- Home

- Outlook Arena

- How to Invest in EV Stocks

How to Invest in EV Stocks

Electric vehicles (EVs) are the next big thing.

As the cost and affordability of EVs drops in the coming years, we are not far from when most vehicles will be electric.

In this ongoing EV revolution, it is important that you find good quality companies which are involved in this space because not every EV stock will turn out to be a multibagger.

– There are various ways to play the EV opportunity. You can...

- Buy stocks of automobile companies that manufacture electric vehicles.

- Buy stocks of EV component makers such as batteries as the rapid penetration of EVs will drive the need for lithium ion batteries.

- Invest in EV charging infrastructure providers

- Invest in commodities that are widely used in EV battery production such as silver, nickel, copper.

- Invest in electric mobility services and financers.

Now let’s take a look at some important points you need to keep in mind when buying EV stocks...

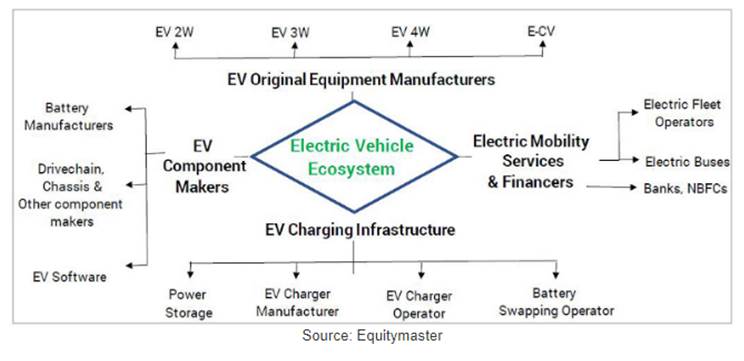

Expand your vision and look beyond EV automakers. Shift your focus to the EV supply ecosystem.

The leading names in EVs are probably not going to be the biggest beneficiaries of the EV transition as most of these players still derive majority of their sales from ICE (internal combustion engine) vehicles.

Even if the EV part of the portfolio grows exponentially, the disruption and cannibalisation will lead to shrinking in their legacy portfolio, which will outweigh the growth aspects.

Consider players involved in charging infrastructure, battery swapping operators, EV ancillary manufacturers, companies with expertise in product and EV software designing, battery makers, metal, mining and chemical companies.

Have a look at the chart below for a deeper understanding of the EV ecosystem.

The EV Ecosystem

In the listed space, the EV ecosystem includes companies like Amara Raja, Exide Batteries, Minda Industries (sensors and controllers), Minda Corporation (safety, communication systems, lightweigting), KPIT and Tata Elxsi (software, design and architecture) to name a few.

With great fundamentals and attractive valuations, such companies will be relatively safer bets in the EV transition.

Look for companies that benefit from both premiumization plus increased volumes /applications in electric vehicles.

As the EV market develops, players in the entire value chain will be forced to evolve. As a result, companies will look to premiumize their products in a bid to set themselves up for tomorrow.

Companies that will see their share price soar are the ones that will be able to manage this transition smoothly.

Those that manufacture products in increasing volumes and with various applications will also see their share prices skyrocket as higher volumes would result in higher sales and earnings visibility.

Now that we have reviewed some key steps to selecting the right stocks, here’s a list of don’ts that could help you avoid dud stocks.

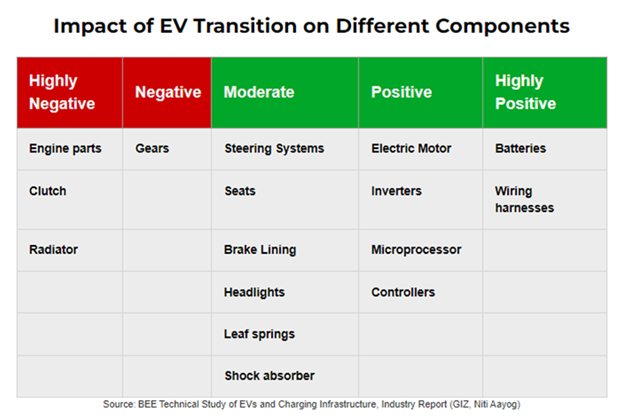

To be on the winning side of the EV bet, it is critical you avoid players where product portfolio is suited to internal combustion engines only.

There are only around 20 moving parts in fully electric car. This compares to 2,000 parts in ICE vehicles.

Companieslike ShriRam Pistons and Rings, or UCAL Fuel systems (that makes carburettors and Air Suction Valves) could be on the losing side of this race.

Be cautious about companies betting aggressively on electric vehicles in a way that require huge capital investments, and doing so while taking debt.

This is because the technologies to fuel EV are still evolving rapidly, and what works now may not work in future, and will lead to poor returns.

A promising company must have a low debt-equity ratio, a strong track record of profitability, strong cash flows and a high ROE. It must also have solid backing of its promoters.

You are now on a strong wicket to go out and find the right EV stock for yourself.

If you need some more help, you can check out our list of Electric vehicle stocks here.

You can also check out the playlist on electric vehicles on Equitymaster's YouTube channel.

![]() Will Biocon Lead Indian Pharma's Rare 'Patent Cliff' Opportunity

Will Biocon Lead Indian Pharma's Rare 'Patent Cliff' Opportunity

Apr 12, 2024

The last time such a cliff occurred during 2011-15 and offered substantial upside in pharma stocks.

![]() L&T's Role in Green Hydrogen Profits

L&T's Role in Green Hydrogen Profits

Apr 8, 2024

The shift to hydrogen for fuel is simply a shift away from depleting finite sources of fossil fuels.

