- Home

- Todays Market

- Indian Stock Market News November 14, 2017

Sensex Trades on a Volatile Note; Capital Goods Stocks Top Losers Tue, 14 Nov 01:30 pm

After opening the day flat, Share markets in India witnessed volatile trading activity and are presently trading in red. Sectoral indices are trading on a mixed note with stocks in the consumer durables sector and auto sector witnessing maximum buying interest. Energy stocks and capital goods sector are trading in the red.

The BSE Sensex is trading down by 62 points (down 0.2%) and the NSE Nifty is trading down by 30 points (down 0.3%). The BSE Mid Cap index is trading down by 0.3%, while the BSE Small Cap index is trading down by 0.2%. The rupee is trading at 65s.44 to the US$.

In news from the PSU sector. According to an article in a leading financial daily, the central government is turning to state-owned enterprises to make up for the shortfall in revenues.

The article notes that the Finance Ministry assessed the financial health of 14 state-owned firms and asked 12 of the companies to payout between 30% and as much as 100% of their FY17 or FY18 net profits in dividends, share buybacks or bonus issues. Two companies were exempted.

The government has often used dividends from state-owned firms as a means to meet the fiscal deficit targets.

India's central budget is under pressure this year following an unexpected slump in economic growth, which saw GDP (gross domestic product) growth, slip to its lowest level in three years.

As of September, the half-way mark for the fiscal year, the budget deficit had reached over Rs 5 trillion or more than 91% of its full-year target. A sharp fall in dividends from the Reserve Bank of India (RBI) owing to demonetisation costs added to the shortfall.

With this measure, the government hopes to stick to its fiscal deficit target for the year.

Fiscal Deficit target of 3% of GDP

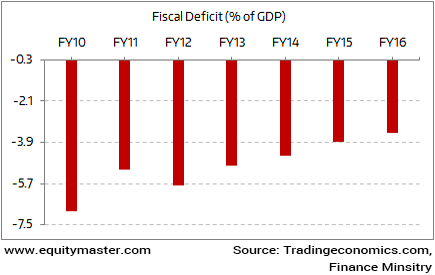

One of the important yardstick to measure the financial health of an economy is fiscal deficit. It is the difference between the government revenues and expenditure. The difference is generally bridged by debt. The present government is committed to reduce the gap. The long term fiscal deficit target is 3% of the Gross domestic product (GDP). This simply means relatively less expenditure. Hence, less government spending.

In last one decade India is making serious efforts to reduce the fiscal deficit level. Ever since, the new government came in it has been in favor of fiscal consolidation and meet the long term fiscal deficit target of 3% by FY17-18.

Just Released: Multibagger Stocks Guide

(2018 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Mind you, demonetisation as well as Goods and Service Tax (GST) implementation has resulted in a slowdown. Further, government has announced flurry of projects but execution is still pending. This means the government needs to relax its spending to spurt the growth again.

This means, once again, the government needs to fight dual challenge. First, maintaining its stance on fiscal consolidation and sticking it fiscal deficit target of 3% of GDP for FY17-18. Second, it must relax the deficit target for reviving the economy from the shock of demonetisation and GST.

Moving on to news about the economy. Moving on to news about the economy. According to data released by the Central Statistics Office (CSO), retail inflation as measured by the Wholesale Price Index (WPI) rose to 3.59% in October, a sharp rise from of 2.6% in September 2017.

Wholesale inflation rate, measured by the wholesale price index (WPI), is a marker for price movements in bulk buys for traders and broadly mirrors trends in shop-end prices.

The index portrays new series of WPI data released by the government earlier this fiscal, with 2011-12 as the base year, replacing existing the base year of 2004-05.

Food articles turned out to be major drivers as the data showed that prices of wholesale food articles rose by 3.2% in October, as against a 2% rise in the previous month. Vegetable index was up by 19.9% as compared to a rise of 15.5% in September.

Primary articles, which accounts for more than a fifth of the entire wholesale price index grew 3.3% in October from 0.2% in September.

Last month, the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) forecasted that retail inflation will hover around 4.2-4.6% between October-March this year, higher than the previous projection of 4-4.5%.

The RBI retained its neutral policy stance, citing uncertainty on the future trajectory of inflation because of several uncertainties, flagging possible return of inflationary pressures. However, it also kept the door ajar for a future rate cut if incoming data were conducive. While the government has been eyeing a sharp cut in interest rates, RBI has maintained its cautious stance.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades on a Volatile Note; Capital Goods Stocks Top Losers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!