- Home

- Todays Market

- Indian Stock Market News December 27, 2016

Sensex Continues Positive Trend; Consumer Durables Lead Gains Tue, 27 Dec 11:30 am

After opening the day on a flat, the Indian share markets have moved slightly in to the green. All the sectoral indices with the exception of the Realty Sector are trading on a positive note, with stocks in the Oil & Gas Sector and the Consumer Durables sector leading the gains.

The BSE Sensex is trading up 108 points (up 0.4%) and the NSE Nifty is trading 41 points (up 0.5%). Meanwhile, the BSE Mid Cap index is trading up by 1%, while the BSE Small Cap index is trading up by 0.8%. The rupee is trading at 67.95 to the US$.

India's largest telecom operator Bharti Airtel has struck a deal worth over US$ 120 million for network modernization and expansion in Delhi. The contract with Swedish equipment maker Ericsson comes as the company looks to modernize its service to counter tough competition from Reliance Jio in the country's most lucrative market.

The contract network expansion follows Bharti Airtel's recent acquisition of additional 10 MHz spectrum in the 2,300 MHz band and 5 MHz spectrum in 2,100 MHz band for Rs 1,430 crore and Rs 2,770 crore, respectively.

The new four-year contract being initiated in this quarter will bring these spectrums into use, and allow Airtel to offer enhanced coverage and capacity. Thereby improving its presence and performance in the national capital.

The contract makes Ericsson the sole supplier for Airtel's mobile network in the circle. It includes modernization of all 2G sites and expansion of the 3G network. It is also adding a 4G network using the 2,300 MHz band for enhanced coverage and capacity.

Airtel recently awarded a big-ticket 4G deployment and expansion contract worth about US$ 500 million to Finnish telecom gear vendor Nokia for deployment in three new circles -- Gujarat, Bihar, and UP East-in addition to six circles -- Mumbai, MP, West Bengal, Odisha, Punjab and Kerala circles -- it already serves.

In related news Bharti Airtel on Friday moved the Telecom Disputes Settlement and Appellate Tribunal (TDSAT) against the regulator Telecom Regulatory Authority of India (TRAI) allowing Mukesh Ambani-led Reliance Jio to continue free promotional offer beyond stipulated 90 days.

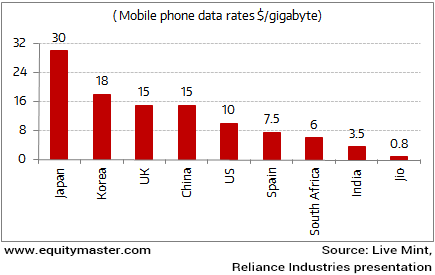

Jio first launched an inaugural free voice and data plan beginning September 4 and earlier this month extended it till March 31. Its disruptive pricing has led to established players scurrying for cover.

Jio's Pricing to Disrupt the Telecom Apple Cart

Airtel asked the quasi-judicial body to direct TRAI to ensure that Reliance Jio does not provide its free voice and data plan beyond December 2016. The next date of hearing has been fixed for 06 January, 2017.

In news about the economy, industrial activity, measured by the SBI composite index, has hit an all-time low of 45.5 for December 2016, as compared to the revised index of 50 in November. The index stood at 52.6 and 52.1 in September and October respectively.

The stark decline can be attributed to historically low credit growth, coupled with a reduction in consumer demand due to the demonetisation exercise.

A composite index reading of '42 to 46' and '50 to 52' implies 'moderate decline' and 'low growth', respectively, in manufacturing activity in the economy. According to State Bank of India's report Ecowrap, the monthly index, however, increased to 49.4 in December 2016 from 48.3 in the previous month. Both these readings indicate 'low decline' in manufacturing activity.

The SBI Composite Index is a leading indicator for tracking primarily manufacturing activity in Indian economy aiming to foresee the periods of contraction and the expansion. It uses various macroeconomic indicators such as Gross Domestic Product and Index of Industrial Production, along with various thematic indicators.

As per SBI analysts, credit growth is at historically low levels, even lower than what it was in 2009 following the global financial crisis, and if the credit growth collapses, obviously the (composite) index will collapse. Industrial activity has actually shrunk in November and December. The fortnightly data of all scheduled commercial banks indicate that credit offtake has declined to a historical low of 5.8% YoY as on 09 December 2016.

The report observed that the impact of demonetisation on different sectors is largely negative in the short term, and that factory output may continue to be in the negative territory in December 2016.

Demonetisation surely has had an impact on the short term, however my colleague Kunal Thanvi, in a recent edition of the 5 Minute WrapUp has highlighted a sector which can manage to beat the demonetisation blues.

Here's Kunal:

- Even if sales take a big blow this year, the auto growth story won't break down. Individuals and businesses will buy cars, two-wheelers, and trucks irrespective of demonetisation. A one-year hit to profitability won't change the long-term earnings power of fundamentally strong auto firms.

If anything, the recent correction in auto stocks is bringing valuations down to reasonable levels. Buying good auto stocks at the right price will likely result in healthy returns a few years later when the market begins 'weighing' them.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Continues Positive Trend; Consumer Durables Lead Gains". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!