![]() Tesla is Coming to India. Should You Worry About Your Auto Stocks?

Tesla is Coming to India. Should You Worry About Your Auto Stocks?

Mar 18, 2024

With India approving new EV policy to boost Tesla's market entry plans, how will Tesla shake up India's EV market? Find out...

![]() One More Tata Group Stock to Ride Gains in the EV Ecosystem

One More Tata Group Stock to Ride Gains in the EV Ecosystem

Mar 13, 2024

According to reports, Tata Motors' electric vehicle subsidiary, TPEML, is gearing up for a potential US$ 1-2 bn IPO in the next 18 months.

![]() How L&T is Driving India's Green Hydrogen Boom

How L&T is Driving India's Green Hydrogen Boom

Mar 11, 2024

The bluechip is powering ahead with its green hydrogen plans.

![]() Tata Motors Demerger: Will Shareholders Witness Value Unlocking?

Tata Motors Demerger: Will Shareholders Witness Value Unlocking?

Mar 5, 2024

Tata Motors shocked investors with a post-market demerger announcement, causing an 8% surge in share price today. Can it fulfil its growth commitments?

![]() Bluechip Powering India's Green Hydrogen Megatrend

Bluechip Powering India's Green Hydrogen Megatrend

Feb 22, 2024

The shift to hydrogen for fuel is simply a shift away from depleting finite sources of fossil fuels.

![]() IPO Bandwagon Gets Bigger with Oyo and Ola Set to Launch Biggest IPOs of 2024

IPO Bandwagon Gets Bigger with Oyo and Ola Set to Launch Biggest IPOs of 2024

Feb 21, 2024

Both these companies share contrasting tales on how far they've come to launching their initial public offers this year. Read on...

![]() Multibagger EV Penny Stock Develops New Battery Charger

Multibagger EV Penny Stock Develops New Battery Charger

Feb 16, 2024

This penny stock has rallied over 280% in the past one year, following back-to-back order wins from the Indian railways. Now, it has eyes set on the EV battery charging space.

![]() This Stock is a Better EV Bet Than Tata Motors

This Stock is a Better EV Bet Than Tata Motors

Jan 16, 2024

The company boasts better fundamentals and a wider exposure to the electric vehicle theme.

![]() Why Exide Industries Share Price is Rising

Why Exide Industries Share Price is Rising

Apr 9, 2024

Exide Industries stock price hits record high today. What's driving the rally?

![]() Can Tata Motors, Maruti Suzuki Crash After India's EV Policy 2024?

Can Tata Motors, Maruti Suzuki Crash After India's EV Policy 2024?

Apr 3, 2024

The policy may allow large-scale entry of Chinese auto firms like BYD in the local market.

![]() Electric Vehicle Stocks in India Get Another Boost with the EMPS Scheme: Top EV Stocks to Benefit

Electric Vehicle Stocks in India Get Another Boost with the EMPS Scheme: Top EV Stocks to Benefit

Mar 15, 2024

All you need to know about the new Electric Mobility Promotion Scheme (EMPS) 2024.

![]() Ather Energy IPO: All You Need to Know

Ather Energy IPO: All You Need to Know

Mar 11, 2024

Ather Energy's IPO rumours are electrifying the market. Discover the timeline, investment prospects, and everything you need to know.

![]() Top Murugappa Group Stocks Making Big Moves in 2024. Here's How You Can Profit...

Top Murugappa Group Stocks Making Big Moves in 2024. Here's How You Can Profit...

Mar 7, 2024

From semiconductors to electric vehicles, this corporate house is tapping emerging trends, and its new strategy might just pay off. Continue reading...

![]() Best EV Stock: Olectra Greentech vs JBM Auto

Best EV Stock: Olectra Greentech vs JBM Auto

Feb 23, 2024

India's e-bus sales are set to double to 8% of the total bus sales and this company stands to benefit the most.

![]() This EV Charging Company is Set to Make its Dalal Street Debut Soon

This EV Charging Company is Set to Make its Dalal Street Debut Soon

Feb 21, 2024

From grey market premium to price band, here's everything you need to know about this EV charging company's upcoming IPO.

![]() Maruti's New Technology Might Forever Alter the Electric Vehicle (EV) Market

Maruti's New Technology Might Forever Alter the Electric Vehicle (EV) Market

Feb 16, 2024

Maruti is aiming for the skies and plans to launch electric air copters by 2025, with its eyes set on global expansion.

![]() Mining Stocks Gold Rush Has Just Begun

Mining Stocks Gold Rush Has Just Begun

Jan 31, 2024

November 29, 2023 changed the course of India's energy transition and electric mobility.

![]() Which Sectors Will be the Biggest Gainers in 2024?

Which Sectors Will be the Biggest Gainers in 2024?

Jan 10, 2024

Look beyond defence, railway, and EV stocks this year.

FAQs

Which are the best electric vehicle stocks in India right now?

As per Equitymaster's Indian Stock Screener, here is a list of the best electric vehicle stocks in India right now...

These companies have been ranked as per their PE (Price to Earnings) ratio. Generally, speaking, high PE stocks are considered to be expensive. And low PE stocks are said to be cheap.

Of course, there are other parameters you should take into account before forming a hard opinion on the stock valuation.

Where can I find a list of electric vehicle stocks?

The details of listed electric vehicle companies can be found on the NSE and BSE website.

For a curated list you can check out our list of electric vehicle stocks.

What kind of dividend yields do electric vehicle stocks offer?

There is no consistent trend of dividends across the industry, with different companies adopting different dividend policies.

For more details, check out our list of top electric vehicle stocks offering high dividend yields