- Home

- Outlook Arena

- How to Find the Intrinsic Value of a Stock?

How to Find the Intrinsic Value of a Stock?

Don't Miss: Best Chance to Access Midcap Stocks Research at 80% OFF

Renowned Greek storyteller Aesop had once said ''A bird in hand is worth two in the bush''.

Warren Buffett, one of the greatest investors of all times, has often referred to this line as the basis for valuing all assets.

And rightly so.

Reduced to its simplest form, investing is indeed about laying out a bird now to get two or more out of the bush.

Of course, in the context of investing, the ''birds'' are nothing but the money and the bush refers to the underlying ''asset''.

And the entire fable translates into the ''Time Value of Money'' concept.

In simple words, Time Value of Money means that you can make people part with their money only if you promise to repay more money in the future.

How much more?

Well, that depends on the rent that the money earns. This rent is nothing but what we popularly know as the interest rate.

Let us try and understand this with the help of an example.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Looking to Buy Midcap Stocks?

If you're looking to buy some high-quality midcap stocks, then our co-head of research Rahul Shah has got some great recommendations.

You can get instant access to these stocks by subscribing to his popular stock research service, Midcap Value Alert.

The great news is... as part of Equitymaster's 28th anniversary celebrations... you have the chance to access this service at a huge 80% OFF

Get Full Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

If given a choice between receiving Rs 10 m now and Rs 10 m three years from now, which option would you choose?

Of course, it will be the first option, isn''t it?

Why?

Simply because you can take Rs 10 m now and invest it at say 8% for three years. This will give you a corpus of Rs 12.6 m three years down the line.

As this Rs 12.6 m is more than the Rs 10 m you will receive three years from now, you will choose the first option.

This is nothing but ''Time Value of Money'' in action. A sum now and a sum in the future is linked to an interest rate.

You need to promise someone more money down the line if you want him to part with his money.

The interest rate is the link that connects the present and future sum of money.

So, Rs 12.6 m discounted at 8% over three years gives you the present value of Rs 10 m. Likewise, Rs 10 m compounded at 8% over 3 years gives you a future value of Rs 12.6 m.

The concept of time value of money is the most fundamental principle of finance.

It forms the bedrock on which the values of almost all the assets are based. It''s also the bedrock to determine the intrinsic value of a stock.

Determining Intrinsic Value

A stock is a financial asset that generates cash flows.

Thus, intrinsic value of any asset can be defined as the present value of all the distributable cash flows the asset generates during its lifetime.

Please note that we used the term ''present value'' above. This means that all cash flows in the future have to be discounted by an appropriate discount rate or an interest rate.

The formula for intrinsic value applies to any kind of asset - farmland, a coal mine, an office, a bond or a company''s equity.

Now, Warren Buffett expands Aesop''s ''a bird in hand...'' concept by adding three very relevant questions. These can help an investor find the intrinsic value of any asset.

- How certain are you there are indeed birds in the bush? How confident are you that the asset will generate cash flows in the future?

- When will they emerge and how many will there be? What is the exact year the cash flows will appear and an informed guess on the magnitude?

- What is the risk free rate? What is the interest rate or the discount rate that you will use?

Intrinsic Value of a Bond

Let''s apply the three questions to find the intrinsic value of a bond. Of course, this article is about finding the intrinsic value of a stock.

However, we believe you''ll grasp the method of finding the intrinsic value of a stock better if we start with bond. It''s a lot simpler to value the latter than the former.

So, let''s say a 10-year Government bond has face value of Rs 1,000 and 8% coupon rate.

Well, the intrinsic value of the bond is the same as its face value i.e. Rs 1,000.

Why?

Simply because there''s a near 100% certainty the bond will give an 8% coupon or generate Rs 80 as cash flows next year onwards.

Besides, in the case of Government bond, the discount rate is same as the coupon rate (8%).

There is hardly any variation in the frequency of cash flows and its magnitude. So we can calculate the intrinsic value of this bond with a high degree of accuracy.

The present value of all the future net cash flows the bond will generate in its lifetime is Rs 1,000.

Intrinsic Value of a Stock

Can we extend the analogy of a bond to equity?

Of course.

Like a bond, the intrinsic value of a company''s equity (or stock) can also be seen as the present value of all the future net cash flows the company is likely to generate during its remaining life.

