- Home

- Outlook Arena

- What is Put-Call Ratio?

What is Put-Call Ratio?

PCR is the common acronym for the Put-Call Ratio.

Puts and Calls are tools for options traders to hedge their positions. It is also widely used for speculative purposes.

A call option contract gives the owner the right, but not the obligation, to buy a specified amount of an underlying security, at a specified price, within a specified time.

A put option gives the holder of the option the right, but not the obligation, to sell a specified amount of an underlying security, at a specified price, within a specified time.

The put-call ratio is an indicator used by traders to gauge the overall trend of a market.

Calculating the Put-Call Ratio

The put-call ratio is calculated by dividing the number of traded put options by the number of traded call options.

A put-call ratio of 1 indicates the number of buyers of calls and the number of buyers for puts are equal.

A ratio above 1 means there are more put buyers than call buyers and vice versa.

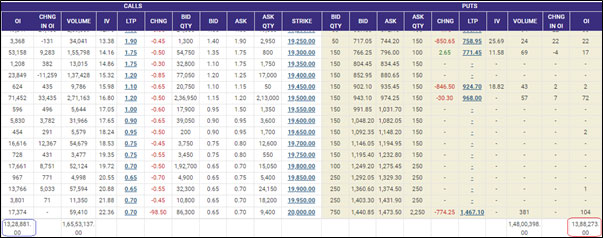

The total contracts of put and call can be seen in the option chain of the contract.

Indian options traders can visit https://www.nseindia.com/option-chain to check the option chain.

The table below is from the link above.

The Put-Call Ratio (PCR) in the example above will be 1.04 by dividing total open interest (OI) of puts (marked red) by that of calls (marked blue).

------------------------------

Call: 1,328,881

Defining the Trend from Put Call Ratio

If traders are buying more puts than calls, it signals a rise in bearish sentiment. If they are buying more calls than puts, it suggests that they see a bull market ahead.

An average put-call ratio of 0.7 for equities is considered an oversold market while above 1.5 is considered overbought.

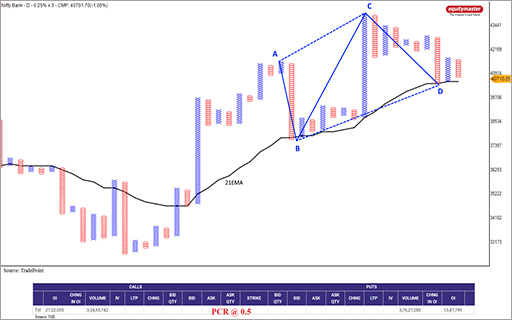

In the context of Indian markets, Nifty is a widely traded option and as the benchmark index, the PCR will define the market trend.

A PCR below 0.6 offers a great buying opportunity while a PCR above 1.75 is considered to be a very overbought market.

However, it is also important to look at the market based on economic parameters or black swan events like a pandemic.

It is also considered a contrarian indicator.

The change in open interest is observed by options traders to gauge the momentum of the market trend.

When the ratio is trending around 1.5-1.6, a trader will look at the market to reverse and take the position as it is in an oversold zone.

Similarly, When the ratio is trending around 0.7-0.65, a trader will look at the market to turn bearish and take the position as it is in an overbought zone.

Though the PCR may not define the tops and bottoms for the market, but the PCR can help traders make money from a dead-cat bounce or a pull-back.

Complex options strategies like straddles and strangles are traded using the put call ratio.

![]() BHEL Shares Rally on Short Covering Bets. What Next?

BHEL Shares Rally on Short Covering Bets. What Next?

Aug 23, 2023

This could be the reason why BHEL share price is rising.

![]() Top 5 High Quality Penny Stocks to Add to Your Watchlist

Top 5 High Quality Penny Stocks to Add to Your Watchlist

Mar 21, 2023

With so many options out there, it can be challenging to find high-quality penny stocks that are worth adding to your portfolio.

![]() Trading Strategy for Budget 2023

Trading Strategy for Budget 2023

Jan 19, 2023

In this video, I'll show you an options strategy for Budget 2023. I also discuss sectors I'm bullish on leading up to the Budget.

![]() Why Everyone Must Learn to Trade

Why Everyone Must Learn to Trade

Sep 12, 2022

Did you know, when you ask for buy or sell advice, you are faced with three (and not two) outcomes? Continue reading as I explain why everyone should learn to trade.

![]() Options Writers Should Grab the Opportunity in the Nifty this Week

Options Writers Should Grab the Opportunity in the Nifty this Week

Aug 23, 2022

The Equitymaster proprietary TruStop (TM) system indicates the Nifty is likely to consolidate.

![]() A Trading Strategy that Guarantees You Never Lose Money?

A Trading Strategy that Guarantees You Never Lose Money?

Apr 28, 2022

What if you could use a strategy to almost guarantee you don't lose money on a trade? Read about this smart trading strategy here...

![]() A Trader's War Room

A Trader's War Room

Mar 3, 2022

What should you be your war-time trading strategy?

![]() What Poker can Teach You About Trading

What Poker can Teach You About Trading

Jan 18, 2022

How lessons from poker can improve your trading strategy.

![]() Is Intraday Trading For You?

Is Intraday Trading For You?

May 13, 2021

Do you think you have what it takes to be an intraday trader? Find out in this video.

![]() How to Make Passive Income by Writing Options

How to Make Passive Income by Writing Options

Jul 8, 2020

Professional traders rely on options writing to generate passive income. Its time you did too.

![]() Will Morgan Stanley's Upgrade Lead to a New High for Indian Stocks?

Will Morgan Stanley's Upgrade Lead to a New High for Indian Stocks?

Aug 4, 2023

How should one approach Morgan Stanley's re-rating of the Indian stock market?

![]() Bank Nifty: It's Worth a Shot

Bank Nifty: It's Worth a Shot

Feb 21, 2023

Continue reading to find out the current best strategy for trading in Bank Nifty.

![]() An Option Strategy Nifty Traders Shouldn't Miss Out On

An Option Strategy Nifty Traders Shouldn't Miss Out On

Sep 15, 2022

Options traders can look for strangle short strategy for next week or monthly expiry.

![]() My Secret Nifty Trading Strategy

My Secret Nifty Trading Strategy

Aug 25, 2022

This is how I trade the Nifty.

![]() What the Interest Rate Hike Means for Traders

What the Interest Rate Hike Means for Traders

Jun 20, 2022

How should you trade the market now? Find out in this video...

![]() Bearish Momentum Resumes in the IT Index

Bearish Momentum Resumes in the IT Index

Apr 25, 2022

IT stocks are a 'short on rise' opportunity as most of them are in future & options (F&O) segment.

![]() REITs: The Big Investment Theme of 2022

REITs: The Big Investment Theme of 2022

Feb 15, 2022

As more REITs list over time, there will be more options available. Retail investors need to track this space in 2022.

![]() What Ails the Market?

What Ails the Market?

Jul 8, 2021

Let me tell you why the bulls are finding it difficult to push the market higher.

![]() Profit from a Rangebound Nifty

Profit from a Rangebound Nifty

May 6, 2021

Find out how you can make trading profits in the market when the Nifty is stuck in a range.

The Badla Financier is Dead. Or is He?

Jun 19, 2019

The evolution of the stock financier in India.