- Home

- Todays Market

- Indian Stock Market News December 15, 2016

Sensex Remains Flat; FMCG Stocks Witness Selling Pressure Thu, 15 Dec 01:30 pm

After opening the day on a flat note, the Indian share markets have continued to trade near the dotted line. Sectoral indices too are trading on a mixed note with stocks in the FMCG sector and healthcare sector witnessing maximum selling pressure. IT stocks are trading in the green.

Both the BSE Sensex and the NSE Nifty are trading flat. The BSE Mid Cap index is trading up by 0.1%, while the BSE Small Cap index is trading up by 0.3%. The rupee is trading at 67.80 to the US$.

In its monetary policy yesterday, the US Federal Reserve raised key interest rates by 25 basis points. Post this, the US interest rates now stand at 0.75% from 0.5% earlier. This the first hike since December 2015 and only the second one in the decade.

The Federal Open Market Committee (FOMC) cited an improving economy and a strong outlook for the labour market as reasons for the hike.

Along with the above announcement, the FOMC said that the inflation expectations have increased considerably and forecasted a steeper path for borrowing costs in 2017.

The US Federal Reserve sounded hawkish with respect to hike in interest rates in near future. Many analysts expect the FOMC to increase the rates further and faster if President Elect Donald Trump's infrastructure promises are on track.

The FOMC, in an effort to progress towards its inflation goal, have projected three rate increases in 2017, putting the rate at 1.4% by the end of the year. It would then rise to 2.1% by the close of 2018.

Indian markets have been volatile in their reaction to the above decision.

In a recent edition of The 5 Minute WrapUp, Tanushree has written on how one can profit from the Fed's decision. Give it a read to understand how you can make the most of the US interest rate hike.

That said, the hype and hoopla surrounding Fed meetings is irritating at best and dangerous at worst. Long-term investors would do well to avoid getting swayed by such events.

It's obvious that demonetisation does not worry us a lot. Its impact will likely last only a few quarters. However, there is something even long-term investors should be worried about. Ankit Shah has the details in the latest issue of The Inner Circle

In another news update, the Wholesale Price Index (WPI) data released by the Central Statistics Office (CSO) showed the annual wholesale inflation declining for the third consecutive month to 3.2% in November. The corresponding figure for October stood at 3.4%.

Cash crunch, owing to the Prime Minister Narendra Modi's demonetisation move has weighed largely on the WPI rates as most of the wholesale transactions are done in cash.

Apart from that, the fall in the WPI can be attributed to the fall in food inflation. Food articles, which have a weight of 14% in WPI, declined to 1.5% in November. This was seen as against 2.6% in October and 5.6% on a YoY basis.

Owing to the liquidity crunch arising from demonetisation, vegetables inflation contracted 24.10% in November 2016 against 13.25% increase in the same month last year.

While inflation for primary articles fell in November, fuel and power and manufactured products group inflation continued to rise during the month. Manufactured products inflation had a weight of 65% rose to 3.2% in November as compared to a contraction of 1.4% in the same month last year.

Similarly, inflation for fuel and power stood at 7.9% in November as compared to a steep contraction of 11% in November last year.

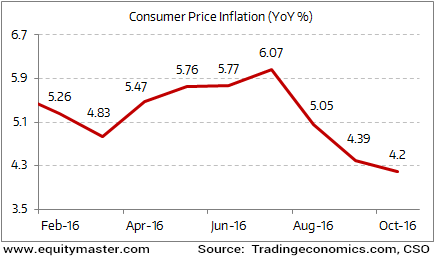

Along with the WPI, the Consumer Price Index (CPI) that came in on Tuesday also fell to a two-year low during the month of November.

Both WPI and CPI have begun a downward trajectory over the past few months on the back of a fall in food prices.

CPI May Hit a 15-Month Low

Demonetisation alone is not helping the low inflation numbers. As we stated in one our recent editions of The 5 Minute WrapUp...'The expected fall in the inflation will be on account of three key reasons. First, the favorable base effect. Second, the harvest hitting the market. And last, the impact of the demonetisation which is mainly hitting the prices of the perishable commodities like fruits and vegetables.'

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Flat; FMCG Stocks Witness Selling Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!