- Home

- Outlook Arena

- Best Bank Stocks in India

Best Bank Stocks in India

The Indian banking system largely consists of public sector banks, private sector banks, and foreign banks, in addition to cooperative credit institutions.

Access to the banking system has improved over the years due to persistent effort from the Government to promote banking technology and promote expansion in unbanked and metropolitan regions.

The Ministry of Finance launched the Jan Dhan Yojana in 2014, a financial inclusion program to expand affordable access to financial services such as bank accounts, credit, insurance and pensions in all parts of India.

As per the Reserve Bank of India (RBI), India's banking sector is sufficiently capitalized and well-regulated.

Credit, market and liquidity risk studies suggest that Indian banks are resilient and have withstood global downturns well.

Indian banking industry has recently witnessed the roll out of innovative banking models like payments and small finance banks. RBI's new measures may go a long way in helping the restructuring of the domestic banking industry.

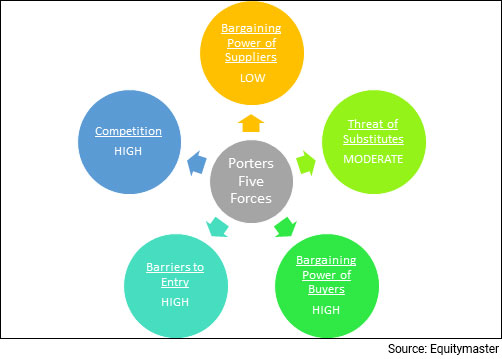

Porter's Five Forces Analysis of the Banking Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the banking sector -

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the banking sector, barriers to entry are high, due to licensing requirement, investment in technology and branch network, capital and regulatory requirements.

The role of trust also acts as a major barrier to entry for new banks looking to compete with major banks, as consumer are more likely to allow one bank to hold all their accounts and service their financial needs.

#2 Bargaining Power of Suppliers

The bargaining power of customers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

This is low in the banking industry as banks are subject to rules and regulations of the RBI. Customers have also hedged inflation by investing in riskier avenues besides banks.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the banking sector, the bargaining power of customers is high, especially for good creditworthy borrowers due to the availability of large number of banks and low switching costs.

#4 Competition

For most industries, having an understanding of the competition is vital to successfully marketing a product.

The competition in the banking industry is high. With entry of foreign banks, competition in the Indian banking sector has intensified.

Banks are increasingly looking at consolidation to derive greater benefits such as enhanced synergy, cost take-outs from economies of scale, and diversification of risks. The RBI has also approved for small finance banks and payment banks which will further increase competition in the industry

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

This is moderate for banks.

Loans, insurances, mutual funds, and fixed income securities are some of the many banking services that are also offered by NBFCs. Technological developments and the threat of payment method substitutes may also lead to substitution of some of the services provided by the banks

Porters Five Forces Analysis of the Banking Sector in India

When to Invest in Banking Stocks

The banking sector has been one of the sectors that has driven the stock market rally in the past decade, giving returns of more than 200%.

Banking stocks are very closely linked to economy as both credit growth and margins are dependent on GDP growth and interest rates.

Banks tend to have high non-performing assets (NPAs) when interest rates are high and economy is underperforming and vice versa.

Therefore, the best time to buy banking stocks is when interest rates start falling as the cost of borrowing for banks goes down immediately while the interest, they charge on loans stays high and falls with a lag.

Key Points to Keep in Mind While Investing in Banking Stocks

Here are some key points to take note of before you invest in banking stocks in India.

#1 Interest Rates

This is the most important factor one must keep in mind while investing in banking stocks.

Since the earnings of banks are highly sensitive to interest rates, it is important to track it.

When interest rates increase, margin spreads tend to expand, as interest income from loans and investments rises faster than interest expense paid to depositors.

However, rising rates expose banks to volatility risks that create a potential mismatch in the valuation of financial assets and liabilities.

Rising interest rates also increase risk of defaults that may arise from borrowers' failure to make the required payments, which can negatively affect the quality of a bank's assets, leading to higher credit loss provisions and lower net income.

#2 Profitability of the bank

While net interest income of a bank tells us how much revenue the bank earned, it does not serve the purpose of measuring how effectively a bank is functioning or truly reflect its asset efficiency.

Hence, one must check the bank's net profit margins.

This will help gauge the extent of operational efficiency as well as capture the nuances of bank's earnings through non-interest income activities and management of their costs.

Here's a list of top banks in India based on their net profit and net profit margins.

| Bank | Net Profit (Rs in m) | Net Profit Margin (%) |

|---|---|---|

| HDFC Bank Ltd. | 3,81,509 | 28.1 |

| ICICI Bank Ltd. | 2,57,838 | 27 |

| Axis Bank Ltd. | 1,41,644 | 20.6 |

| Kotak Mahindra Bank Ltd. | 1,19,319 | 35.4 |

| Bank of Baroda | 77,002 | 10.5 |

| Canara Bank | 57,951 | 8.2 |

| Union Bank of India | 52,085 | 7.6 |

| IndusInd Bank Ltd. | 48,046 | 15.6 |

Data as of March 2022

#3 NPAs

The biggest fear of any bank is its borrowers defaulting on their payment obligations. A borrower may do so wilfully, or he/she may be unable to fulfil payment obligations due to unforeseen circumstances.

