118% Gain in a Falling Market. Is the Magic of EV Stocks Here to Stay?

If you bought the stock in 2010, your returns, till date, would be near zero. But even as the stock markets nose dived in the past month, this long forgotten auto company saw gains as high as 118% in a month.

Reason? The company is the latest to announce its electric vehicle plans.

Turns out its checkered history, going back several decades, has got the markets excited.

In fact, not just the last decade, but last several decades have been nondescript for the company that once enjoyed monopoly in Indian passenger vehicles.

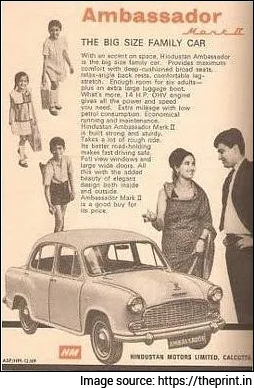

Ambassador cars were the mainstay on Indian roads until the 1970s and 80s. The company that produced the car, Hindustan Motors, enjoyed an equally distinct status in corporate India.

The company's factories occupied 275 acres of land in suburban Kolkata. With even a railway station to its name, till date, Hindustan Motors, attracted employees from all over the country.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Looking to Buy Midcap Stocks?

If you're looking to buy some high-quality midcap stocks, then our co-head of research Rahul Shah has got some great recommendations.

You can get instant access to these stocks by subscribing to his popular stock research service, Midcap Value Alert.

The great news is... as part of Equitymaster's 28th anniversary celebrations... you have the chance to access this service at a huge 80% OFF

Get Full Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Often referred to as a 'Sarkari Car', it was mostly used by top government servants, corporates and the rich and famous. Their patronage alone drove the sales of the company.

Post liberalisation in the 1990s, a number of foreign players entered the Indian markets through joint ventures and tie ups.

Hindustan Motors, tried to remain competitive by launching variants of its vehicles with minor modifications.

There was no major overhaul, no makeover, nor much advertising. The company believed that its name was enough to retain its position in the market dynamics. Unfortunately, that wasn't the case.

Hindustan Motors' joint venture with Mitsubishi in the late 90s was expected to be the much-needed turnaround for the company. However, the hype soon faded as volumes did not match expectations.

On my childhood trips to Kolkata, I have heard stories, of how the thriving township was once "the Detroit of the East". And how it now wears as deserted a look as its namesake.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Equitymaster's Premium Research:

Discover the Lucrative Opportunities in India's Emerging Business space

Read This Letter

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

But after several decades the company seems to have latched on to the tailwind that is expected to transform India's auto sector.

To ride its fortunes in the electric vehicle opportunity, Hindustan Motors has reportedly signed an MoU with a European company. The plan is to invest Rs 6 bn in the joint venture and that the new car is likely to be launched in 2024.While the company has no sales or profits to show, the spectacular rise in the stock price is completely on the back of speculation about the EV fortunes.

Several socks like CV maker Olectra Greentech have seen gains like 2,000% in 12 months, once their EV upside was visible. Plus, they saw their order books swell.

But in this case investors seem to be buying into this smallcap purely out of speculative reasons.

Don't get me wrong. The EV opportunity is here to stay. And several stocks in the EV ecosystem have long runway ahead of them.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Want Low Risk Stocks with High Growth Potential?

Access Our Premium Research on Safe Stocks at 60% Off

Full Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

But piling on to stocks without fundamentals, purely due to the herd mentality reminds me of the fate of stocks like Vakrangee.

So, be careful about stocks that seem to outperform the falling market without a solid rationale.

Pleas stick to the tried and tested checklists.

Warm regards,

Tanushree Banerjee

Editor, StockSelect

Equitymaster Agora Research Private Limited (Research Analyst)

Recent Articles

- Wait for Tata Electronics IPO to Buy Semiconductor Stocks? April 18, 2024

- India's chip designers are already leading the pack in India's semiconductor ecosystem.

- Are Green Hydrogen Stocks on Your Watchlist? April 17, 2024

- The quest to hit net zero has generated huge interest in green hydrogen.

- One of the Most Important Themes Playing out in the Indian Stock Market April 16, 2024

- Are you profiting from premiumisation?

- Stocks to Profit from India's Transformer Gold Rush April 15, 2024

- The transformer is the new gold. These two pick and shovel stocks can be a part of your watchlist.

Equitymaster requests your view! Post a comment on "118% Gain in a Falling Market. Is the Magic of EV Stocks Here to Stay?". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!