So, lets ask the same three questions for equity.

- How certain are you that there are indeed birds in the bush?

- When will they emerge and how many will there be?

- What is the risk-free rate (or discount rate)?

Well, there''s some bad news here.

Unlike bonds, the cash flows of a company are not fixed and hence uncertain. You can only make an educated guess about the possibility, timing and magnitude of future cash flows.

Thus, your estimate of a stock''s intrinsic value will depend on how well you understand the company''s business, its long term growth and profitability prospects.

Of course, if you are well versed with the business or the business lies within your circle of competence, you could be more certain about the cash flows and the future returns.

So to answer the first two questions, the certainty of the cash flows and their timing will depend on the nature of the underlying business and your familiarity with it.

As for the discount rate, since equities are believed to be riskier than bonds, investors would demand a higher return from stocks in order to be compensated for the higher risk.

As such, the discount rate for determining the future cash flows of equities must include a risk premium over the risk free rate to compensate for the higher riskiness.

Discounted Cash Flow Method

Well, one of the most widely taught valuation methods is the discounted cash flow (DCF) method.

The DCF method attempts to determine the intrinsic value of a company''s equity by forecasting the future cash flows the company will generate during its lifetime and then discounting them to arrive at the present value of company''s stock or its intrinsic value.

It works similar to a bond valuation where we discount the cash flows at an appropriate rate to arrive at the bond''s intrinsic value.

However, the difference here is that the cash flows are uncertain for equities as compared to bond. All we have are educated guesses.

Thus, there are two elements in the DCF method.

- Forecasting future cash flows

- Determining the discount rate

Forecasting future cash flows: Here, you first forecast cash flows for the current and future periods out to a reasonable date. So the general practice is to forecast yearly cash flows for a period of 5 to 10 years.

Determining the discount rate: The next step is to determine the discount rate or cost of capital that reflects the riskiness of the asset. In essence, the discount rate is the required annual return on investment.

So, if you are expecting a return of 12% from the stock, that will be your discount rate and if it is 15%, then 15% will be your discount rate.

As we said earlier, the discount rate for stocks will be higher than say a government bond to compensate for the higher risk.

Now, there is one limitation with forecasting for a limited period of around 10 years. A fundamentally strong company would typically have a fairly longer life.

How do you account for those years? By introducing a concept known as the terminal value.

The terminal value is calculated by assuming that beyond year 10, the cash flow grows perpetually at a constant rate.

Limitations of DCF Method

Theoretically, the DCF method sounds quite appropriate. However, the problem lies in its practical application. There are a few limitations that make DCF less reliable.

The first one is that the valuations rely too heavily on future forecasts. For most businesses, it is impossible to forecast 10 years into the future with any degree of certainty.

Several factors such as changes in technology, higher competition etc, can completely derail your estimates.

Furthermore, even slight changes in assumptions pertaining to discount rate and perpetual growth rate can substantially alter the valuations.

Thus, the DCF method may not be of great use to value investors for arriving at the intrinsic value of a stock.

Asset Based Valuation

As we just saw, there are quite a few flaws with DCF valuation. Therefore, it is necessary that we look at other methods of valuation.

One such method is called as the asset based valuation (ABV).

Unlike DCF that uses too many assumptions, asset based valuation approach relies on currently available information.

It''s more realistic and does not involve making future estimates. It''s useful for firms that have hardly any competitive advantage and it does not take into account future growth.

In a nutshell, the approach assumes that intrinsic value comes merely from investment in the assets of the firm and does not generate any positive cash flow for investors, thus creating no value for them.

This valuation approach is useful under two scenarios.

Scenario 1: The company to be valued is making losses and generating negative cash flows. If the industry to which the firm belongs is in serious decline phase, assets should be valued on what they will bring when sold. This is also known as the liquidation method.

Scenario 2: The company to be valued is earning just enough to pay for the cost of capital it employs. In other words, there is no competitive advantage that enables the firm to earn more than its cost of capital. Thus, if the industry is stable and profitable but with no competitive advantage then assets can be valued based on reproduction cost method.

Thus, we have two methods under asset based valuation, liquidation value and reproduction cost method.

