- Home

- Todays Market

- Indian Stock Market News December 3, 2020

Sensex Ends Flat; Maruti Suzuki Rallies 7.5% Thu, 3 Dec Closing

After opening the day at record high levels, Indian share markets erased gains as the session progressed and ended on a flat note, led by a decline in IT stocks and index heavyweight HDFC Bank.

HDFC Bank share price slipped over 1.5% after the Reserve Bank of India (RBI) imposed strictures on the bank after recent outages on internet banking, mobile banking.

At the closing bell, the BSE Sensex stood higher by 15 points. Meanwhile, the NSE Nifty ended up by 20 points.

In early trade, the Sensex rallied over 300 points to hit fresh record high tracking gains in index heavyweights HDFC Bank, Reliance Industries and Maruti Suzuki amid largely positive cues from global markets.

ONGC was among the top gainers today. HDFC Bank, on the other hand, was among the top losers today.

SGX Nifty was trading at 13,206, up by 44 points, at the time of writing.

The BSE Mid Cap index ended up by 0.9%. The BSE Small Cap index ended higher by 0.7%.

Sectoral indices ended on a mixed note with stocks in the oil & gas sector and metal sector witnessing buying interest.

IT stocks, on the other hand, witnessed selling pressure.

Asian stock markets ended on a positive note as major countries moved closer to rolling out coronavirus vaccines, while hopes of more stimulus also boosted sentiment.

Japanese shares closed to a 29-1/2-year high as Japan's government committed to more fiscal spending and US President-elect Joe Biden pledged to act swiftly on stimulus measures.

The Nikkei ended up a modest 0.1% at 26,809.37, but settled near its highest since April 1991. The Shanghai Composite ended down by 0.2% and the Nikkei ended up by 0.1%.

US stock futures are trading flat. Nasdaq Futures are trading up by 8 points, while Dow Futures are trading down by 93 points (down 0.3%).

The rupee is trading at 73.90 against the US$.

Gold prices for the latest contract on MCX are trading up by 1.1% at Rs 49,189 per 10 grams.

To know more about gold, you can check out our detailed article on investing in gold here: How to Invest in Gold?

Speaking of stock markets, the past month was a staggering one. Benchmark indices saw huge buying interest and went on to touch record-high levels.

The BSE smallcap index was up 13% in November.

The BSE smallcap index has risen more than 10% in a month only 6 times in the last decade.

Foreign investors (FIIs) invested a net amount of around Rs 650 bn in November. This is the biggest purchase by FIIs by a big margin so far.

Will this rally in Indian share markets continue in December?

We reached out to Brijesh Bhatia, our new team member and Research Analyst of Fast Profits Reports, for his view on the Indian stock markets.

Here's what he had to say...

- The bulls celebrated Diwali with fireworks and started Samvat 2077 with a roar.

The Nifty gained 11.4% in the month of November. 80% of the trading days ended on positive note. Midcap and Small Cap indices gained 15.5% and 13% respectively.

We had 20 trading days in November 2020. 16 of them ended on positive note with 8 straight days of gains from 2nd to 11th November.

The Nifty has now turned positive for CY2020 and has hit a new all-time high of 13,145.85.

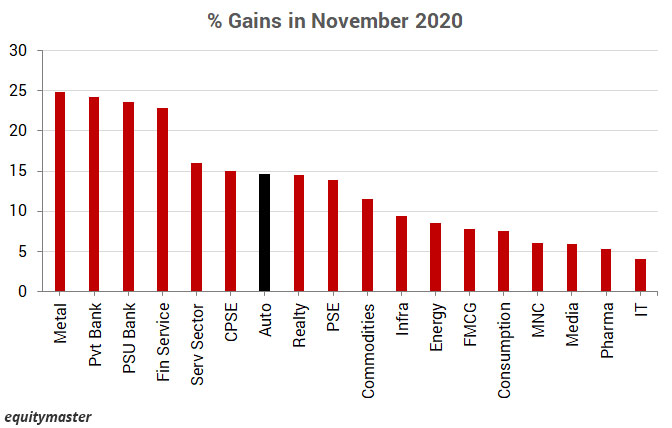

All sectorial indices ended on a positive note for the month.

