnings season.

Most banks both public and private, have witnessed asset quality pressures which have impacted their profitability and loan growth. This has raised concerns over the end of the bad loan saga.

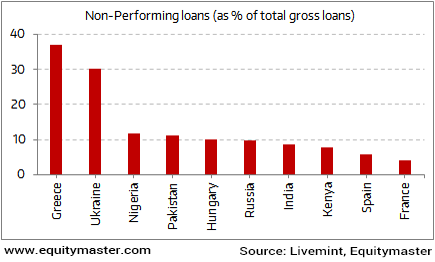

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

Out of the ten major economies facing NPA problems, India is ranked seventh.

Further, according a leading financial daily, a comparison of the NPAs of 25 large Asia-Pacific banks shows that the large Indian banks have the worst NPA ratio when compared to their large cap peers in the region. For FY16, India has been the worst performer with NPAs of 4.6%. Thailand has been the second performer with NPAs of 3.2%.

The overhang of bad debts has not only hit their profitability, but has also restricted their loan book growth. Given the scale of the bad loan problem, the bankers may remain cautious in granting new loans and approving new projects. This may delay India's investment cycle.

Moving on to news from the steel sector. Exports of finished steel were up by over 45% in October as compared the same period a year ago. The overall exports of finished steel stood at 0.78 million tonnes during October 2017, as compared to 0.54 million tonnes in the same month last year, according to Joint Plant Committee's latest report.

Export of total finished steel was up by 57.7%in April-October 2017 at 5.6 million tonnes over same period last year. However, on month-on-month basis, export in October 2017 at 0.78 MT was 30% lower than 1.1 million tonnes in September this year.

On the other hand, the imports grew 11.5%to 0.6 million tonnes in October this year from 0.54 million tonnes in the same month a year ago.

The governmet has various proposals and measures such as anti-dumping duties on exported steel which protect the domestic steel industry.

The government's proposal to give domestic steel makers a preference in government projects should protect them from cheaper imports. But in the meanwhile, the steel makers are chasing imports out by ramping up production.

While exports have consistently gone up, the bigger concern is weak consumption growth. The consumption data over the past few months clearly show that there are no takers for domestic steel. So steel makers have been forced to export more, with overseas shipments rising.

We do not think the trend is sustainable. And unless domestic consumption picks up, steel producers may have to take price cuts to utilize their capacities.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends Day in Red; Metal Stocks Lose the Most". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!