- Home

- Todays Market

- Indian Stock Market News December 20, 2016

Sensex Drifts Lower; Banking Stocks Witness Selling Pressure Tue, 20 Dec 11:30 am

After opening the day on a flat note, the Indian share markets are trading below the dotted line. Sectoral indices are trading on a mixed note with stocks in the IT sector and consumer durable sector witnessing maximum buying interest. Banking sector and telecom sector stocks are trading in the red.

The BSE Sensex is trading down by 66 points (down 0.3%) and the NSE Nifty is trading down 21 points (down 0.3%). The BSE Mid Cap index and the BSE Small Cap index are trading down by 0.8% and 0.4%, respectively. The rupee is trading at 67.88 to the US$.

In its latest move to the demonetisation drive, the Reserve Bank of India (RBI) has announced that the deposits of more than Rs 5,000 in old Rs 500 and Rs 1,000 notes can be made only once per account until December 30. Also, customers depositing more than Rs 5,000 will have to explain why they didn't do so before.

The above move is aimed to keep a check on money laundering through bank accounts.

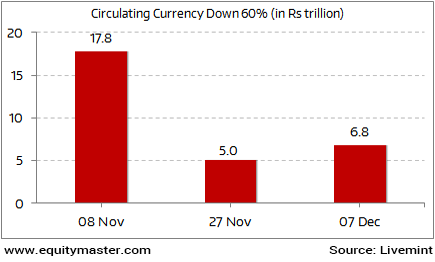

Speaking of demonetisation, numbers released by the Reserve Bank of India (RBI) show that a month after demonetisation, currency in circulation continues to fall. As per the data, currency in circulation as on 9th December stood only a tad more than half of what was in circulation before demonetisation.

After factoring in deposits, withdrawals, and exchange of cash, between 9th November and 7th December, the amount of cash in public hands for carrying out transactions has fallen 60%. This can be seen in the chart below:

Note Ban Impact on Currency

The above effect is a direct result of the withdrawal of the Rs 500 and Rs 1,000 notes. These notes formed 86% of currency in circulation pre-08 November.

The issue is this: the massive stock of money after demonetisation hasn't been re-monetised yet. And this is because the printing (i.e. supply) of the new Rs 2,000 and Rs 500 notes has not kept pace with demand. While the currency in circulation dropped by Rs 14 trillion, the RBI had replenished only Rs 4 trillion.

As Vivek Kaul explained in The Dairy,

- It is worth remembering here that the capacity of the printing presses supplying RBI with notes is around 300 crore notes per month. This, when the presses work 24 hours a day and for the full month.

The total number of 500 rupee notes demonetised stand at 1,716.5 crore. At 300 crore notes a month, it will easily take five to six months to replace the total lot. Even if all the notes are not printed, given the push towards cashless, it will be a while before there is enough cash going around in the economy.

Hence, the point is that people are not hoarding cash. There simply isn't enough cash going around.

In our view, this mess will take another 5 to 6 months to be resolved. Economic activity will remain under pressure until then.

In the news from global markets, the Bank of Japan (BOJ) kept its policy rates unchanged at the conclusion of its two-day policy meeting.

The central bank maintained the negative 0.1% interest rate imposed on banks for some excess reserves. It also kept the 10-year Japanese government bond (JGB) yield target at around zero, and kept annual rises in JGB holdings at 80 trillion yen.

In its economic assessment, the central bank upgraded its views on exports and output. However, the BOJ said that risks to Japan's outlook include developments in the US economy and the impact of US monetary policy on global markets.

Last month, the BoJ offered to buy unlimited amounts of five-year and two-year Japanese government bonds to keep ten-year JGB yields at or below 0%. Keeping ten-year yields at zero has emerged as a key part of the 2017 strategy of generation inflation through more government spending (fiscal policy).

If there's one place on this planet that epitomises the wrong kind of growth, it's Japan. Too much money printing...too much debt...too much government intervention...too much stock market manipulation...

So why bother about Japan?

Because that's where the rest of the world's central banks appear to be heading. Central bank ownership of the world's assets has increased to about 40% of global GDP. We also have the problem of a massive debt bomb in the global financial economy. As Bill Bonner lays down the facts before you, the entire world has a debt problem - with US$ 223 trillion in debt, about three times global GDP.

We don't know about the timing. But the end is going to be ugly.

If you're interested in knowing what's really happening in the world of man and money, you can claim your free copy of Bill Bonner's latest book, Hormegeddon.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Drifts Lower; Banking Stocks Witness Selling Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!