- Home

- Outlook Arena

- Outside View

- Outside View (PersonalFN)

- ICICI Prudential Bharat Consumption Fund: A Worthy Proposition?

ICICI Prudential Bharat Consumption Fund: A Worthy Proposition?Apr 3, 2019

As you may know, the Interim Budget 2019 was a pro-farmer and pro-middle-class budget -- an attempt was made to leave a higher disposable income in the hands of the common man. Apart from increasing household savings, the Union Budget 2019, is also expected to provide a boost to India's consumption story. ICIC Prudential Mutual Fund has come up with a New Fund Offer: ICICI Prudential Bharat Consumption Fund, an open-ended equity scheme following the consumption theme.

ICICI Prudential Bharat Consumption Fund (IPBCF) aims to capture the change in spending pattern and will invest in companies that may directly or indirectly benefit from the increase in consumption led demand.

India has a demographic advantage, income levels are rising, and there is a rise in double-income families, nuclear families, affluent middle-class families, which all augur well for India's long-term consumption story.

In addition, lowering borrowing rates, easy access to consumer credit, technology, and changing lifestyle choice offers a thrust to India's consumption story.

Recognising the thematic nature and IPBCF's investment objective, the scheme is suitable for investors seeking capital appreciation over the long-term with an investment time horizon of around 7-10 years. However, given the portfolio concentration to one theme and its allied sectors, IPBCF is a very-high-risk high-return investment proposition. IPBCF finds its place at the high end of the risk-return spectrum and hence, not suitable for the faint-hearted.

| --- Advertisement ---

Get Details Of Solid Small Caps In Your Inbox For Just Rs 245 A Month A year's subscription to our hugely popular small cap recommendation service, Hidden Treasure, costs just Rs 2,950. Rs 2,950 for a year comes to just Rs 245 per month. That is an extremely small price to pay for details of high-potential small cap stocks in your inbox every month. In fact, there are some stocks you could consider investing in right now too. So hurry, click here to grab this offer before it closes! ------------------------------ |

Table 1: NFO Details

| Type | An open-ended equity scheme | Category | Sector/thematic - Consumption |

|---|---|---|---|

| Investment Objective | To generate long-term capital appreciation by investing primarily in Equity and Equity related securities of companies engaged in consumption and consumption related activities or allied sectors. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved. | ||

| Min. Investment | Rs 5,000 and in multiples of Re. 1 thereafter. | Face Value | Rs 10 per unit |

| Plans |

|

Options |

*default option |

| Entry Load | Nil | Exit Load | 1% of the applicable NAV - If the amount sought to be redeemed or switch out is invested for a period of up to twelve months from the date of allotment Nil - If the amount, sought to be redeemed or switch out is invested for a period of more than twelve months from the date of allotment. |

| Fund Manager | Mr Rajat Chandak Mr Dharmesh Kakkad |

Benchmark Index | Nifty India Consumption Index |

| Issue Opens | March 26, 2019 | Issue Closes | April 09, 2019 |

How will the Scheme allocate its assets?

Under normal circumstances, the IPBCF's asset allocation will be as under:

Table 2: IPBCF's Asset Allocation

| Instruments | Indicative Allocation (% of Total Assets) |

Risk Profile | |

|---|---|---|---|

| Maximum | Minimum | ||

| Equity and Equity Related Instruments of companies engaged in consumption and consumption related activities or allied sectors* | 100 | 80 | High |

| Other equity and equity related securities | 20 | 0 | Medium to High |

| Debt, Units of debt Mutual Fund schemes and Money market instruments | 20 | 0 | Medium to Low |

| Gold/Gold ETF/Units issued by REITs/ InvITs such other asset classes as may be permitted by SEBI from time to time (subject to applicable SEBI limits) | 20 | 0 | Medium to High |

*Indicative list of sectors/industries falling under consumption and consumption related activities or allied sectors are as follows:

1. Automobile including auto components companies

2. Consumer Goods including consumer durables, consumer non-durables, retailing etc.

3. Energy

4. Healthcare Services

5. Media & Entertainment

6. Pharma

7. Services such as Commercial and Engineering Services, Hotels Resorts and Recreational Activities, Transportation, Trading, etc.

8. Telecom

9. Textiles

Please note that the above list is indicative, and the Fund Manager may add such other sector/industries which satisfy the consumption theme. The Fund Manager may also add other sectors as may be added in Nifty Consumption Index from time to time.