However, just as there are a few advantages of this method of valuation, there are a few limitations too.

This approach does not take into account the earnings power of the company, its cash flows or its growth rates. It also does not differentiate between a good management and a bad management.

Therefore, in order to take care of these very limitations, we have our next method for determining the intrinsic value of a company.

Earnings Power Value and Franchise Valuation

As we just saw, ABV''s entire focus is on the valuation of assets on the balance sheet. It does not aim to value the earnings or the cash flows of the company.

It''s a useful method when the company is earning less than or equal to its cost of capital.

But what if the firm consistently earns above its cost of capital?

For such cases, we use what is known as the earnings power value method. For e.g. if the cost of capital is 12% and if the ROE or ROIC of the firm is around 15%-20% then the earnings power value method can be used.

What Does EPV mean?

Earnings power value (EPV) is determined using the current earnings of the company after making all the adjustments.

Since it considers current earnings, future earnings and cash flows do not enter the picture. The adjustments to earnings would mean not including one time charges, adjusting for maintenance depreciation etc.

Further, for companies in a cyclical industry, there would be wide swings in earnings during the peak and the downturn in the business cycle. Hence, in such cases earnings would have to be considered on a normalised basis.

Assumptions for EPV

Benjamin Graham, the father of value investing, has made certain assumptions with respect to EPV.

First, current earnings, properly adjusted, are considered to be nearly the same as the cash flows to shareholders.

Second, this method is more suited for firms where earnings remain constant and are not likely to increase by much in the indefinite future.

By making these assumptions, we arrive at the following formula for the valuation of a firm using EPV:

EPV = Adjusted Earnings * 1/R

Over here, R refers to the current cost of capital. Since the earnings/cash flow is assumed to be constant, the growth rate (G) would be zero.

If a company has an earnings power value of Rs 100 m i.e. it earns Rs 100 m as profits on a sustainable basis and if the cost of capital is 12%, then the intrinsic value of the company under this method will come to 10 upon 12% i.e. Rs 833.3 m.

Thus, if the company has a market capitalisation of Rs 600 m or lower and you are confident that it will continue to earn at least Rs 100 m profits in the foreseeable future, an investment in the company can fetch you good returns provided the market gets back to its senses and gives it a valuation of Rs 833.3 m over the next year or two.

Advantages and Limitations of EPV

The main advantage of EPV is that it considers current information without having to make predictions for the future.

This means that it can be considered more reliable than assuming the rate of growth and cost of capital many years into the future.

However, the limitation is that assumptions are based on earnings which are less reliable than the value of assets.

Importance of a Franchise

What do you think will happen when a company borrows at say 12% (cost of capital) and earns 25% on it?

Competition will try to get in, right? They will come in droves and push the profits down so that the return on capital is close to the cost of capital.

However, there are certain companies that erect a strong barrier to entry and keep the return of capital well above the cost of capital.

They make it difficult for new players to enter the industry and push the returns down.

The intrinsic value for such companies will be higher than asset based valuation companies and the EPV based valuation companies.

Both the asset based as well as EPV based valuation assume that a stock either earns returns that''s equal to its cost of capital or lower than that.

However, for companies that earn significantly better than their cost of capital and do so not for 1 or 2 years but over a very long term period, these companies are special and are known to enjoy a franchise status.

Now, what exactly is a franchise?

The difference between the EPV and the asset value is the value of the franchise enjoyed by the company.

If the asset value based on reproduction cost is say Rs 100 m and if the company is earning Rs 20 m per year and has an EPV of Rs 200 m (based on 10% cost of capital), the difference i.e. Rs 100 m is nothing but the franchise value of the company.

This company is earning more than its cost of capital and there is a strong possibility it will continue to do so in the future.

Thus, the defining character of a franchise is that it allows the company to earn more than it needs to pay for the investments that fund its assets.

For this, the company should have a strong competitive advantage and this also needs to be sustainable.

It should be noted that the franchise concept is nothing but the economic moat of a company that helps it to earn significantly higher than the cost of capital.

If EPV is much greater than reproduction cost and this difference is sustainable, the firm is said to have a sustainable competitive advantage. It''s value is the difference between the two.

Advantages and Limitations of Franchise Value

The main advantage of franchise value is that it involves inputs which are less subjective in nature.

