- Home

- Outlook Arena

- The Best Dividend Stocks to Buy

The Best Dividend Stocks to Buy

Revealing on April 30: Are You Ready for the Upcoming Election Surprise?

The year was 1920.

A banker named Mr Munroe spotted an unusual opportunity. He wanted the depositors to earn more than what the bank's deposits could offer them. And the 50% crash in the stock price of Coca Cola presented the opportunity of a lifetime.

Mind you, this was just a year after the stock of Coca Cola had listed and well before Warren Buffett recognised its moat.

A conflict with the sugar industry caused the stock price of the beverage company to come crashing down.

The company had sufficient profits, return ratios, and cash flows. However, the stock was trading less than the cash per share.

The banker did encourage his depositors in the town of Quincy, Florida, to buy the stock of Coca Cola.

But what he convinced them of was the benefits of its dividends. True to his word, the farm town was relatively unaffected during the Great Depression. And it was the Coca Cola dividends that supported the local economy when the farm income dried up.

Later, Quincy became the richest town in terms of per capita income in the entire United States.

Thus, the story of Coca Cola dividends goes far beyond the merits of the company's moat, financial strength, and management quality that Buffett has made famous.

Investing in dividend stocks is not just about fetching some returns in times of stress.

On the contrary, if done smartly, dividend stocks can make your portfolio returns look better than you could ever imagine. That too across market cycles!

Understanding Dividends with Examples

For a second, imagine yourself as a cattle farmer. You buy a cow, feed it and milk it to earn income from dairy products.

After two years, due to high demand of cows in the market, you sell it at double price.

That's how people earn in the stock market. They buy stocks at low prices, retain dividends (like the farmer earned from selling milk) and then sell them at high prices (like the farmer sold it after 2 years).

So, the profit earned from selling high is capital appreciation profit, and the sum of money paid regularly by a company to its shareholders out of its profits is known as dividend profits.

These days, dividend stocks have become some of the most sought after entities in the share markets.

Dividend yield is analogous to the interest rate that you'd receive on a bank's money market or savings account. Your dividend yield is your next 12 month's expected dividends divided by the price you pay for the shares.

Dividend Stocks in a Low Interest Rate Environment

Nothing tells you about the sustainability of a business better than a company's track record in paying dividends over a long period of time.

While earnings can be manipulated and are therefore less trustworthy, dividends indicate good corporate governance. Plus, consistent growth in dividend payouts is the best yardstick to measure the management's commitment to creating shareholder wealth.

In other words, as with the Coca Cola dividends, you would want to be invested in companies that can offer you some returns even while passing through economic depressions, cyclical downturns, and periodic shocks.

But dividend stocks are not just your friends for bad times. In good times, a handsome dividend receipt can be the icing on the cake!

For countries like India, where inflation has been on average much higher than in the West, dividends make it that much easier to earn inflation-adjusted returns.

The returns on fixed deposits here have rarely managed to offer real inflation adjusted income in recent years.

But if the returns on a safe stock are topped with a healthy dividend yield, beating the inflation number by a wide margin is not impossible.

What Kind of Businesses Pay High Dividends?

A company can do two things with the profits that it earns.

It can either plough the profits back into the company for investing in capex, new products or distribution. Or it can pay out the amount as dividend and become a dividend stock.

As such, dividend payout depends a lot on the cash (after meeting its capital expenditure and working capital requirements) a company generates during a year.

Often companies do not need to reinvest xo into the business (in spite of having high return on investments), purely because they don't see the need for it.

A classic example would be of companies from the FMCG sector. The FMCG sector is a slow yet steady growing industry. Most of the companies garner high return on their investments in this sector. But yet they choose to pay out huge dividends due to the sector's slow growing nature as capex requirements are on the lower side.

As against this commodity businesses like cement, steel, textile or even capital goods and telecom businesses need to constantly reinvest cash. This leaves very little on the table to pay to shareholders by way of dividends.

Is Every High Dividend Yield Company a Good Buy?

Absolutely not. Not all dividend stocks could be treated equal.

When identifying the right dividend stock to invest in, here's a few things to keep in mind...

A good dividend stock should also be available at an attractive dividend yield. Now, this does not mean the higher the yield, the better the stock. On the contrary, a higher yield can be a result of an extremely beaten down stock price.

But more importantly, a company with high dividend yield should have good governance practices and must not have a history of ignoring the interest of minority shareholders.

Thus, along with the strong corporate governance, good growth prospects and a healthy dividend policy are crucial for investing well.

Like I explained in my video, companies with questionable corporate governance must be avoided despite very attractive dividend yields.

Is there a Catch in High Dividend Yield Stocks?

Now, you may have great companies that are growing very fast, but they are not willing to pay out dividends. And if the valuations are right, there is no reason to ignore such companies.

But going by the track record of cash-rich companies going overboard with their expansion or acquisition plans, one cannot be too sure of the cash flows being put to the best use.

The absence of dividends, therefore, does not assure that the company will grow fast enough to compensate with returns.

That said, you will find companies in India with higher growth prospects compared to their counterparts in the West that offer much lower dividend yields. The average dividend yield of most consistent dividend stocks here ranges between 1% and 3%.

There are a few outliers, and one can find some mouth-watering yields during market corrections. However, keep in mind that, if a company is indeed growing its earnings fast enough, a consistent dividend yield between just 1% and 3% can add up to a mind-boggling return over a period of time.

But there is a catch...