If the payment is overdue for a period of more than 90 days, then the loan becomes a non -performing asset (NPA). This is because the bank isn't earning any interest from the loan.

NPAs beyond a certain limit could damage the fortunes of a bank leading to its bankruptcy.

To avoid such a situation, it is crucial to check the net NPA ratio of the bank. Net NPAs in the range of 1-2% are considered safe.

#4 Return on Equity (RoE) ratio

Return on Equity measures how efficiently a company is using its equity capital. ROE is a gauge of a corporation's profitability and how efficiently it generates those profits. The higher the ROE, the better a company is at converting its equity financing into profits

Here's a list of top banks in India with an RoE of more than 10%.

| Bank | RoE (%) |

|---|---|

| HDFC Bank Ltd. | 16.7 |

| ICICI Bank Ltd. | 15.49 |

| Kotak Mahindra Bank Ltd. | 13.19 |

| Axis Bank Ltd. | 12.78 |

| The Federal Bank Ltd. | 11 |

| IndusInd Bank Ltd. | 10.57 |

| Canara Bank | 10.03 |

Data as of March 2022

#5 Investment in New Technology/Startups

If you look at the history of the financial world over the last 50-60 years, you will see there was hardly any innovation. This is because traditionally the banking sector is very slow to adopt new technologies.

However, with the rise of disruptive technologies like AI, machine learning, and blockchain, the industry is now at the forefront of technological innovation.

Due to this, the banking sector will undergo a massive transformation in the coming years. And the fastest growing entities will possibly be the ones that adapt to this change without compromising on the core of margins and asset quality.

Many banks are investing heavily in their own technology and other startups to catch up with non-banks in the digital banking space. These will be the ones that will be successful in the future.

#6 Valuations

The most commonly ratios for banks are the Net NPA to Advances ratio and Price to Adjusted Book Value ratio, which is the ratio of Price to Book Value adjusted for NPA per share.

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out our list of banking stocks according to their P/BV Ratios.

#6 Dividend yields

There is no consistent trend of dividends across the industry, with different companies having different dividend policies.

For more details, check out the top stocks offering high dividend yields.

Top Banking Stocks in India

The banking sector is in its growth phase with credit growth picking up after the pandemic. The top banking stocks in India can immensely benefit with so many factors positively affecting the industry.

Here are the top banking stocks in India which score well on crucial parameters.

#1 HDFC Bank

#2 ICICI Bank

#5 Federal Bank

For more details, you can check out Equitymaster's Powerful stock screener for filtering the best banking stocks in India.

List of Banking Stocks in India

The details of listed banks can be found on the NSE and BSE website. However, the overload of financial information on these websites can be overwhelming.

For a more direct and concise view of this information, you can check out our list of banking stocks.

You can also read our banking sector report and check the latest banking sector results.

You can also checkout our playlist on Banking Stocks on Equitymaster's YouTube channel.

Best Sources for Information on the Banking Sector

Ministry of Finance - https://finmin.nic.in/

Reserve Bank of India - https://www.rbi.org.in/

Indian Brand Equity Banking Sector Report - https://www.ibef.org/industry/banking-presentation

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() Why Union Bank of India Share Price is Rising

Why Union Bank of India Share Price is Rising

Apr 23, 2024

With NPAs on the decline, Union Bank is optimistic about robust growth and it's well-placed to capitalise on the pickup in corporate credit cycle.

![]() Why Axis Bank Share Price is Falling

Why Axis Bank Share Price is Falling

Apr 20, 2024

The stock is down 5% in the last five days.

![]() Why IOB Share Price is Rising

Why IOB Share Price is Rising

Apr 2, 2024

Shares of this PSU bank zoomed 8% in a day. What's driving the rally?

![]() Why IDFC First Bank Share Price is Falling

Why IDFC First Bank Share Price is Falling

Mar 19, 2024

Here's why shares of the bank fell 5% in day, after the company reported robust quarterly numbers for the December 2023 quarter.

![]() Why South Indian Bank Share Price is Rising

Why South Indian Bank Share Price is Rising

Feb 23, 2024

South Indian Bank zooms 10% in a day. What's driving the rally?

![]() Why Yes Bank Share Price is Rising

Why Yes Bank Share Price is Rising

Feb 8, 2024

Yes Bank shares hit their highest level since June 2020, surging 43% in three days. What's driving the rally?

