- Home

- Todays Market

- Indian Stock Market News December 2, 2020

Sensex Opens Flat; Tech Mahindra & Bajaj Finance Top Losers Wed, 2 Dec 09:30 am

Asian share markets are trading on a mixed note today. The Hang Seng is trading down by 0.2% while the Shanghai Composite is trading on a flat note. The Nikkei is down 0.1%.

In US, Wall Street indices closed at record highs in overnight trade as investors grow increasingly hopeful about a vaccine to combat rising Covid-19 cases.

The Dow Jones Industrial Average gained 0.6% while the Nasdaq ended up by 1%.

Back home, Indian share markets have opened the day on a flat note.

The RBI's monetary policy committee will today begin its bi-monthly meeting, the resolution of which would be announced on December 4.

The BSE Sensex is trading down by 73 points. The NSE Nifty is trading lower by 11 points.

Tata Motors and Maruti Suzuki are among the top gainers today.

The BSE Mid Cap index and the BSE Small Cap index have opened the day up by 0.4% and 0.5%, respectively.

Sectoral indices are trading on a mixed note with stocks in the realty sector and metal sector witnessing buying interest. IT stocks, on the other hand, are trading in red.

The rupee is trading at 73.40 against the US$.

Gold prices are trading up by 0.4% at Rs 48,486 per 10 grams.

To know more about gold, you can check out our detailed article on investing in gold here: How to Invest in Gold?

Speaking of stock markets, the past month was a staggering one. Benchmark indices saw huge buying interest and went on to touch record-high levels.

The BSE smallcap index was up 13% in November.

The BSE smallcap index has risen more than 10% in a month only 6 times in the last decade.

Foreign investors (FIIs) invested a net amount of around Rs 650 bn in November. This is the biggest purchase by FIIs by a big margin so far.

Will this rally in Indian share markets continue in December?

We reached out to Brijesh Bhatia, our new team member and Research Analyst of Fast Profits Reports, for his view on the Indian stock markets.

Here's what he had to say...

- The bulls celebrated Diwali with fireworks and started Samvat 2077 with a roar.

The Nifty gained 11.4% in the month of November. 80% of the trading days ended on positive note. Midcap and Small Cap indices gained 15.5% and 13% respectively.

We had 20 trading days in November 2020. 16 of them ended on positive note with 8 straight days of gains from 2nd to 11th November.

The Nifty has now turned positive for CY2020 and has hit a new all-time high of 13,145.85.

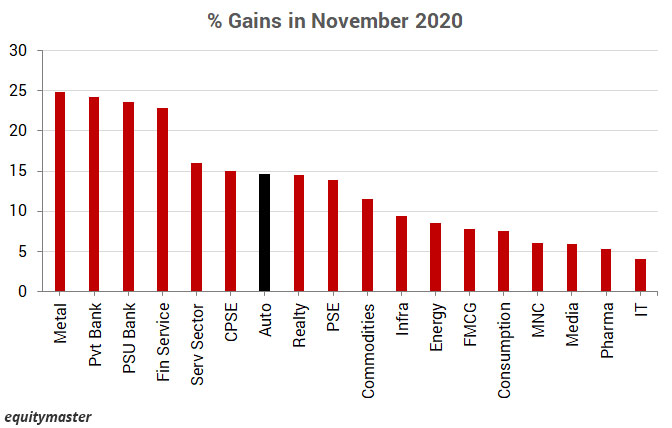

All sectorial indices ended on a positive note for the month.

Metals (24.84%), Private Banks (24.25%), PSU Banks (23.63%), and Financial Services (22.84%) gained more than 20%.

Sectors like IT (4.05%) and Pharma (5.30%) which has outperformed in the first leg of rally, were the underperformers.

The stocks in Nifty 200 were on fire too. Out of 200 stocks, 179 ended on a positive note which means 90% stocks were in green zone.

The broad-based buying indicates the momentum is still in the bull's favour. Entering the month of December, can this momentum prolong?

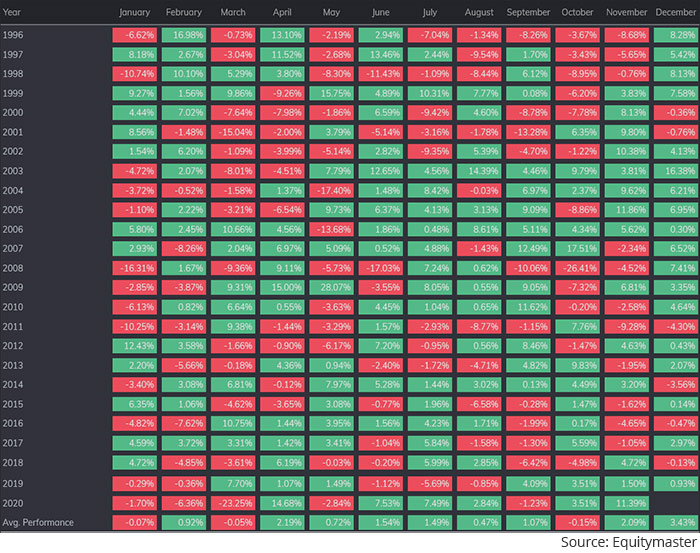

Well, if we look at the seasonality chart for Nifty 50, December tends out to be the best month for bulls with an average return of 3.43% since 1996.

