The One Chart that Opens the Door to Exponential Returns

Michael Moritz is the billionaire head of the VC firm Sequoia Capital.

He was once asked why Sequoia was so successful. Moritz mentioned longevity. He said some VC firms succeed for five or ten years, but Sequoia has prospered for four decades.

On being asked the secret sauce, Moritz replied, "I think we have always been afraid of going out of business".

Only the paranoid survive.

There are 2 ways of surviving in the financial world.

The first is the one that most of investors who swear by investing legends like Warren Buffett and Charlie Munger follow.

Compounding: The eighth wonder of the world

It's a tried and tested investing strategy. But only if you give it years to work its magic.

It's like planting a Chinese bamboo tree. The first couple of years will never show much progress on the outside. But 5 years later, the progress will create something remarkable.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

This Silvery-white Metal is a Potential Fortune Maker

This silvery-white metal goes inside almost all the electronic gadgets that you use: mobile phone, laptop, Bluetooth speakers.

Not only that... this metal also goes inside equipment used by large data centres, telecom towers, railways, planes, EVs.

We're talking about Lithium. Lithium is the new oil.

Our research has found the best way to tap into this rising demand of lithium in India.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

As Buffett puts it, 'Time is the friend of a wonderful company and an enemy of a bad one'.

Buffett didn't panic and sell during 14 recessions he has endured in his investing carrier. I'm sure all of us are aware of the wonders of compounding and have been practising it in some or the other asset class.

But today I'm writing about the other way of investing which appeals only to a limited audience. But if done right, this strategy can make you a fortune.

On a lighter note, whenever I think of VC investing, the speed and magnitude of returns come to mind. I'm always reminded of a line from one of my favourite Hindi movie Hera Pheri 2.

"21 days mein paise double".

Just look at all the tech IPOs which listed in the last 1 year. The maximum returns were made by VCs and private equity players.

The poor retail investor was left holding overpriced, overhyped stocks in their portfolios.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Investing in Small Companies Offer Huge Potential Long-Term Growth for Early Movers

Find out how you can access our Premium Research on India's Emerging Businesses

Full Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Venture capital funds have a peculiar way of operating. Actually, it's not peculiar. It just looks peculiar to stock market investors because our focus is on minimising risk.

But VCs work on the premise of 'more is better'.

The more darts you throw at the board, the higher the statistical probability that you will hit the bulls-eye. Thus, more is better.

The common rule of thumb is that of 10 start-ups, three or four fail completely. Another three or four return the original investment. Only one or two will produce substantial returns.

For a VC fund to beat public equity markets, the one or two successful companies, give them a 50x returns over a 5-7 year period.

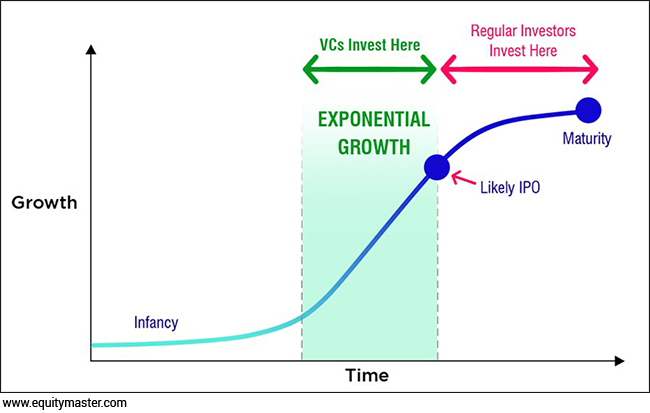

Only way to get a 50-100x return in such a short span of time is to invest during the growth phase of the company.

Here are some examples...

- Tiger Global made a 340 times return on its investment in Freshworks.

- Info Edge clocked 1,000 times return on Zomato when it went public.

- Despite Paytm's disastrous listing, Chinese investors Ant Financial and Alibaba made over US$1 bn.

That precisely is the inherit advantage which venture capitalists have. This road is fraught with risks. But investing in an early-stage start-up can prove to be the jewel in your portfolio.

Look at this chart...

A Picture Speaks a Thousand Words

The explosive growth of a young company is often captured by VCs. The growth leads to re-rating in the valuation of the company every time it raises funds.

Have you ever seen a VC fund raiser for a fast growing start-up happen at lower valuation?

I haven't.

When a when a company is growing and its losses are rising, the focus of investors and promoters is to grow revenues as fast as possible. This way the losses can be overlooked in the short term.

This is exactly how VCs make their exponential returns.

Unfortunately, when the stock lists, the explosive growth period of the company is behind it. It will likely grow at or marginally above its industry's growth rate.

In that case how can investors make exponential gains like VCs?

The full market size of these industries hasn't been discovered yet. And this is where the opportunity is. It's like finding sun rise sectors and strong companies in them before the market.

That is the space from where your next 50-100 bagger will come from.

Warm regards,

Aditya Vora

Research Analyst, Hidden Treasure

Recent Articles

- Why CE Info and Netweb Technologies Can Go Where NVIDIA Can't... April 24, 2024

- A 100-day programme will look for companies that can fortify India's deeptech foray.

- Can Your Stocks Benefit from Higher Inflation? April 23, 2024

- Higher Inflation is good for these companies.

- Hidden Potential: Can This Mid-cap Stock Double Your Money? April 22, 2024

- This mid-cap stock could soar if things go right.

- Semiconductor Stocks for Your Watchlist April 19, 2024

- These companies are riding India's semiconductor boom.

Equitymaster requests your view! Post a comment on "The One Chart that Opens the Door to Exponential Returns". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!