Further, it is stated in the offer document that the scheme may have exposure to:

- Derivative instruments upto 100% of the net assets. Derivatives include Index futures, stock futures, Index Options and Stock Options & such other derivative instruments as permitted by SEBI from time to time.

- ADR/GDR/ Foreign Securities to the extent of 50% of net assets. Investment in ADR/GDR/Foreign Securities would be as per SEBI Circular dated September 26, 2007, as may be amended from time to time.

- Securitised debt upto 50% of debt portfolio.

- Stock lending up to 20% of net assets.

The Cumulative Gross Exposure (CGE) across various asset classes will not exceed 100% of the Net Assets of the Scheme. Also, the Scheme will not engage in short selling, equity-linked debentures, repos in corporate bonds and credit default swaps.

What will be the Investment Strategy of IPBCF?

The Scheme intends to invest predominantly in equities and equity-related securities of companies that are likely to benefit directly or indirectly from consumption and related activities or allied sectors. As mentioned earlier, these companies may directly or indirectly benefit from the increase in consumption led demand. Indicatively, the list of sectors/industries falling under consumption and consumption related activities are:

- Automobile including auto components companies

- Consumer Goods including consumer durables, consumer non-durables, retailing etc.

- Energy

- Healthcare Services

- Media & Entertainment

- Pharma

- Services such as Commercial and Engineering Services, Hotels Resorts and Recreational Activities, Transportation, Trading, etc.

- Telecom

- Textiles

Broadly, IPBCF will invest in companies, which, in the opinion of the Fund Manager, offer an attractive investment opportunity to participate in the growth of the consumption sector. The Scheme Information Document states global corporations view India as one of the key markets from where future growth is likely to emerge. The growth in India's consumer market would be primarily driven by a favourable population composition and increasing disposable incomes.

IPBCF can also invest in equity & equity related securities of other companies.

To build a portfolio, IPBCF will follow a blend approach, i.e. a combination of value and growth, and will invest in stocks across market capitalisation i.e. large-cap, mid-cap, and small cap. Also, derivative instruments like Interest Rate Swaps, Interest Rate Futures, Forward Rate Agreements Stock / Index Futures or Options or other instruments for the purpose of hedging, portfolio balancing and other purposes, as permitted under the Regulations.

Further, IPBCF may also invest in other schemes managed by the AMC or in the schemes of any other Mutual Funds, provided it is in conformity with the investment objective of the Scheme and in terms of the prevailing Regulations. And as per the SEBI Regulations, such inter-scheme investments shall not exceed 5% of the Net Asset Value (NAV) of the Fund.

The Scheme may also invest in depository receipts including American Depository Receipts (ADRs), Global Depository Receipts (GDRs) and foreign securities.

While investing in debt & money market instruments, IPBCF aims to identify securities which offer an optimal level of yields/returns, considering risk-reward ratio. The Scheme will carry out a rigorous in-depth credit evaluation of the securities, which includes studying the operating environment of the issuer, and the short and long-term financial health of the issuer.

The rated debt instruments, in which IPBCF will have exposure to, will be of investment grade as rated by a credit rating agency.

In addition, the investment team of the AMC will study the macroeconomic conditions, including the political, economic environment and factors affecting liquidity and interest rates. The AMC would use this analysis to attempt to predict the likely direction of interest rates and position the portfolio appropriately to take advantage of the same. IPBCF may also invest in securitised debt.

Who will manage the ICICI Prudential Bharat Consumption Fund?

ICICI Prudential Bharat Consumption Fund will be managed by the duo: Mr Rajat Chandak and Mr Dharmesh Kakkad.

Mr Rajat Chandak has to his credit a Bachelors' degree in Commerce (B.Com) and Post Graduate Diploma in Management in Finance (PGDM- Finance) from the Institute for Financial Management and Research. He has around 10 years of experience in fund management/research analysis and is associated with ICICI Prudential Mutual Fund since May 2008.

At ICICI Prudential Mutual Fund some of the other schemes he manages are: ICICI Prudential Bluechip Fund, ICICI Prudential Value Fund - (Series 4, 11), ICICI Prudential Bharat Consumption Fund - Series 4, ICICI Prudential Long Term Wealth Enhancement Fund, ICICI Prudential R.I.G.H.T Fund, ICICI Prudential Regular Savings Fund, ICICI Prudential Multiple Yield Funds, ICICI Prudential Capital Protection Oriented Funds, and ICICI Prudential Balanced Advantage Fund.

