How Long Before Markets Recover from the Banking Crisis?

In early 2007, Former Citigroup CEO Chuck Prince laid out his strategy for running the world's largest bank then...

- As long as the music is playing, you've got to get up and dance. We're still dancing.

A few months later the music duly stopped. The markets went into turmoil.

Mr Prince resigned, leaving his bank with total losses worth up to US$ 17.5 bn to write off.

Citigroup did not fail but Lehman Brothers did. And the collapse proved to be the tip of the iceberg called subprime credit.

Ironically, sixteen years later, the central banks in West are once again caught napping. And big banks seem to be in no mood to acknowledge the crisis in their backyard.

In February 2023, Credit Suisse assigned zero lending value for bonds issued by Adani Group's listed subsidiaries.

Weeks later, auditor PwC reported material weaknesses in Credit Suisse's own books of accounts and internal controls.

That's not all. Swiss authorities plan to impose losses on Credit Suisse bond holders as part of the bank's rescue plan.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

India's Potentially Decade-Long $10 Trillion Bull Run...

Our Co-Head of Research Tanushree Banerjee believes India is going on a decade-long $10 trillion bull run.

And she has discovered 7 mega trend that could potentially be among the top wealth creators in this upcoming bull run.

At our upcoming event, Tanushree will reveal all the details of this mega opportunity, including the golden buying window to enter India's potentially decade-long $10 trillion bull run.

Click Here to Get Full Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

When large global banks such as Citigroup and Credit Suisse lose depositors' trust, it typically has a domino effect on the entire financial system.

More importantly, it takes a while before the actual proportion of risks are known.

For instance, the remarks by FDIC Chairman Martin Gruenberg at the Institute of International Bankers earlier this month got little media coverage then.

Mr Gruenberg had made two stark and alarming observations:

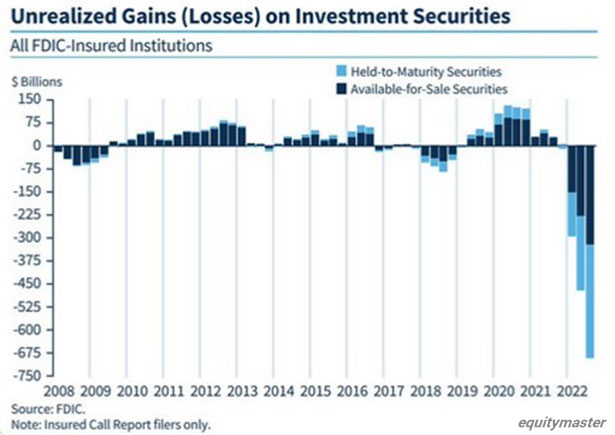

- The total unrealized losses in the treasury books of American banks were to the tune of US$ 620 billion at the end of 2022.

- The unrealized losses on securities have meaningfully reduced the reported equity capital of the banking industry.

Let me explain.

One factor driving the current disruption has been the massive flows into and out of Treasurys and bonds. Demand for these so-called safe-haven assets typically rises in times of stress in markets. But prices for safe bonds have been under pressure for much of the past year as the US Fed and other global central banks sharply raised interest rates in a bid to fend off inflation. This has caused massive treasury losses for the banks.

The actual risk posed by the notional treasury losses in the banks' books is evident in this chart published by the FDIC.

It literally shows how the swift and sharp rise in interest rates have created a ticking time bomb for the banking sector.

Ticking Time Bomb for US Banks in 2023

We don't know yet whether the consequences dearer money and regulatory changes will cascade throughout the US banking sector. Also whether there are more bank shutdowns coming.

It does seem inevitable that banks in the US and Europe will now need to pull back on lending to shore up their balance sheets. Also, they are likely to see stricter reserve capital standards.

But in the meanwhile it could inflict pain on not just on the American and European capital markets, but fund flows into equities world over.

In other words, it is not unrealistic to assume that the current crisis could last months if not years. And the stock markets could price in too much of the near-term pain too soon.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

This Silvery-white Metal is a Potential Fortune Maker

This silvery-white metal goes inside almost all the electronic gadgets that you use: mobile phone, laptop, Bluetooth speakers.

Not only that... this metal also goes inside equipment used by large data centres, telecom towers, railways, planes, EVs.

We're talking about Lithium. Lithium is the new oil.

Our research has found the best way to tap into this rising demand of lithium in India.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Well, ideally that should mean a rare opportunity for a long-term investor. For it is such market crisis that offer the chance to buy coveted stocks at discounted valuations.

But of course, only if you are well prepared to lap up the opportunity while it lasts.

The opportunity is not just about buying stocks that seem cheap in valuation terms. Beware! There can plenty of value traps, if you aren't careful.

But making a watchlist of stocks based on long term megatrends can offer you the best chance to focus on your high conviction bets.

For instance, you could screen stocks with the best fundamentals from a wide variety of themes like electric vehicles or defence or digitisation.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Investing in Small Companies Offer Huge Potential Long-Term Growth for Early Movers

Find out how you can access our Premium Research on India's Emerging Businesses

Full Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Or you could search for stocks in India that legends like Peter Lynch or Benjamin Graham or Joel Greenblatt would have loved buying.

Irrespective of the approach you take, ensure that you turn the current crisis into an opportunity of a lifetime.

Warm regards,

Tanushree Banerjee

Editor, StockSelect

Equitymaster Agora Research Private Limited (Research Analyst)

Recent Articles

- Why CE Info and Netweb Technologies Can Go Where NVIDIA Can't... April 24, 2024

- A 100-day programme will look for companies that can fortify India's deeptech foray.

- Can Your Stocks Benefit from Higher Inflation? April 23, 2024

- Higher Inflation is good for these companies.

- Hidden Potential: Can This Mid-cap Stock Double Your Money? April 22, 2024

- This mid-cap stock could soar if things go right.

- Semiconductor Stocks for Your Watchlist April 19, 2024

- These companies are riding India's semiconductor boom.

Equitymaster requests your view! Post a comment on "How Long Before Markets Recover from the Banking Crisis?". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!