![]() Top 10 Private Bank Stocks to Watch Out for in India in 2024

Top 10 Private Bank Stocks to Watch Out for in India in 2024

Feb 1, 2024

Fiercely competing with their public sector peers, investors must keep an eye on these 10 private banks in the coming year.

![]() Top 2 PSU Banks with Reasonable Valuations

Top 2 PSU Banks with Reasonable Valuations

Jan 26, 2024

The ability for banks like Union Bank of India and Canara Bank to manage their NIMs would be key, given that the rate easing cycle is still 6-9 months away.

![]() Why Bank of Baroda Share Price is Rising

Why Bank of Baroda Share Price is Rising

Dec 27, 2023

Shares of the third largest PSU bank in the country touched their 52 week high today. Here's why.

![]() Why PNB Share Price is Rising

Why PNB Share Price is Rising

Nov 15, 2023

Shares of PNB have surged around 80% in a year. The stock is currently trading very close to 52-week high. Let's explore the reasons driving this rally.

![]() Will HDFC Bank Share Price Revive Post Q4 Results?

Will HDFC Bank Share Price Revive Post Q4 Results?

Apr 22, 2024

During the quarter, HDFC Bank sold its stake in HDFC Credilla for a gain of Rs 55.3 billion and made a floating provision of Rs 109 billion.

![]() Why PNB Share Price is Rising

Why PNB Share Price is Rising

Apr 4, 2024

PSU bank stocks got a shot in the arm after experts noted the favorable credit environment and bolstered asset quality of select PSU banks, suggesting the trend could continue.

![]() PSU Stocks Watchlist: Top 5 Public Sector Banks to Watch Out for Big Dividends in 2024

PSU Stocks Watchlist: Top 5 Public Sector Banks to Watch Out for Big Dividends in 2024

Apr 1, 2024

Public sector banks (PSBs) in India are poised for a record-breaking dividend payout exceeding Rs 150 bn in FY24, driven by significant profit surge. Do you own any of these 5 PSBs?

![]() 5 PSBs on the Move: Government to Reduce Stake?

5 PSBs on the Move: Government to Reduce Stake?

Mar 15, 2024

This five public sector lenders are planning to reduce government stake to less than 75% to comply with MPS norms. More details inside.

![]() 5 Best PSU Bank Penny Stocks in India

5 Best PSU Bank Penny Stocks in India

Feb 10, 2024

With strong credit growth and cleaner balance sheets, the best PSU bank stocks could see more upside in the medium term.

![]() Why IOB Share Price is Rising

Why IOB Share Price is Rising

Feb 7, 2024

Shares of this PSU bank zoomed 13% today and hit their 52-week high. What's driving the rally?

![]() Why AU Small Finance Bank Share Price is Falling

Why AU Small Finance Bank Share Price is Falling

Jan 30, 2024

AU small Finance Bank tanks 12% in a day, hits 9 month's low. Here's what caused sudden fall?

![]() Why HDFC Bank Share Price is Falling

Why HDFC Bank Share Price is Falling

Jan 17, 2024

Interest rates appear to have peaked and widespread expectations of easing rates could improve the NIMs for large players like HDFC Bank.

![]() Why Axis Bank Share Price is Rising

Why Axis Bank Share Price is Rising

Dec 5, 2023

Axis Bank share price jumps over 10% in a week, hitting a new 52-week high. Here's why.

![]() Why IDFC First Bank Share Price is Falling

Why IDFC First Bank Share Price is Falling

Nov 1, 2023

After reporting robust quarterly numbers, shares of the lender have encountered a roadblock. Read on to find out why.

FAQs

Which are the top banking companies in India?

Based on marketcap, these are the top banking companies in India:

- #1 HDFC BANK

- #2 ICICI BANK

- #3 SBI

- #4 AXIS BANK

- #5 KOTAK MAHINDRA BANK

You can see the full list of the banking stocks here.

And for a fundamental analysis of the above companies, check out Equitymaster’s Indian stock screener which has a separate screen for top banking stocks in India.

What are the top gainers and top losers within the banking sector today?

Within the Banking sector, the top gainers were AXIS BANK (up 6.0%) and INDIAN OVERSEAS BANK (up 5.7%). On the other hand, KOTAK MAHINDRA BANK (down 10.9%) and ARMAN HOLDINGS (down 4.9%) were among the top losers.

When should you invest in the banking sector?

Banking stocks are very closely linked to economy as both credit growth and margins are dependent on GDP growth and interest rates. Banks tend to have high non-performing assets (NPAs) when interest rates are high, and economy is underperforming and vice versa.

Therefore, the best time to buy banking stocks is when interest rates start falling as the cost of borrowing for banks goes down immediately while the interest they charge on loans stays high and falls with a lag.

To know more about the sector's past and ongoing performance, have a look at the performance of the NIFTY Bank Index and BSE Bankex Index.

Where can I find a list of banking stocks?

The details of listed banking companies can be found on the NSE and BSE website. For a curated list, you can check out our list of banking stocks.