What the Stock Market in 2021 Taught me About Investing in 2022

The New Year signifies the completion of one revolution of the earth around the sun.

These events add value to our lives. In fact, human memory remembers time better through events and specific moments rather than dates.

And covid is the biggest event of our time. All of us have had ups and downs in our lives due to covid during the year gone by.

But from the perspective of the stock market, things have been pleasant.

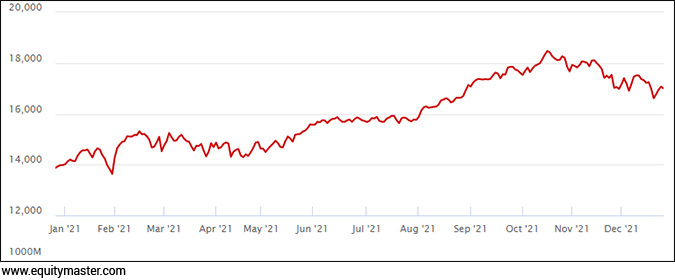

The Nifty is up 23% so far during the year. Investors' portfolios, in general, would have also returned as much.

As dramatic it may seem, as I write for the last time in the year 2021, I thought I should be candid with you. After all, most of the time we write about our views on stocks, the market, the economy.

So, let me try something slightly different this time.

For starters let me analyse certain events in the stock market, the economy, and life itself. I'll try to relate it to how the markets reacted to these events in 2021.

In life, learning from our mistakes is costly. The smarter approach should be to learn from other people's mistakes.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

India's Potentially Decade-Long $10 Trillion Bull Run...

Our Co-Head of Research Tanushree Banerjee believes India is going on a decade-long $10 trillion bull run.

And she has discovered 7 mega trend that could potentially be among the top wealth creators in this upcoming bull run.

At our upcoming event, Tanushree will reveal all the details of this mega opportunity, including the golden buying window to enter India's potentially decade-long $10 trillion bull run.

Click Here to Get Full Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

This is the advice Jack Ma of Alibaba gives all those who want to start a business, 'Make mistakes in a job and learn from it, as the downside will be limited'.

So here are my observations of 2021 and what we can extrapolate to the future...

Markets Never React to the Same News More than Once

Every time a new covid wave is likely to hit us, we assume the markets will decline rapidly. The memories of March 2020 are still fresh in our minds.

Now the assumption of a negative hit the economy is valid. But the important point is the rebound which happens after lockdowns.

Thus, I think the golden rule is this - Markets never react to the same information/news in the same way they did when it hit the first time.

The second wave, which was much more catastrophic than the first wave is a testimony to the fact that markets do not react to the same news twice.

In March 2021 before the second wave hit us, the Nifty was around 14,900. As the second wave hit us at the end of March and April, the Nifty barely moved.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

This Silvery-white Metal is a Potential Fortune Maker

This silvery-white metal goes inside almost all the electronic gadgets that you use: mobile phone, laptop, Bluetooth speakers.

Not only that... this metal also goes inside equipment used by large data centres, telecom towers, railways, planes, EVs.

We're talking about Lithium. Lithium is the new oil.

Our research has found the best way to tap into this rising demand of lithium in India.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Imagine reading the newspapers and the internet showing you photos of human apathy at its worst.

Families were destroyed, but Mr Market, a ruthless animal, had no negative reaction at all.

Nifty in 2021

What's the lesson here? Markets never react to same information more than once.

Narratives Change Very Fast in the Market. Be Aware and Act Fast

The old Marwaris of Dalal street have always taught me the stock market is ruthless.

When a major negative event in the company comes to light, first sell the stock. Then analyse the bad news.

Let me show you how narratives change.

A couple of years ago, RBL Bank was touted to be the next HDFC Bank. All marquee investors and FIIs were flocking to it.

IPO price was Rs 225. It listed at a premium of 22% to issue price.

Today, the stock trades below Rs 150.

The narrative has changed from, 'It's the next HDFC Bank', to 'It's going the Yes Bank way'.

A big U-turn from HDFC Bank to Yes Bank! That's how fast narratives change in the market.

But in reality, the writing on the wall was there for a long time.

In 2020, all banks and financial stocks were battered, including RBL bank. As markets rebounded, a majority of banks, including PSU banks, were up 100-300% from their lows. Many private banks made new life time highs.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Investing in Small Companies Offer Huge Potential Long-Term Growth for Early Movers

Find out how you can access our Premium Research on India's Emerging Businesses

Full Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

However, even before today's fall, RBL bank was down 65% from its previous high in 2019.

The writing on the wall was there for all to see for a long time.

When Everyone on the Street Talks about Something, that's the Time to Sell, Not to Buy

This is an old saying which repeats in every bull market. Cycles may change but human behaviour of greed and fear will never change.

100 years from now, the same rules will still apply. After all, the veterans call stock market as a psychological game more than a numbers game.

In February 2021, we were told commodities are in a super cycle. The craze for steel and aluminium stocks were at its peak.

Quarterly target prices were upgraded by analysts. Terms like 'structural growth' were doing the rounds.

Since when did commodities become structural? Aren't they the prime definition of cyclical stocks?

When media channels, analysts, and everyone on the street, was talking about it in March and April, the smart hands sold these stocks.

Tata Steel, JSW Steel, SAIL and many more, still haven't reached their peaks made in April 2021.

The same narrative played out with the chemical stocks. They were touted as the next FMCG.

Retail investors believed this narratives and bought them at astronomical PE ratios.

That was the time to sell.

The lesson?

Buy stocks when nobody is talking about them and sell them when the world tells you to Buy.

That's how the smart hands made money.

As I end this piece, let me ask you a billion-dollar question. The answer to which has been a mystery to me for many years.

Why is the ITC stock not moving?

I would love to hear from you, dear subscribers. Write to me here.

I wish you a Happy New Year!

Warm regards,

Aditya Vora

Research Analyst, Hidden Treasure

Recent Articles

- A Rare Opportunity to Profit from Pharma Stocks April 25, 2024

- This opportunity can create a lot of wealth. Keep an eye on it.

- Why CE Info and Netweb Technologies Can Go Where NVIDIA Can't... April 24, 2024

- A 100-day programme will look for companies that can fortify India's deeptech foray.

- Can Your Stocks Benefit from Higher Inflation? April 23, 2024

- Higher Inflation is good for these companies.

- Hidden Potential: Can This Mid-cap Stock Double Your Money? April 22, 2024

- This mid-cap stock could soar if things go right.

Equitymaster requests your view! Post a comment on "What the Stock Market in 2021 Taught me About Investing in 2022". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!