- Home

- Todays Market

- Indian Stock Market News December 12, 2016

Sensex Finishes in the Red; Auto Stocks Tumble Mon, 12 Dec Closing

Indian share markets began the trading week on a weak note amid mixed global markets. At the closing bell, the BSE Sensex stood lower by 231 points (down 0.9%), while the NSE Nifty finished down by 91 points (down 1.1%). Meanwhile, the S&P BSE Mid Cap & the S&P BSE Small Cap finished down by 1.1% and 0.7% respectively. Losses were largely seen in auto sector and banking sector.

Asian markets finished in the red as of the most recent closing prices. The Hang Seng and the Shanghai Composite were down by 1.4% and 2.5%, respectively. European markets edged lower in early trade with the CAC 40 down by 0.11%, Germany's DAXis off 0.35% and London's FTSE 100 is lower by 0.16%.

The rupee was trading at 67.46 against the US$ in the afternoon session.

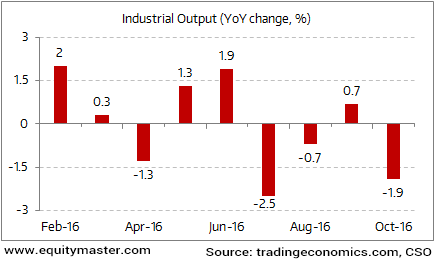

The index of industrial production (IIP) slipped 1.9% in October. This was recorded as against a 0.7% rise in September and up 9.9% YoY in the same month last year. The historical trend can be seen in the chart below:

Factory Output Deteriorates, More Pain Ahead

The disappointing numbers were due to decline in manufacturing sector (down 2.4% YoY), mining (down 1.1% YoY) and capital goods sector (down 25.9% YoY).

Mind you, these disappointing numbers are pre-demonetisation. So with the effect of demonetisation factored in, there could be more pain in the store for the business activity in India.

As Richa wrote in a recent edition of The 5 Minute WrapUp...

- Now, with the overall sentiments being low across all the sectors due to the demonetisation drive, the business activity in India is expected to slow down for next few months. The major contributors to the industrial output like capital goods and manufacturing are expected to face major hiccups. With these numbers bleeding, we expect to see an extended adverse impact on the India's job market as well.

The slowdown in business activity would also have an adverse impact on the India's job market as well. As Tanushree wrote an interesting follow up on the destruction of jobs due to demonetisation:

- And as per estimates, demonetisation will render another 400,000 jobless in a few months. Hindustan Times arrived at this number based on estimates by top headhunting companies in India. Ecommerce, real estate, and infrastructure are expected to shave the most jobs. But mind you, this number is just from the organised sector. It does not include the lakhs of jobs already being lost in the unorganised textile, gems, and jewellery sectors.

The government will likely be busy making currencies available and offering digital payment sops for months. Schemes like National Skill Development, which were supposed to create millions of jobs, are now on the backburner.

So the pain of demonetisation will not be felt on consumption growth until the 30th of December 2016. Consumption demand is bound to stay paralysed for much longer. It is not only the cash crush and the suppressed demand that will weigh heavily on consumption. The loss of jobs and underemployment will also hurt.

In another news update, as per a leading financial daily, the goods and services tax (GST) is not likely to be rolled out from April 1, 2017. This comes as the relevant laws will not make it to Parliament in the ongoing winter session which ends on December 16.

In its meeting yesterday, the GST Councilwas unable to clear the draft GST law. The Council is now going to meet on December 22-23 to consider all remaining issues.

Earlier last month, the government finalised the tax rates for GST. The development came as GST Council decided upon a multi-layered tax rate system. The Council finalised a four-tier tax structure, with the tax rate on items of mass consumption at 5%. Other slab rates decided by the Council are 12%, 18%, and 28%. To know more on this, please read one of our previous stock market commentaries here. Also, to get a detailed view on the Goods and Services Tax (GST), you can read Vivek Kaul's report titled GST & You: What the Media DID NOT TELL YOU About the GST.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Finishes in the Red; Auto Stocks Tumble". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!