You cannot invest in companies trying to lure investors with high dividends sourced from borrowed funds. In other words, dividends and the growth in payouts must come from the company's internal cash flows. Stay away from leveraged companies paying high dividends.

Instead, look for companies that can consistently earn more for every rupee invested. Entities that do not need to constantly invest in the business and have healthy margins, sufficient pricing power, and little or no debt are your best bets.

Typically, companies sporting such fundamentals dominate market share and profits. They also tend to have more new product launches and dictate the trends in their sector.

So, companies that score well on the dividend front are typically the ones that will dominate the business for years to come.

Why are Dividend Stocks called the Best Income Compounding Vehicles?

An investor can make use of power of compounding by investing in such a way that interest earned in a year is added to the principle the next year. Thus, this new total is considered when calculating future interest. Follow this pattern sincerely for a few years and you will be surprised at the amount of wealth you will have accumulated at the end of the period.

If you consider the dividend receipts investors have pocketed from the best companies of the past several decades, you will see why Einstein called compounding 'the eighth wonder of the world'.

Some call the strategy of investing in dividend compounding companies 'compound interest on steroids' This is because the interest rate, rather than being fixed, grows year after year - an investor's dream.

Reinvested dividends fetch higher dividends the next year and continue to do so every year thereafter. This generates much higher returns than an instrument that compounds money at a fixed rate. Put differently, Rs 100 compounding at a fixed rate of 5% will yield Rs 5 in the first year, Rs 5.25 in the second year, and Rs 6.1 at the end of the fifth year.

In contrast, a stock priced at Rs 100 and yielding Rs 5 in dividends but growing at 10% every year, will pay out Rs 9.2 at the end of the fifth year - 50% greater than the first case.

The Growth - Yield payoff

Of course, of the thousands listed on the bourses, there are only a handful of companies that are able to increase dividends for an extended period of time.

But, if the right stock is unearthed, there is no beating the strategy of dividend compounding.

Let's get to some real life examples of dividend stocks that have offered mind-boggling returns by way of dividends alone. And continue to do so!

Companies such as Asian Paints and Dabur have earned the distinction of being the most consistent dividend payers for more than a decade. But these are the relatively well known names.

Page Industries offered a dividend yield as high as 20.3% on the IPO price in a decade after listing.

You also have companies like Pidilite and Hawkins that have payout ratios few can match.

A Simple Checklist for Picking Great Dividend Stocks

There are some important points to keep in mind while selecting great dividend stocks...

A good place to start would be to study how the company earns its revenues. Are its revenues stable or are they highly cyclical? For this, it is necessary to understand whether the business of the company is stable or volatile, cyclical, based on too much debt, etc.

Look for the stable business. Because if the company's own income is dicey, then its dividend stream will eventually follow suit.

The second question to ask yourself is how does the company manage to keep its cash flows stable and growing? In other words, what competitive advantage does the company enjoy that it will not only be able to keep its cash flows stable but also be able to grow them?

The competitive advantage helps the company build a safety moat around itself. This moat would protect the business from competition. And if the company is able to use its competitive advantage to widen the moat over time, then it is the perfect business to be in.

Another question is whether the company is able to grow its earnings or not. If it has stable cash flows and is able to grow them, then it should ideally follow that earnings are growing too.

But if the company is growing its earnings and not its cash flows, then it could be possible that it is manipulating its earnings. This could be risky. If cash flows don't grow, then it will be hard for the company to pay out a growing dividends stream.

The final question is the risks associated with the company itself. For this you need to question things like competition, management honesty, vulnerability to technological disruption, management's capital allocation skills, etc.

And of course, all said and done, a high dividend yield doesn't necessarily mean a good stock price.

You need to see whether the company is available at a cheap valuation compared to its fundamentals or not. For if you pay too high a price for a good dividend stock, then in the long term your returns would be miniscule, if not negative.

Investors would do well to use this checklist next time they want to buy stocks purely for dividends.

How Much Should One Invest in High Dividend Yield Stocks?

Allocation to stocks cannot be determined by the dividends fetched from them. Rather investors must keep in mind that even high dividend yield stocks like Coal India have eroded shareholder wealth and bit the dust due to poor capital allocation, lack of corporate governance, and management apathy.

So, investors should bear in mind that all high dividend yield stocks are NOT wealth creators...even over the long-term.

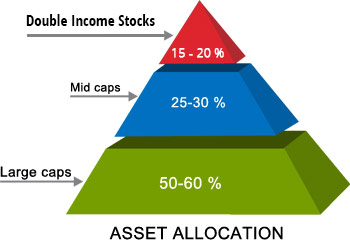

So, allocation to dividend stocks must depend on the marketcap of the company in question.

If the company is a bluechip or a smallcap please allocate funds to the stock accordingly.

Further, we believe that a single stock should ideally not comprise more than 5-6% of the total money allocated towards equities

The Best Dividend Stocks to Buy Now

Finding stocks which fit the criteria of quality dividend stocks has just become easier with Equitymaster's advanced screening tool.

Here are the lists of best dividend stocks on the Equitymaster's Stock Screener:

Based on Dividend Yield

Based on Dividend Payout

Based on Dividend Growth

Check out Equitymaster's user-friendly and free stock screener to discover the latest mouthwatering dividend stocks.

Let me repeat.

Buying the best dividend stocks does NOT mean picking the ones with the highest yields. You must do a thorough quality check of the business before buying a high dividend yield stock.

Happy Dividend Investing!

Tanushree Banerjee

Editor, StockSelect

Equitymaster Agora Research Private Limited (Research Analyst)