- Home

- Todays Market

- Indian Stock Market News December 24, 2015

European Markets Rally! Thu, 24 Dec RoundUp

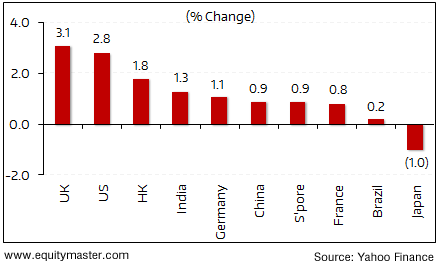

Major global markets witnessed upward movement in the week gone by. Benchmark indices in Europe and the US led the rally. Last week, the US Federal Reserve hiked interest rates for the first time in a decade. However, the Fed gave signs that the pace of future rate hikes will gradual, which cheered the global markets. Benchmark indices in the UK and the US ended the week higher by 3.1% and 2.8% respectively.

Back in India, the winter session of Parliament was saved from a complete washout by a few bills that were cleared towards the end of the session. But none of the bills that would have kicked off the government’s ambitious reforms agenda made it to law. The winter session became the second session in a row to fail to pass the constitutional amendment bill to roll out the goods and services tax (GST). The BSE Sensex ended the week higher by 1.3%.

Key world markets during the week

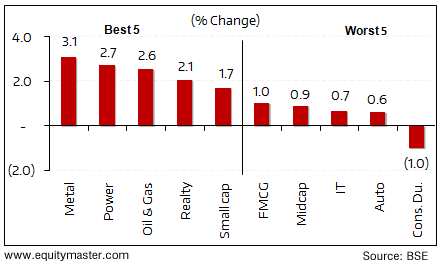

Metal stocks were the top gainers this week. Barring, consumer durables all sectoral indices ended the week in the green.

BSE indices during the week

Now let us discuss some key economic and industry developments during the week gone by.

As per an article in Economic Times, depositors have pulled out a net Rs 400 billion from banks since the Reserve Bank of India (RBI) lowered its policy rates by 0.5% in October. According to RBI data, term deposits mobilized by the commercial banks dipped by Rs 414 billion between October 2 and November 27. This was as against Rs 396 billion additions to term deposits that were seen in the same period a year ago.

Most of the above activity is seen as depositors have parked their funds in alternate investment avenues. Off late, falling interest rates have prompted a shift from traditional bank term deposits to tax-free bonds and select mutual funds debt schemes. The same can be seen with the rise in bond issuances by various companies in recent times. During the past two months, NTPC, Power Finance Corporation, Rural Electrification Corporation, Indian Railways Finance Corporation and National Highway Authorities of India have together sold bonds worth more than Rs 160 billion. These securities offer tax-free interest rates that are higher than bank fixed deposits now.

Reserve Bank of India (RBI) warned state-run banks to stop paying excessive dividends to the shareholders. The statement was made as the risk of bad loans has increased considerably owing to deterioration in the economy.

Further, Financial Stability Report also stated that the risk to banking stability has increased in the past six months owing to worsening asset quality coupled with sluggish profitability. The deterioration in asset quality is evident from the numbers, wherein gross non-performing assets (GNPAs) of state-run lenders have jumped to 8.1% as of 30 September as compared to 6.1% on 31 March.

Reportedly, credit assessment of state-run banks has not been up to the mark, which in-turn has led to the deterioration in asset quality. The report has also blamed bankers for poor credit evaluation which made it a bit difficult to recover the money from the defaulters.

Movers and shakers during the week

| Company | 16-Dec-15 | 23-Dec-15 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top gainers during the week (BSE-A Group) | ||||

| Pipavav Defence | 77 | 100 | 31.0% | 85/39 |

| OPTO Circuits | 11 | 13 | 16.6% | 27/11 |

| Essar Oil | 219 | 255 | 16.2% | 255/98 |

| Housing Dev. Infra | 64 | 72 | 13.7% | 143/54 |

| Berger Paints | 222 | 251 | 12.9% | 258/171 |

| Top losers during the week (BSE-A Group) | ||||

| ABB India Ltd | 1,197 | 1,111 | -7.1% | 1525/1021 |

| Financial Tech | 125 | 118 | -5.6% | 222/95 |

| The Ramco Cements | 374 | 363 | -2.9% | 384/270 |

| Godrej Consumer | 1,318 | 1,284 | -2.5% | 1457/940 |

| BOSCH Ltd | 18,718 | 18,251 | -2.5% | 27989/17873 |

Source: Equitymaster

Now let us move on to some of the key corporate developments of the week gone by.