Hope we have a Santa rally this Christmas too and end the pandemic year near all-time high levels!

You can read Brijesh's detailed profile here.

And in case you missed his first Equitymaster video, you can watch it now.

In news from the banking sector, the Supreme Court on Tuesday rejected Chanda Kochhar's appeal against the Bombay High Court's March 5 order which had dismissed her plea against her termination as the managing director and CEO of ICICI Bank, saying the issue falls within the realm of a private bank and employee.

Reports state that the ruling is a major setback for Kochhar who now stands to lose her pension related benefits, including bonuses and stock options.

The Bench led by justice SK Kaul while dismissing Kochhar's appeal upheld the Bombay HC order that held that her services were not governed by any statute, "but it is a purely contractual relationship with ICICI".

Kochhar was terminated from ICICI Bank months after she had voluntarily left the second largest private sector lender. She had moved the Bombay High Court on November 30, 2019, challenging the termination of her employment by ICICI Bank.

She had contended before the high court that the bank also denied her remuneration and clawed back all the bonuses and stock options between April 2009 and March 2018, for her alleged role in granting out of turn loans to the Videocon Group which purportedly benefitted her husband Deepak Kochhar.

ICICI Bank share price has opened the day down by 0.3%.

In news from the power sector, ABB Power Products is among the top buzzing stocks today.

Yesterday, shares of the company rose 13% to Rs 1,296, also its new high on the BSE.

In the past three days, the stock has zoomed as much as 33% after Hitachi ABB Power Grids in India, listed on the stock exchanges as 'ABB Power Products and Systems India', has signed a Memorandum of Understanding (MoU) with Ashok Leyland and the Indian Institute of Technology Madras (IITM) for an e-mobility pilot.

The triumvirate will run an electric bus (e-bus) pilot for in-campus commuting by IITM's students and staff.

ABB Power Products share price has opened the day up by 1.4%.

Moving on to news from the automobile sector, auto sales contracted after three months of robust growth as automakers trimmed production to reduce inventory pile up at dealerships.

Despite record wholesale numbers in October, dealers had warned vehicle manufacturers, and especially two-wheeler manufacturers, to curb production in November due to high inventory in the system, saying that retail sales hadn't recovered, leading to pile up of inventory.

"We once again caution both OEMs (original equipment manufacturers) and dealers to keep a check on vehicle inventory as post-festival demand may remain subdued. Since inventory levels are at their highest during this financial year, it may impact dealers' financial health, leading to closures and job losses," the Federation of Automobile Dealers Associations (Fada) had said.

Maruti Suzuki reported a 2.4% year-on-year (YoY) decline in domestic wholesales for November to 135,775 units, as it reduced vehicle inventory at dealerships after the festive season. It had sold 139,133 units a year ago.

Sequentially, factory dispatches decreased from 166,825 units in October and 150,040 units in September.

The sales of Hyundai, the second largest passenger vehicles manufacturer, also reflected the industry's strategy to control production. The company reported a 9.4% YoY increase in domestic dispatches to 48,800 units in November on the back of decent demand for its sport utility vehicles, Venue and Creta.

However, sequentially, dispatches declined from 56,605 units in October and 50,313 units in September.

The country's largest two-wheeler maker Hero MotoCorp said it is seeing an increase in demand and is continuously ramping up supply and production across its manufacturing units to cater to this.

Mahindra & Mahindra (M&M) reported a 3.6% growth in its vehicle sales for November. The company sold 42,731 vehicles last month, compared to 41,235 during the same period last year.

In the utility vehicles segment, Mahindra sold 17,971 vehicles in November 2020, compared to 14,161 vehicles in November 2019, registering a growth of 27%.

Tata Motors' November sales also grew to 49,650 vehicles from 41,124 units in the year-ago period.

Meanwhile, Eicher Motors sold 63,782 units of motorcycles in November 2020, against 60,411 units in November 2019.

India's automakers, which were grappling with a slowdown even before the pandemic, saw a recovery after the nation restarted most activities to revive sentiment and growth in the aftermath of one of the world's strictest coronavirus lockdowns.

The pandemic had stalled production and led to a washout in the initial months of the lockdown. Sales slowly picked up from July, mostly led by first-time buyers as people opted for personal mobility over public transport.

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen. Stay tuned for more updates from this space.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat; Tech Mahindra & Bajaj Finance Top Losers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!