Beware. These Stocks Could Poison Your Portfolio in 2023

It goes without saying that stock market losses hurt. Losses don't go down well with our brains. There are proven psychological studies around this. It is believed that we individuals feel the pain of loss twice as intensively than the equivalent pressure of gain.

And this pain or fear is not without reason. For e.g. if you lose 50% in a stock, you need to invest in a 2-bagger just to break even on that sum of money. If you lose 80% in a stock, you need a 5-bagger to breakeven on that sum of money.

And god help you if you lose 90% in some stock. You will need a huge 10-bagger just to get back your original investment.

Is it any wonder that people are so loss-averse when it comes to investing?

So, how do you minimise losses in investing? I will be honest with you. It is impossible to have a totally loss-free portfolio. Losses are part and parcel of investing, especially if you've been investing for long.

Therefore, to completely eliminate losses is like living in a fool's paradise.

But there's something else you can do. You can try to minimise your losses. You can try to keep your losses to a bare minimum so that they don't cause a big dent to your long-term portfolio.

One of the best ways to do this in my view is to avoid poisonous stocks. Yes, you heard that right.

If you want to prevent large scale wealth-destruction, then stay away from poisonous stocks as far as possible.

Now, the question is, what exactly are poisonous stocks and how do you identify them?

Well, there is no universal definition of a poisonous stock. Each investor can define it the way he wants.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

----------------------------------------

However, as far as my definition is concerned, poisonous stocks are stocks that are expensively valued and have weak balance sheets and are also frequently loss making.

Let me repeat that.

Poisonous stocks are stocks that are expensively valued, have weak balance sheets and are frequently loss making.

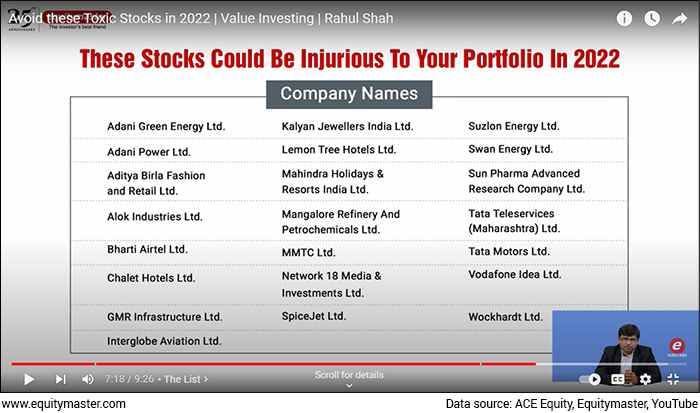

In fact, this is not the first time I am talking about poisonous stocks. My first video on poisonous stocks went live on 6th of Jan this year.

In it, I had labelled the following stocks as poisonous and had asked investors to stay away from them.

Here's the full list for you.

There are 22 names in it, starting right from Adani Green Energy to Wockhardt Ltd.

These poisonous stocks were shortlisted based on the 3 rules that I just highlighted i.e., expensive valuations, weak balance sheets and loss making operations.

I would recommend that you watch the 6th Jan video if you want to get into the full details of how I managed to shortlist these stocks.

However, today, let's discuss the performance of these stocks.

You see, out of 22 stocks, 12 stocks have destroyed investor wealth in 2022 so far while the remaining 10 have given positive returns.

The biggest loser, Tata Teleservices Ltd is down almost 60% in 2022 so far, followed by Vodafone Idea, SpiceJet, Wockhardt and others.

In terms of gainers, Adani Power which we labelled as one of the 22 poisonous stocks, has done a complete U-turn. Instead of collapsing, the stock price has skyrocketed and has earned almost 230% returns for investors in 2022.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

India's Lithium Megatrend is an Emerging Opportunity for Investors

We all know how oil producing countries made fortunes in the last century.

But now, the world is moving away from oil... and closer to Lithium.

Lithium is the new oil. That's the reason why India is focusing heavily on expanding its lithium reserves.

If you can tap into this opportunity, then there is a potential to make huge gains over the long term.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

So, what do we make of these numbers? Was it correct to label these stocks as poisonous stocks or have I misguided investors and made them miss strong performers like Adani Power, Lemontree Hotels and Swan Energy?

Well, if you had invested Rs 100 in each of these stocks right after I published the list, you would have earned a positive return of almost 11% so far in 2022.

This is much better than the 2% returns earned by the Sensex during the same period. Therefore, it will be safe to say that a portfolio consisting entirely of my 22 poisonous stocks would have ended up outperforming the benchmark index.

Well, poisonous stocks was meant to destroy investor wealth and not build it.

However, this poisonous stock portfolio has increased investor wealth by 11% and has even outperformed the index.

Therefore, you can say that collectively, these stocks have not proved to be poisonous at all. In fact, they have proved to be market beaters.

So, has my list of poisonous stocks failed? Should I discard it and come up with better rules for shortlisting these stocks. Well, not so fast.