Metals (24.84%), Private Banks (24.25%), PSU Banks (23.63%), and Financial Services (22.84%) gained more than 20%.

Sectors like IT (4.05%) and Pharma (5.30%) which has outperformed in the first leg of rally, were the underperformers.

The stocks in Nifty 200 were on fire too. Out of 200 stocks, 179 ended on a positive note which means 90% stocks were in green zone.

The broad-based buying indicates the momentum is still in the bull's favour. Entering the month of December, can this momentum prolong?

Well, if we look at the seasonality chart for Nifty 50, December tends out to be the best month for bulls with an average return of 3.43% since 1996.

Hope we have a Santa rally this Christmas too and end the pandemic year near all-time high levels!

You can read Brijesh's detailed profile here.

And in case you missed his first Equitymaster video, you can watch it now.

Services Sector Grows for 2nd Straight Month

In news from the economic space, India's services sector expanded for the second month in a row in November though at a slower pace than the previous month and witnessed a rise in employment for the first time in nine months.

The IHS Markit India Services Business Activity Index was 53.7 in November, lower than 54.1 in October, and above the critical 50 mark that separates growth from contraction.

Services firms hired additional workers in November, ending an eight-month sequence of job shedding.

The upturn in total new work was driven by the domestic market, with new export orders decreasing sharply again in November. The latest fall in international sales, the ninth in consecutive months, was attributed to subdued global demand and travel restrictions.

Earlier this week on Tuesday, a survey showed PMI manufacturing falling to a three-month low of 56.3 in November from an over 12-year high of 58.9 in October.

Put together, Indian private sector activity rose for the third straight month in November, but the pace of growth softened from October's near nine-year high. The Composite PMI Output Index was down to 56.3 from 58 in October.

Note that India's economy recovered faster than expected in the September quarter as a pick-up in manufacturing helped the gross domestic product (GDP) clock a lower contraction of 7.5%.

The GDP had contracted by a record 23.9% in the first quarter of 2020-21 fiscal (April 2020 to March 2021).

What effects the above developments have on Indian stock market remains to be seen.

Moving on to stock specific news...

Maruti Suzuki was among the top buzzing stocks today.

Shares of Maruti Suzuki hit an over 11-month high of Rs 7,777, up 7.5% on the BSE.

The stock of the passenger vehicles (PV) bellwether was trading higher for the fourth straight day, rising as much as 7% during the period, even as the company's volumes in November rose at a modest pace by 1.1% to 153,223 units, dragged by a 5% decline in the core mini and compact portfolio.

In an interview with Bloomberg Television on Wednesday, the company's Chairman R.C. Bhargava said Maruti is expecting retail sales in December to be "pretty good" as there are pending orders with its dealerships and the rate of enquiries has sustained even after the festive season.

"The pending demand has been very much in the forefront of what is causing the increase in sales," said Bhargava. "2020 hasn't been a good year. We lost the first quarter, so I definitely expect 2021 to be much better than 2020."

Despite the pandemic, Bhargava was a "little bit" surprised that demand has continued as many expected a drop after the end of the festival period.

The inventories at the dealerships are probably at the lowest they have had for years, he said.

Note that India's automakers, which were grappling with a slowdown even before the pandemic, saw a recovery after the nation restarted most activities to revive sentiment and growth in the aftermath of one of the world's strictest coronavirus lockdowns.

The pandemic had stalled production and led to a washout in the initial months of the lockdown. Sales slowly picked up from July, mostly led by first-time buyers as people opted for personal mobility over public transport.

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

Moving on to news from the pharma sector, shares of Fermenta Biotech jumped over 8% intraday today after the company's US arm acquired membership interest in AGD Nutrition.

Fermenta Biotech USA, LLC, a wholly-owned subsidiary of the company, has acquired a membership interest in AGD Nutrition, LLC.

AGD Nutrition LLC is in a similar line of business as that of the company and Fermenta Biotech USA, LLC. The main purpose of the acquisition is to facilitate exports and enhance the company's footprint in North America, the company said in an exchange filing.

As per reports, the aggregate consideration for the purchase of membership interest is US$ 1,260,500.

Fermenta Biotech share price ended the day up by 6.4%.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends Flat; Maruti Suzuki Rallies 7.5%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!