- Home

- Todays Market

- Indian Stock Market News December 12, 2017

Sensex Ends Over 220 Points Lower; Telecom Stocks Bleed Tue, 12 Dec Closing

After opening the day marginally lower, share markets in India witnessed selling pressure throughout the day and ended the day on a weak note. Losses were seen across most sectors with stocks in the telecom sector and stocks in the realty sector leading the losses.

At the closing bell, the BSE Sensex stood lower by 228 points (down 0.7%) and the NSE Nifty closed down by 82 points (down 0.8%). The BSE Mid Cap index ended the day down 1%, while the BSE Small Cap index ended the day down by 0.7%.

Asian stock markets too, finished in red. As of the most recent closing prices, the Hang Seng was down by 0.59% and the Shanghai Composite was down by 1.24%. The Nikkei 225 was down by 0.32%. Meanwhile, European markets were trading in the green. The FTSE was up by 0.26%. The DAX stood flat, while the CAC 40 was up by 0.13%.

The rupee was trading at Rs 64.43 against the US$ in the afternoon session.

As per an article in the Economic Times, Financial Minister Arun Jaitley said that India is following the roadmap of fiscal consolidation.

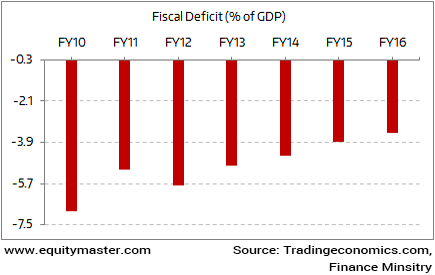

Also, as per the news, a finance ministry statement quoting Jaitley stated that fiscal deficit as a ratio of GDP stood at 3.9% in 2015-16 and 3.5% in 2016-17 and is budgeted to be 3.2% for the current financial year.

One must note that in the last one decade, India is making serious efforts to reduce the fiscal deficit level. Ever since, the new government came in it has been in favor of fiscal consolidation and meet the long term fiscal deficit target of 3% by FY17-18. This will be the lowest target compared to the last couple of years, as can be seen from the chart below:

Fiscal Deficit target of 3% of GDP

That said, challenges remain. The notebandi exercise has resulted in a slowdown. Further, government has announced flurry of projects but execution is still pending. This means the government needs to relax its spending to spurt the growth again.

This means, once again, the government needs to fight dual challenge. First, maintaining its stance on fiscal consolidation and sticking it fiscal deficit target of 3% of GDP for FY17-18. Second, it must relax the deficit target for reviving the economic growth from the shock of demonetisation.

It would be interesting to see how the government tackles these challenges ahead.

In the news from commodities market, crude oil witnessed buying interest today. Brent crude oil, the international benchmark for oil prices, jumped above US$ 65 per barrel for the first time since 2015.

Gains were seen after the shutdown of the Forties North Sea pipeline hit supply levels from a market that was already tightening due to OPEC-led production cuts.

Rising crude oil prices do not bode well for the Indian economy. This we say is because India is hugely dependent on petroleum imports. In fact, the share of petroleum imports for India has only increased over the years.

India is the world's third-largest oil consumer. And energy consumption in India is set to grow as our economy remains one of the few 'bright spots' in a slowing, aging world economy. And India could face a potent risk with a rise in crude oil prices.

The only way out for India is to reduce its dependence on oil imports and achieve fuel-sufficiency.

To keep a tab on the movements in crude oil and other commodities, you can read the stock market commentary from the Daily Profit Hunter team. Their commentary tracks the developments in the global economy as well as stock, currency, and commodity markets.

In the news from cryptocurrency space, Bitcoin is witnessing volatile trades today and dipped slightly after its futures trading debut this week.

Note that cryptocurrencies have no central bank backing and have not yet been regulated. Yet, these seem to have found favour among a large number of people, with demand growing every day. There are over 800 cryptocurrencies in existence today, with new ones being added to the list every day.

While the world of digital currencies is intriguing, it can get very confusing for the layman. Our team member, Ankit Shah, Research Analyst, has decided to study cryptocurrencies and help our readers understand them.

Ankit has released a premium guide for Equitymaster Insider subscribers, titled Bitcoin 101 which contains everything you need to know about bitcoins and other digital currencies.

If you haven't been receiving Ankit's insights, get on the Insider's list now.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends Over 220 Points Lower; Telecom Stocks Bleed". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!