We compared the performance of the poisonous stock portfolio with the Sensex and realised that my poisonous stock portfolio earned 11% returns versus 2% by the Sensex.

But what if we remove the outlier i.e., Adani Power. As you saw, Adani Power was the best performing poisonous stock in 2022, up more than 3x. However, if you remove Adani Power from the list, then the returns of the portfolio fall to just 0.6% from 11%.

I know some of you are wondering whether removing Adani Power is fair. After all, this amounts to changing the facts to suit my theory instead of changing my theory in response to the facts.

Well, let's take a look at the following table and then figure out whether my decision to ignore Adani Power was incorrect.

| Stock A | Stock B | |

|---|---|---|

| Earnings per share | ||

| FY15 | 10.1 | -2.8 |

| FY16 | 10.9 | 1.7 |

| FY17 | 10.8 | -16.0 |

| FY18 | 10.7 | -5.5 |

| FY19 | 13.9 | -2.6 |

| FY20 | 11.7 | -5.9 |

| FY21 | 15.1 | 3.3 |

| Latest D/E | 1.7x | 4.0x |

| 3 Yr Avg ROE | 11.6% | -101.7% |

| Valuation as on Dec 31, 2021 | ||

| PE (x) | 8.0x | 137.7x |

| PBV (x) | 0.9x | 2.8x |

Which of the two companies do you think you'd be more comfortable investing in? I guess most of you will go with Stock A if you believe in the principles of sensible, long-term investing.

After all, stock A has a more predictable earnings profile, has less debt and above all, is more attractively priced. Stock B on the other hand seems like a speculative bet as its historical fundamentals aren't up to the mark.

Well, let me tell you that both the stocks are amongst the top power stocks in India.

Stock A is none other than the power sector behemoth NTPC while stock B is Adani Power.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Your Invitation to Access

Our Small Business Stock Research is Still Open

Get Access Now

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Adani Power, as you all know, was one of the poisonous stocks for 2022 and is still up a massive 230% during the year. NTPC on the other hand, has outperformed the benchmark index by a significant margin in 2022 and is up almost 40% this year. However, it is still way below Adani Power's impressive outing in 2022.

Does Adani Power's better showing in 2022 turn it into a better investment than NTPC? I don't think so. I believe that returns alone does not turn a bad quality stock into a good one. For a stock to qualify as a good quality one, it should have a long track record of sound earnings and sound financials.

Therefore, even though Adani Power has outperformed NTPC in a big way, I will be happy to own 20 stocks that has the same fundamentals as NTPC instead of owning a 20-stock portfolio with the same characteristics as Adani Power.

The latter is a poisonous portfolio in my view and one stock turning into a 3-bagger does not change my view.

Therefore, I felt it was not wrong to analyse the performance of the poison portfolio after removing Adani Power.

The fact that it returned 230% doesn't suddenly turn it into a fundamentally strong company. The improvement has to reflect in the company's performance for a few years for it to move out of the poison portfolio list.

With this important thought in mind, it is now time to unveil the poison stock list for the year 2023.

Here are the stocks from the BSE 500 universe that I believe could be dangerous for your portfolio in 2023.

These Stocks Could Harm Your Portfolio in 2023

| Adani Green Energy Ltd. | Interglobe Aviation Ltd. | Shree Renuka Sugars Ltd. |

| Alok Industries Ltd. | Lemon Tree Hotels Ltd. | SpiceJet Ltd. |

| Ashok Leyland | Mahindra Holidays & Resorts India Ltd. | Sun Pharma Advanced Research Company Ltd. |

| Bharti Airtel Ltd. | Network 18 Media & Investments Ltd. | Swan Energy Ltd. |

| Chalet Hotels Ltd. | PVR Ltd. | Tata Motors Ltd. |

| Tata Teleservices (Maharashtra) Ltd. | Vodafone Idea Ltd. |

The list has almost the same names as 2022 except for a couple of new stocks. Please note that this is entirely my interpretation of poison stocks. Please feel free to have your own parameters for poison stocks and also to include or exclude a few stocks from this list as you deem fit.

As far as I am concerned, there's very small chance I may recommend stocks from this list to my subscribers over the next year or two at least. After all, rule number one in investing is not to lose money and the second rule is to always keep the first rule in mind.

Happy Investing.

Warm regards,

Rahul Shah

Editor and Research Analyst, Profit Hunter

Recent Articles

- Can Your Stocks Benefit from Higher Inflation? April 23, 2024

- Higher Inflation is good for these companies.

- Hidden Potential: Can This Mid-cap Stock Double Your Money? April 22, 2024

- This mid-cap stock could soar if things go right.

- Semiconductor Stocks for Your Watchlist April 19, 2024

- These companies are riding India's semiconductor boom.

- Wait for Tata Electronics IPO to Buy Semiconductor Stocks? April 18, 2024

- India's chip designers are already leading the pack in India's semiconductor ecosystem.

Equitymaster requests your view! Post a comment on "Beware. These Stocks Could Poison Your Portfolio in 2023". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!