- Home

- Todays Market

- Indian Stock Market News December 7, 2016

Sensex Remains Flat; All Eyes on RBI's Monetary Policy Announcement Wed, 7 Dec 11:30 am

After opening the day on a flat note, the Indian share markets registered marginal gains and continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the oil & gas sector and auto sector witnessing maximum buying interest. Healthcare sector stocks are trading in the red.

The BSE Sensex is trading up 41 points (up 0.2%) and the NSE Nifty is trading up 20 points (up 0.2%). The BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading up by 0.4%. The rupee is trading at 67.88 to the US$.

All eyes are set on the RBI's monetary policy meeting today. The results of the meeting will be out within a few hours.

Today's monetary policy announcement is crucial as it is likely to offer some guidance on the demonetisation drive. Apart from that, the announcement will also offer some clarity regarding economic growth and inflation.

The consensus among market participants for now is clear. The repo rate will be cut by 0.25%. We too believe there's a strong possibility of a 0.25-0.5% rate cut. However, that is not what we are concerned about. As our recent edition of The 5 Minute WrapUp states...

- It's old news. Interest rates in India have been falling steadily since January 2015.

We are more concerned about Dr Urjit Patel as RBI governor and the possibility of negative real interest rates for savers.

As regards the governorship of Dr Urjit Patel, we hope he uses today's policy to lay out his thoughts more clearly. This we say is because it's reasonable to expect a clearly articulated view from the central banker during this time.

A rate cut, or the lack thereof, is not as crucial as the governor's thoughts on the impact of demonetisation. We want to know whether he expects the near-term demand slowdown to have a snowball effect on the economy and specific businesses. But no one at the RBI has offered a concrete view so far.

In the 28 November issue of The 5 Minute WrapUp, Tanushree explained why HYPERLINK "https://www.equitymaster.com/5MinWrapUp/detail.asp?date=11/28/2016&story=4&title=Governor-Urjit-Patel-Off-To-A-Disappointing-Start" \t "_blank"Dr Patel is off to a disappointing start.

- Although banks have been at the core of the demonetisation drive, Dr Urjit Patel chose not to comment for nearly twenty days. At such times, we would typically expect the central banker to outline a plan. However, what we got from Dr Patel was rather more like political rhetoric.

Earlier, in the 11 November issue of The 5 Minute WrapUp, Tanushree explained why savers have received a bad deal due to demonetisation.

- On one hand banks will have a deposit base much bigger than they would have earlier envisaged. On the other hand, the poor demand for credit is unlikely to pick up soon. The correction in bond yields has prompted corporates to raise funds via corporate deposits and non-convertible debentures (NCDs). Issue of NCDs, in fact, is at a seven year high. There will be few takers for bank loans at high yields. Threatened with prospect of poor margins, banks may therefore decide to cut deposit rates sharply.

The above scenario, coupled with the demonetisation move, can make matters worse for the economy. So apart from worrying about the demonetisation drive, depositors in India should also be concerned about their returns on the money parked in the bank.

In another news update, the Reserve Bank of India (RBI) has removed the so-called two-factor authentication for online card transactions involving sums up to Rs 2,000. The move is initiated in order to simplify electronic payments and encourage digital economy. The move is said to aid e-commerce marketplaces.

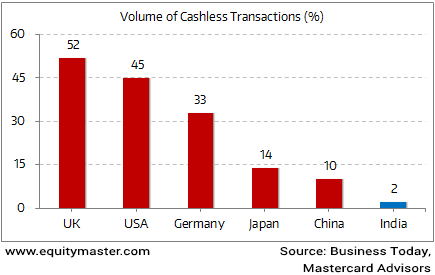

The above development comes in line with the government's push towards a cashless society - which also stands as one of the major offshoots of the demonetisation drive. However, if one has to go by present events, just about 2% of the volume of transactions in India are cashless. This volume is way below other nations. The chart below presents the quantum of cashless transactions in some of the major economies of the world...and how far India has to go to become a cashless economy.

Is India Ready to Go Digital?

The situation is this: According to the World Bank, there are only 18 ATMs per 100,000 citizens in India compared to 129 in Brazil. Additionally, just 22% of Indians use the Internet "at least occasionally" and only 17% have a smartphone.

Furthermore, as per Newslaundry.com, there were 5.3 bank branches per one lakh Indians in rural India 15 years ago. Today the figure stands at 7.8 bank branches per one lakh Indians. This shows that a majority of rural India has very little access to banks and the organized financial sector. They rely heavily on cash and the informal credit system.

So, in our view, digital India is a way distant dream...particularly for rural India.

As one of our recent editions of The 5 Minute WrapUp says... 'Unless the whole financial system is made more secure and fool proof, the shift towards a cashless economy can prove to be a financial nightmare for the common man.'

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Flat; All Eyes on RBI's Monetary Policy Announcement". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!