Most figures like earnings, book value of assets are readily available. The limitation is that franchise value is susceptible to changing values in cost of capital.

For instance, if we increase the cost of capital to 10% instead of 8%, the value of franchise will fall. Also, if companies frequently change their accounting techniques to record transactions, franchise value estimate may not be accurate.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Equitymaster's Premium Research:

Discover the Lucrative Opportunities in India's Emerging Business space

Read This Letter

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Franchise Valuation With Growth

Imagine a business that has a franchise as well as growth in earnings.

In other words, imagine a business that has a return on capital comfortably higher than its cost and is also seeing its earnings grow at a decent rate.

Such a business will certainly be valued higher than the one with franchise but with no earnings growth.

This is because growth requires investment and on this investment, the return on capital will be higher than the cost of capital.

As a result, the company''s capital base will go on increasing leading it to be valued higher than the firm with no growth or the EPV method.

Let us try and arrive at a valuation method for a firm with a franchise as well as growth in earnings. For this, let us go back to the formula we used for the EPV method and build on it.

If you remember we had the following formula:

EPV = Adjusted Earnings * 1/R (R refers to the current cost of capital)

Now, let us introduce three more variables in the equation C, ROIC, and G.

C is the capital base of the company. In other words, it is the total tangible invested capital of the business.

ROIC is the return on invested capital of the business and can be calculated as:

ROIC = EBIT (1-tax rate)/C

Please note that the EBIT (1-tax rate) is the adjusted earnings we used in the EPV formula.

And lastly, G is the expected growth rate of the business from now until perpetuity.

What are the formulae for perpetuity and perpetuity with growth?

These are CF/R and CF1/(R-G) respectively.

In the first, the numerator stays constant or does not grow for an infinite period of time.

In the second, the numerator grows at a fixed rate every year for an infinite period of time.

Now, for the EPV, we used a formula similar to the perpetuity method because there was no growth.

But since for franchise with growth method, we are assuming a fixed growth rate G, our denominator for the formula will be (R-G).

Of course, R here is the cost of capital and G the expected growth rate of the business from now until perpetuity.

Now, let us move on to the numerator of the valuation equation.

In the EPV formula, we had the adjusted earnings as the numerator. This was after tax and it also took into account the maintenance depreciation outgoings for the company.

This adjusted earnings can also be written as C*ROIC. It''s the capital base of the company multiplied by its ROIC.

Therefore if capital base is Rs 100 and ROIC is 15%, the adjusted earnings equal 100 times 0.15 i.e. Rs 15.

As a matter of fact, ROIC, C, and adjusted earnings are the three variables in the equation and the third can be easily found out if the first two are known.

It''s time to bring growth into the equation now.

C*ROIC will remain the numerator for an equation with no growth as we saw in the EPV formula.

But what happens when we bring growth into the picture?

Please note that growth requires investment in the capital base of the company. If ROIC remains constant, for a 10% growth in adjusted earnings, capital base will also have to increase by 10%.

This investment in growth will essentially have to come from the cash flow that the company generates. This cash flow is nothing but the adjusted earnings for the company.

As a consequence, the funds for growth will come from the adjusted earnings of the company. We can get the funds required for growth by the formula C*G.

Please note that we have taken ROIC to be constant. Therefore for a 10% growth, 10% more capital is required.

So if the capital base is Rs 100 and expected growth is 10%, the extra capital required will be Rs 10 which we calculate from the formula C*G.

Similarly, if the capital base is Rs 500 and expected growth is 15%, the extra capital for growth under a constant ROIC will be Rs 75 (i.e. 500*15%).

As a result, the numerator of the valuation formula will no longer have the adjusted earnings.

It will now have the equation (C*ROIC) - (C*G)

This is the cash that will remain after investing for growth.

If we recall, (C*ROIC) is nothing but the adjusted earnings of the firm or the cash flow for a no growth firm.

(C*G) on the other hand is the extra capital required for growth.

Thus, the formula is nothing but cash generated minus cash invested. The difference between the two gives us the final distributable cash flow.

Thus, in the numerator we now have a distributable cash flow which under constant ROIC is growing at a fixed rate G every year.

Also, in the denominator we have a perpetuity that''s growing at the same fixed rate G.

