- Home

- Todays Market

- Indian Stock Market News December 14, 2016

Sensex & Nifty Trade Marginally Lower Ahead of Fed Decision Wed, 14 Dec 01:30 pm

The Indian share markets continue to trade flat with a negative bias ahead of a certain Fed rate hike later in the day. Sectoral indices are trading on a mixed note with realty and information technology stocks leading the pack of gainers. Whereas, metal and PSU stocks heading the losers.

The BSE Sensex is trading lower by 72 points while the NSE Nifty is trading lower by 26 points. The BSE Mid Cap index is trading down by 0.4% while BSE Small Cap index is trading down by 0.2%. Gold prices, per 10 grams, are trading at Rs 27,627 levels. Silver price, per kilogram is trading at Rs 41,525 levels. Crude oil is trading at Rs 3,543 per barrel. The rupee is trading at 67.49 to the US$.

Power stocks are trading on a mixed note with KSK Energy and Torrent Power leading the losses. According to an article in The Economic Times, NTPC Ltd is entering the wind power segment with a 50-MW project in the state of Gujarat.

In this regard, Inox Wind Ltd has received a turnkey order from NTPC for the supply and installation of 25 units of its 2-MW generators. The company expects to commission the wind farm by the first quarter of fiscal year 2017-18.

The move is a part of the company's target of sourcing about 11% of its planned capacity of 128 GW by 2032 from renewable energy. NTPC currently has roughly 47 GW of operational power plants, including several solar assets totaling 360 MW. It, however, had so far not initiated any wind projects and this scheme in Gujarat is its first one, the reports noted.

Under the deal, lnox Wind will supply and install (Subscription Required) its advanced 2MW DFIG 100 rotor diameter Wind Turbine Generators (WTGs) for NTPC.

The energy sector is the backbone of any economy. The shortages and vagaries of traditional and non-renewable sources like oil and coal leaves a lot of scope for companies in the renewable energy space. Richa Agarwal, our research analyst, has penned an interesting piece on wind energy segment in India (Subscription Required) and has spoken in detail about the financial performance of the companies in this space. Here's an excerpt:

"In my view, a better way to capitalize on the opportunity in the wind segment is to bet on the businesses whose fortunes are linked to - yet not entirely dependent on - demand revival and growth in the wind energy segment it...and, of course, are still undervalued by the market."

Considering power sector woes, shortage of coal had led to poor electricity generation and another problem is the dismal financial health of state electricity boards (SEBs).

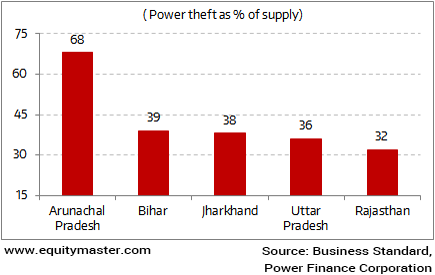

Top 5 States Grappling with Power Thefts

As per a survey by Power Finance Corporation, states such as Bihar and Uttar Pradesh, that have been grappling with huge power cuts, incidentally rank high on power thefts and pending consumer complaints. However, Soft coal prices, visibility of regular supplies, expectation of easing financial stress on balance sheets and power trading reaching a critical mass level are some of the factors supporting the power sector, reports noted.

Going forward, the government's resolution to provide uninterrupted power to all on a 24X7 basis is expected to drive robust energy growth in the coming years.

Moving on to the news from

The USFDA had inspected Halol unit from November 17 to December 1, 2016 and issued a Form-483 citing nine inspectional observations. The violations listed by the USFDA after its latest inspection at Halol include problems with Sun's quality control system. Moreover, lack of proper maintenance of important records related to the manufacturing process and cited concerns about the accuracy of some of the drug testing methods employed. Besides these, other findings included delays in informing the agency of contamination or failure of drug batches.

Notably, the approval of several of Sun Pharma's key drugs in the United States, depends on clearance of the Halol plant. In this regard, the company has been working on improving processes at Halol since the USFDA warned it a year ago of concerns with the manufacturing process at the site.

Further, the Halol plant has been under regulatory scanner since September 2014. Subsequently, no new product approvals have been granted from the plant. Remediation measures undertaken to restore compliance also hit supplies from the plant impacting the overall sales.

Sun Pharma's share price was trading flat at the time of writing.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex & Nifty Trade Marginally Lower Ahead of Fed Decision". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!