Mr Dharmesh Kakkad is associated with ICICI Prudential Mutual Fund since June 2010. Prior to working in Dealing function, he was working in the Operations Department of the fund house. In June 2012, he was designated as Junior Dealer and currently is a Senior Dealer. He has to his credit a Bachelors' degree in Commerce (B.Com), is a Chartered Accountant (CA), and a Chartered Financial Analyst (CFA), USA.

At ICICI Prudential Mutual Fund some of the other schemes he manages are ICICI Prudential Asset Allocator Fund, ICICI Prudential Thematic Advantage Fund, ICICI Prudential Moderate Fund, ICICI Prudential Equity Savings Fund, ICICI Prudential Equity Arbitrage Fund, ICICI Prudential Balanced Advantage Fund and ICICI Prudential Passive Strategy Fund.

The overseas investments of the Scheme will be managed by Ms Priyanka Khandelwal.

The outlook for ICICI Prudential Bharat Consumption Fund:

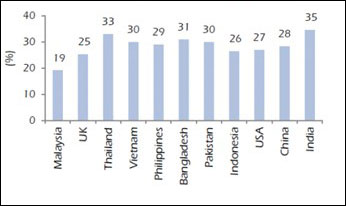

India is the second most populated country in the world with over a billion population -- and mainly with a demographic advantage. Meaning, India's 65% population is below 35 years of age (Census 2011).

Millennial forms 35% of India's population

India's has the largest millennial population in the world. Plus, as mentioned earlier, rise in income levels, the rise in double-income families, nuclear families, affluent middle-class families, all augur well for India's long-term consumption story.

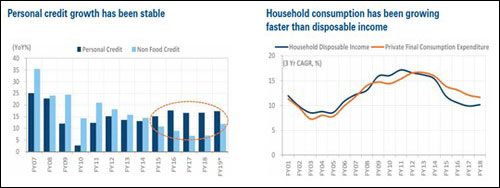

In addition, lower borrowing rates, easy access to consumer credit, technology, and changing lifestyle choice offers a thrust to India's consumption story. Discretionary spending has gone up, particularly in the last two decades.

The Scheme Information Document states that India hit a ten-year high and stood first among the 63 nations surveyed in the global consumer confidence index with a score of 136 points for the quarter ending December 2016.

Further, global corporations view India as one of the key markets from where future growth is likely to emerge. The growth in India's consumer market would be primarily driven by a favourable population composition and increasing disposable incomes.

According to a Boston Consulting Group (BCG) report, The New Indian: The Many Facets of a Changing Consumer, and as cited in the Scheme Information Document, India's robust economic growth and rising household incomes are expected to increase consumer spending to US$ 3.6 trillion by 2020. The maximum consumer spending is likely to occur in food, housing, consumer durables, and transport and communication sectors. The report further states that India's share of global consumption would expand more than twice to 5.8 per cent by 2020.

By 2025, India would rise from the 12th to the 5th largest position in the consumer durables market in the world; the market is estimated to reach US$ 12.5 billion in 2016. The consumer durables market in India is expected to reach US$ 20.6 billion by 2020, according to India Brand Equity Foundation. The growth in demand is likely to accelerate with rising disposable incomes and easy access to credit. Increasing electrification of rural areas and wide usability of online sales would also aid growth in demand.

So, there is ample potential in India's consumption story. But many of the variables of this theme are also hinged on job creation and rise in disposable income, which is imperative for it to realise the growth as envisaged.

Hence ICICI Prudential Bharat Consumption Fund is suitable for investors who are willing to take extremely high risk and have an investment time horizon of around 7-10 years. It is not for the faint-hearted as the fortune of the fund will be closely linked to undercurrents of this theme.

PS: If you're looking at the best equity mutual funds to invest in 2019 right away, here is PersonalFN's special premium report: Top 5 Undiscovered Equity Funds to Invest In 2019.This report tells you about five worthy, high growth potential equity schemes that can be instrumental in building significant wealth over the next 5-7 years.

And only for a limited period you can get this report virtually free, click here to know how.

Author: Rounaq Neroy

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

Disclaimer:

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

Equitymaster requests your view! Post a comment on "ICICI Prudential Bharat Consumption Fund: A Worthy Proposition?". Click here!

2 Responses to "ICICI Prudential Bharat Consumption Fund: A Worthy Proposition?"

NAZIR KHAN

Apr 8, 2019Thanks