- Home

- Todays Market

- Indian Stock Market News December 28, 2017

Indian Indices Trade Marginally Higher; Metal Sector Up 2.2% Thu, 28 Dec 11:30 am

Stock markets in India are presently trading marginally higher. Sectoral indices are trading on a positive note with stocks in the realty sector and metal sector witnessing maximum buying interest.

The BSE Sensex is trading up 10 points (up 0.03%) and the NSE Nifty is trading up 8 points (up 0.1%). The BSE Mid Cap index is trading up by 0.1%, while the BSE Small Cap index is trading up by 0.4%. The rupee is trading at 64.17 to the US dollar.

In the news from the macroeconomic front, as per an article in the Economic Times, as per a finance ministry announcement, India will borrow an additional Rs 500 billion this fiscal year.

The above borrowing comes as a negative development as it could breach the fiscal deficit target for the first time in four years and also weigh on bond and equity markets in India.

This additional borrowing could raise the fiscal deficit to 3.5% of gross domestic product (GDP), higher than the stated target of 3.2%.

The government has budgeted spending of Rs 21.5 trillion in FY18. Of this, it had spent Rs 12.9 trillion by October with a fiscal deficit of Rs 5.25 trillion against a full-year fiscal deficit budget of Rs 5.47 trillion. And this has led to fiscal slippage concerns this year.

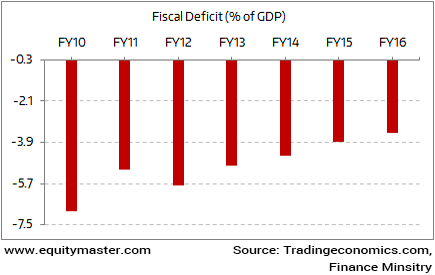

One must also note that in the last one decade, India is making serious efforts to reduce the fiscal deficit level. Ever since, the new government came in it has been in favor of fiscal consolidation and meet the long term fiscal deficit target of 3% by FY17-18. This will be the lowest target compared to the last couple of years, as can be seen from the chart below:

Fiscal Deficit target of 3% of GDP

That said, challenges remain in achieving the above stated target. The notebandi exercise resulted in a slowdown. Further, government announced flurry of projects but execution is still pending. This means the government needs to relax its spending to spurt the growth again.

This means, once again, the government needs to fight dual challenge. First, maintaining its stance on fiscal consolidation and sticking it fiscal deficit target of 3% of GDP for FY17-18. Second, it must relax the deficit target for reviving the economic growth from the shock of demonetisation.

It is also worthwhile to note that creating economic growth by the government spending its way out of trouble, cannot continue indefinitely.

As Vivek Kaul writes in one of his recent editions of the Vivek Kaul's Diary... 'At the end of the day the government has a limited amount of money at its disposal. Further, its expenditure tends to be terribly leaky and does not reach a major portion of those it is intended for.'

It would be interesting to see how the government tackles the above challenges. We'll keep you updated on the developments from this space.

In other news, the Lok Sabha has approved a bill to hike cess on luxury vehicles from 15% to 25%.

This is done with a view to enhance funds to compensate states for revenue loss following the rollout of the Goods and Services Tax (GST).

The above bill seeks to replace the Ordinance which was issued in September to give effect to the decision of the GST Council and provides for a hike in the GST cess on a range of cars from mid-size to hybrid variants and the luxury ones to 25%.

Automobile manufacturers may face some hiccups on the back of above development. Meanwhile, we'll keep you posted on the recent developments from this space.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Trade Marginally Higher; Metal Sector Up 2.2%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!