The final formula will thus look like this:

PV = ((C*ROIC) - (C*G))/(R-G)

This can be further reduced to PV = C*(ROIC-G)/(R-G)

We have borrowed this terminology and most of our discussion on valuation from Prof. Bruce Greenwald''s famous book ''Value Investing''.

PV refers to the present value of the future cash flows and hence the term.

The formula for PV shows us the way in evaluating firms that not only have competitive advantage but also have strong earnings growth going for them.

Imagine a hypothetical scenario where we have two firms having the same capital base, return on capital as well as cost of capital. The only difference is the growth rate between the two.

While firm A is not able to grow its earnings, firm B has a sustainable, constant growth rate of around 5% for many years into the future.

Now let us try plugging these numbers in the two formulas for EPV and PV respectively.

Let us assume the ROIC to be 20% for both companies, capital base as Rs 100 and R to be around 12%.

For the no growth firm, we will have to substitute the respective values in the following formula C*ROIC/R (Please remember that C*ROC is nothing but the adjusted earnings).

This gives us 100*0.2/0.12 = Rs 167. Thus, the EPV of the firm is Rs 167 with no growth in earnings.

Now, let us calculate the intrinsic value of the firm with growth in earnings assumed at 5% per annum. For this, we will use the equation we just developed.

PV = C*(ROIC-G)/(R-G)

Putting in the values, we get 100*(0.2-0.05)/ (0.12-0.05). This results into an intrinsic value of the firm of Rs 214.

For a firm that has a franchise or in other words where the return on capital is higher than the cost of capital, growth in earnings will create a value greater than where there is no growth.

In the case we just studied, the intrinsic value of the firm where there is a franchise as well as growth is nearly 30% higher than the firm with franchise but no growth.

Now, here''s another interesting observation. If one takes the ROIC down to just 10% and everything else remaining constant, then both the EPV as well as PV change to Rs 83 and Rs 71 respectively!

Did you see what just happened here?

PV, which takes into account growth came in lower than EPV where there is no growth. This leads us to a very important conclusion.

Growth adds value only when return on capital is greater than cost of capital or where there is a sustainable competitive advantage. If the same is not there, growth destroys value.

So next time you see a firm that is growing earnings at a strong pace but does not have a competitive advantage, we think it will be better to give it a miss unless it''s trading at a significant discount to its asset value.

So how will the ratio of PV/EPV look like at different levels ROIC, R, and G. We have a table below that will give you some idea about the same.

G = Growth Rate, R = Cost of Capital, ROIC = Return on Invested Capital

As can be seen, even with a very high ROIC and growth rates in relation to cost of capital, the maximum one should pay for a firm over its EPV is 3x.

In fact very few companies on the face of this earth are able to command even that high a valuation. For competition constantly chips away, trying to bring both growth rates and ROIC down in the process.

This brings us to the end of our discussion of the third and the final method of valuation.

Summary of the 3 Valuation Methods

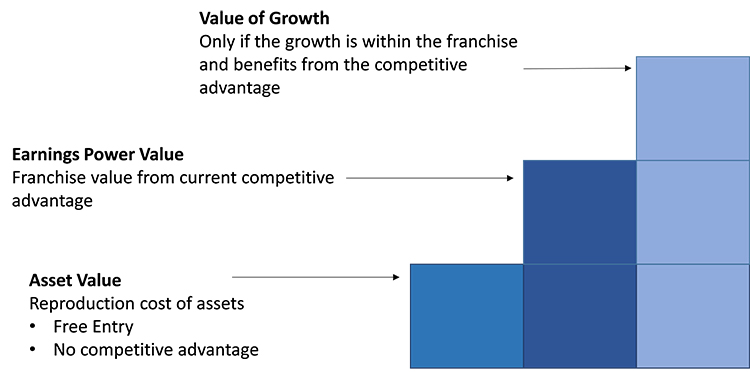

Just to recap, we now have three methods of valuation.

The first is the asset based valuation where we value the stock based on its liquidation value or replacement value.

The second method is the earnings power value or the EPV method where we value a company having a franchise but with practically no growth in earnings.

And finally we saw the present value method or the PV method whereby we valued a company having both a strong franchise as well as witnessing a growth in earnings.