As per an article in leading financial daily, Sun Pharma received a warning letter from US Food and Drug Administration (USFDA) on its Halol plant in Gujarat. USFDA had conducted an inspection at its Halol plant in September 2014. The inspection report stated various adverse observations in relation to this plant. In order to rectify these deficiencies, the company had been taking various remedial steps since then. Recently, the company also received OAI (Official action indicated) from the US regulators. The warning letter reiterates the earlier observation made in the inspection report. The company will have to respond to the warning letter within a specified period of time.

As per an article in leading financial daily, owing to the recent diesel car ban in New Delhi, Tata Motors has been taking steps to revamp its portfolio. Accordingly the company is working on fully electric systems and partial hybrids for their future range of passenger vehicles.

Earlier, high cost of batteries made the electric vehicles expensive. However, higher production of electrical vehicles in China has led to a reduction in the cost of batteries. Partial hybrids too are cost efficient as they offer superior mileage. The initial cost of purchase of partial hybrid vehicles is expensive. However, in long run they become cost effective due to better mileage.

Further, the company management stated that the company is commissioning a battery assembly pilot line in Pune. Going forward, this will help it to concentrate more on the electric version of passenger vehicles.

In recent times, Tata Motors has been focusing on bolstering its passenger vehicles portfolio through new launches. It has outlined a product plan till 2020 as per which 2 new vehicle launches will be slated every year.

As per an article in leading financial daily, Tata Steel is in talks with Greybull Capital Llp to sell its European long products business. Long products are steel products which are used in the construction sector. Further a letter of intent has also been signed with this regards. Reportedly, as per an industry executive the deal is supposedly pegged at around US$ 500 million and the buyer will not take on any debt. However, there is no confirmation on the same from the company. The decision comes at a time when steel industry is facing a tough time in Europe. European markets are flooded with cheap imports from China that is proving to be a big hassle for the domestic players. The company has written down most of the value of its UK assets as an impairment loss. The deal, if struck will come as a relief to the company as it is intending to sell its long products business since the calendar year of 2014.

As per an economic daily, Larsen & Toubro's (L&T) subsidiary- L&T Construction has won orders worth Rs 12 billion across various businesses during December 2015. Under Metallurgical & Material Handling business, the company has secured orders worth Rs 6.6 billion. The company's subsidiary- Larsen & Toubro (Oman) LLC has won an EPC (Engineering Procurement Construction) order worth US$ 63.6 million. The same is received from Oman Oil Refineries and Petroleum Industrial Company (ORPIC) for a Pet Coke Handling and Storage project. Further, it has also secured an EPC order from the world's largest integrated producer of zinc for the construction of a 1.5 MTPA Lead-Zinc Ore Beneficiation Plant in Rajasthan.

Under Power Transmission & Distribution business, the company has won orders worth Rs 5 billion in both the international and domestic markets.

In the international market, Larsen & Toubro Saudi Arabia LLC, a fully owned subsidiary of L&T, has bagged an order valued at SAR 212 million (US$ 56.6 million) for the construction of two 115 kV substations at the Dammam area. The same is received from National Grid, Saudi Arabia - a subsidiary of Saudi Electricity Company. These projects are in the eastern province of Saudi Arabia and are scheduled to be completed in 22 months.

As for the domestic markets, the company's solar business has bagged 25 MW (mega watt) of solar capacity on EPC basis from a reputed solar developer. This capacity addition shall be in the southern part of India where the solar industry is an area of focus.

With the US Fed rate hike behind it, the markets will look towards the upcoming results season next month for direction. The progress of key reform bills in the upcoming session of parliament will also be tracked. However, investors should avoid being carried away by short-term events and focus on picking stocks with sound long-tem fundamentals.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "European Markets Rally!". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!