We believe the three methods will be best demonstrated by the image below. It nicely summarizes the three approaches with the help of slices of value.

We would also like to use a great Warren Buffett analogy to describe the three different types of businesses we discussed using the three valuation methods.

As per him, a ''Gruesome'' business is a kind of a savings account which pays an inadequate interest rate.

This is the business that can be valued using mostly the asset based valuation method as the return on capital is less than cost of capital.

On the other hand, a ''Good'' business is a one that pays an attractive interest rate. This is the business that can be valued using the EPV method.

And finally, Warren Buffett talks about a ''Great'' business as a type of savings account that pays an extraordinarily high interest rate that will rise as the years pass.

This is the business we discussed that not only has a franchise but also a growth in earnings.

As per Buffett, the surer money tends to be made in the first kind of business when it is bought at a significant discount to the company''s liquidation value or the replacement cost value.

However, the big money tends to be made in the third kind of business where the company has a sustainable competitive advantage or a franchise which is backed by growth in earnings for many years to come.

Multiple-based Valuation Approach

Despite their practical utility, the valuation methods we talked about seldom get quoted in company research reports.

Instead, what we see is nothing else but multiple based valuations like Price to Earnings, Enterprise Value / EBITDA or Price to Book Value.

Please note that like our three approaches, these multiple based methods are not another set of independent methods of valuation.

On the contrary, these are nothing but a variation of the three approaches we just discussed with some assumptions and simplifications thrown in.

Therefore, if we are familiar with the original approaches to valuation, we can easily derive the multiples that can be assigned to companies in the multiple based approaches.

With this background, let us discuss one of the most common methods of valuing companies i.e. the P/E (price to earnings) method.

Price to Earnings Multiple Approach

What should be the ideal P/E multiple for a stock? Let us try and answer this question using our three valuation methods.

We know that asset based valuation method values a company based on its assets. Here, earnings do not enter the picture.

However, the P/E method requires that one give a certain multiple to the earnings of a company. Consequently, we cannot use the asset based valuation method to arrive at an ideal P/E multiple for a firm.

Now, let us turn our attention to the second of the three methods i.e. EPV method.

You would recall that here we assume the company''s return on capital to be greater than the cost of capital. Also, the company under consideration has a stable earnings profile with no growth.

You would also recall the formula i.e. EPV = Adj. Earnings* 1/R

To arrive at a P/E for such kind of firms, all you need to know is the cost of capital of the firm and also calculate the adjusted earnings.

If the cost of capital of the firm is 12%, then the maximum P/E multiple you should give to such stocks is 1/12% i.e. 8.3 times.

If the cost of capital is say 15%, the maximum P/E would drop to 6.7x.

If it''s 10%, then the P/E would come to 10X.

You would notice all that one needs to do is find out if the company''s return on capital is higher than its cost on a sustainable basis. If this is true then the maximum earnings multiple one should give the stock is 1 / Cost of Capital.

Some assumptions are in order. One, the PAT or the earnings of the firm under consideration is the same as adjusted earnings.

Two, the company is either debt free or its cost of debt is the same as its cost of equity with the interest expense being non-tax deductible.

Thus, once you''ve factored in these two assumptions, the expected P/E of a stock with stable earnings and with its return on capital higher than cost of capital is nothing but a very simple formula as we just saw.

So, this was about a firm with earnings staying constant.

But what about the case where the firm has a competitive advantage as well as growth in earnings?

To find an ideal P/E multiple for such stocks, we will have to turn to our last of the three methods of valuation viz. the PV method.

The formula was: PV = C*(ROIC-G)/(R-G)

Now, by plugging in the observed values of ROIC, R, and G, we get the intrinsic value PV of the firm in the form of a multiple of C.

And invested capital C can be expressed in terms of adjusted earnings by the formula E/ROIC.

Please recall that E was nothing but C*ROIC i.e. capital base multiplied by the return on the same invested capital base.

Thus, what we now have is the intrinsic value of the firm expressed in multiple of its earnings, E.

Price to Earnings: Example

An example will help make things clearer.

Say there is a firm with an ROIC of 20%, G of 6% and the cost of capital being 12%.

Substituting these values in the PV equation, we get PV = C (0.2-0.06)/ (0.12-0.06). Simplifying this further, we get PV = 2.33 C.

Now, we need to go one step further and replace C with E/ROIC. Therefore the final equation in terms of E will now be PV = 11.7 E.

Consequently, an ideal P/E for a firm with the characteristics we just outlined is approximately 11.7X or about 12X.

Thus, if you know the long term expected ROICs, and Gs of the firms you are studying, you can calculate the approximate P/E the stock can command after taking into account a suitable cost of capital.

Please note this formula will not work for G > ROIC.

But this is not much of a problem because for most firms, long term growth on a sustainable basis is lower than it''s ROIC.

Summary of Multiple-based Valuation

The beauty of the Present Value (PV) formula is that it can be used to arrive at not just an approximate earnings multiple but also multiples like price to book value and EV/EBIT.

If the company under consideration is debt free then effectively C becomes the book value of the company and ROIC becomes RONW.

Therefore the PV that we get is nothing but an intrinsic value by way of a book value multiple of the stock.

This now brings us to the conclusion of this article on franchise with growth as well as multiple-based approach to valuations.

Conclusion

We discussed a formula that needs to be brought into use when the firm under consideration has both growth as well as some form of sustainable competitive advantage.

We then saw the PV varies with different combinations of ROIC/R and R/G with valuations getting higher and higher as both ROIC and G increase.

We then arrived at the multiple based approaches to valuation using the same PV formula we studied in the first part of the lecture.

We now have approaches to value practically all kinds of firms.

These are firms that earn less than or equal to their cost of capital, firms that earn more than the cost of capital but with a stable earnings profile, and lastly, firms that not only earn more than their cost of capital but also witness stable, long term growth in earnings.

Also, firms that grow their earnings at a strong pace but do not earn more than cost of capital do nothing but destroy value over a long term period.

Consequently, such companies are best avoided unless available at a significant discount to their asset value.

We hope our readers now have an even better grip on the different approaches to valuation.

FAQs on Intrinsic Value of a Stock

1. Intrinsic value formula

The intrinsic value is the true value of a stock, its actual worth, irrespective of what investors and speculators are willing to pay for it. It is calculated based on the future cash flows or asset prices of a company.

A commonly used method for calculating the intrinsic value is the Discounted Cash Flow (DCF) method. This process involves predicting the future cash flows of a company and discounting them using the weighted average cost of capital (WACC) (debt and equity).

2. The importance of Intrinsic Value

Sometimes, due to external factors (like negative market sentiments), the price of a stock can deviate from its intrinsic value (true value). Now, this can be a good time to buy the stock. As usually, in the long-term, the price of a stock does diverge back to its intrinsic value, allowing you to profit from this temporary deviation.

An effective valuation tool, the intrinsic value metric is useful only in some cases. Unlike the P/E ratio, it can be used to value high-growth stocks that are yet to turn a profit.

For instance, a high-growth tech business is yet to turn a profit. A P/E ratio simply won't work as there is no profit. However, an investor can predict and make estimates about the company's future to arrive at the intrinsic value using the discounted cash flow method.

3. How to calculate the intrinsic value? Here's an example.

A commonly used method for arriving at the intrinsic value of a stock is the discounted cash flow (DCF). According to this method, the value of a business today is a function of its potential profitability and assets.

Let us understand this better with an example.

A high-growth tech company has been reporting a 35% annual sales growth. Since it is expanding quickly, the expenses are outgrowing the revenues, resulting in a net loss. However, this is temporary. As the company matures, the sales will outpace the expenses churning out a profit. But that is still a few years away.

So as an investor, your first job is to predict the stock's future cash flows.

A good way to start is to study the stock's underlying business. This knowledge will help you build a financial model and make assumptions and estimates about the future of a company.

Once you have estimated the future cash flows, calculate the present value of each of these future cash flows using an appropriate discounting factor (like the WACC).

Thereafter sum up the present values to obtain the stock's intrinsic value.

Here are links to some insightful Equitymaster articles and videos on intrinsic value of stocks.

- The Safest and Best Way to Get Rich in Stocks

- Why ITC and not HUL is my idea of a good investment right now

- Of Price and Value and the Great Divide

- Should You Buy High, Sell Higher in this Market or Buy Low, Sell High?