- Home

- Outlook Arena

- Best Textile Stocks in India

Best Textile Stocks in India

The Indian textile industry is among the oldest industries in the country dating back several centuries.

The industry is also the second largest provider of employment, only next to agriculture. As of 2022, the domestic textile industry constituted 5% of the country's GDP.

Owing to its labor-intensive nature, the Indian textile industry enjoys a comparative advantage in terms of skilled manpower and cost of production relative to major textile producers.

The Indian textile sector is broadly divided into two groups. These are yarn and fiber, and processed fabrics and apparel.

The industry is extremely varied, with the hand-spun and hand-woven textiles sectors at one end of the spectrum and the capital-intensive sophisticated mills sector at the other end of the spectrum.

The growth for this sector is expected to be fueled by support from the Indian government through funding and machinery sponsoring.

In 2021, the Indian government started the product-linked incentive (PLI) scheme for textile industry to expand manmade fabrics and technical textile segment’s value chain.

Further, as export demand and domestic consumption both increases, the retail sector may experience a rapid growth in the coming decade.

Porter’s Five Forces Analysis of the Textile Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the textile sector -

#1 Barriers to Entry

New companies often bring new resources and can drive down product prices and reduce profitability of the industry.

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the textile sector, barriers to entry are high. To succeed, one must have superior technology, skilled and unskilled labor, distribution network, and access to global customers.

#2 Bargaining Power of Suppliers

The bargaining power of suppliers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

For the textile sector, the bargaining power of suppliers is low. This is because there is an excess of available suppliers giving them a weak bargaining power.

In addition, the suppliers lack switching costs and have a low level of product differentiation.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the textile sector, the bargaining power of customers is low for premium and branded product segments for domestic customers.

For global customers it is high due to the presence of alternate low-cost sourcing destinations.

#4 Competition

For most industries, having an understanding of the competition is vital to successfully marketing a product.

The competition in the textile industry is high. This is because the industry is very fragmented and competition from other low cost producing nations is only going to intensify.

The immense growth opportunities of the sector have led to entrants of large players, even global ones, in the Indian landscape.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

This is high for the textile sector. The Indian textile industry faces a threat from low cost producing countries like Pakistan and Bangladesh (as labor cost is around 50% cheaper than India).

Porters Five Forces Analysis of the Textile Sector in India

When to Invest in Textile Stocks in India

India is a key growth market for the textiles sector due to its cost effectiveness, durability and versatility. Hence, it becomes essential for long term investors to understand how and when to invest in textile stocks.

First the when to invest part...

As the demand for textiles is closely linked to the economy - domestic and global, textiles stocks are usually riskier and categorized as cyclical stocks.

Generally considered an offensive tactic in investing, cyclical stocks can be used to generate high returns when the economy is doing well.

Just like the best steel stocks in India, the fortunes of best textile stocks in India are prone to economic booms and busts.

Therefore, the best time to buy textile stocks is during an economic slowdown or when there is overcapacity in some segment of the industry.

Before investing in a textile company, check whether the industry is due for revival or not.

For investors in textile stocks between 2018-2020, the sector was a clear underperformer at the time as it struggled with cheap imports, a consumption slowdown, over capacity, and several other issues.

The situation entirely changed in the next couple of years. Textile stocks have now become multibaggers.

This is because textile players saw increased revenues and margins amid rising consumption.

There were other factors at play too which helped. To name a few:

- The lower dependence on China meant more demand for Indian companies. Buyers adopted a China plus one strategy to shift from China and look for other suppliers.

- And GST council's move to defer rate hike on textiles.

As you can see, many things had to come in place for textile stocks to become as long-term stocks to buy in India.

Key Points to Keep in Mind While Investing in Textile Stocks

Here are a few things to keep in mind while investing in textile stocks.

#1 Cotton and Yarn prices

An increase in cotton price leads to an increase in yarn prices.

When cotton and yarn prices are on the rise, it becomes difficult for the textile companies to pass on raw material costs to buyers. This affects their margin.

Higher prices also make exports uncompetitive. This results in hardships for the exporting companies to fulfil export commitments and taking further orders.

In a scenario where prices are rising, you should focus on companies which can convert cotton to yarn.

Textile companies engaged in the conversion of cotton to yarn not only benefit from increase in margins but also additional demand.

Also, it takes at least 15-18 months to set up a new spinning unit. So, spinning companies have an edge here as compared to conventional textile companies.

#2 Exports as a percentage of revenue

Textile companies that earn a large share of their revenue from exports have better margins as international prices tend to be higher than domestic prices. Although this is not the case every time.

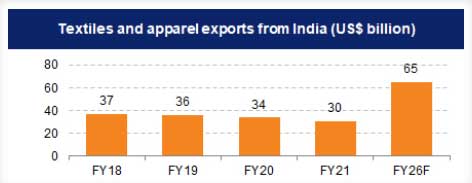

Why we’re adding this point here is that India’s exports are projected to skyrocket in the coming years.

Earlier, countries like China, Bangladesh, and Vietnam were flooding the global markets with cheap products making it difficult for Indian textile companies.

But in 2022, a ban on import of cotton/cotton made products from China to the US opened up a big opportunity for India. This ban resulted in market share gains for Indian textile companies who export.

So before investing in a textile company, see if it focuses more on exports.

#3 Clientele

Textile companies which have a strong global clientele are likely to do well in the long run. Although their contract tenures should be taken into consideration.

For example, Indian textile companies which have contracts which global giants like Walmart, Marks& Spenser, H&M, Zara, and others may have a competitive edge.

#4 Profitability of the company

Before you compare the performance of two textile companies, say for instance, Page Industries vs Monte Carlo, do factor in their operating performance.

Here’s a list of top textile companies in India based on their consolidated net profit.

| (Rs m) | Net Sales | Total Expenditure | Operating Profit | Net Profit |

|---|---|---|---|---|

| Trident Ltd. | 69,192 | 54,570 | 15,100 | 8,150 |

| K.P.R. Mill Ltd. | 40,737 | 30,898 | 10,685 | 7,308 |

| Page Industries Ltd. | 40,206 | 32,337 | 8,078 | 5,365 |

| Nahar Spinning Mills Ltd. | 35,939 | 27,830 | 8,254 | 5,022 |

| Welspun India Ltd. | 67,068 | 58,165 | 9,768 | 3,921 |

| Nitin Spinners Ltd. | 26,923 | 20,407 | 6,535 | 3,261 |

| Vedant Fashions Ltd. | 10,087 | 5,284 | 5,289 | 3,084 |

| Indo Rama Synthetics (India) Ltd. | 39,011 | 36,145 | 3,111 | 2,682 |

| RSWM Ltd. | 38,174 | 33,854 | 4,642 | 2,400 |

| Siyaram Silk Mills Ltd. | 19,031 | 15,688 | 3,687 | 2,125 |

| Rupa & Company Ltd. | 14,287 | 11,616 | 2,778 | 1,908 |

| Century Enka Ltd. | 20,978 | 18,335 | 2,849 | 1,842 |

| Lakshmi Machine Works Ltd. | 30,716 | 28,426 | 3,100 | 1,797 |

| Garware Technical Fibres Ltd. | 11,761 | 9,775 | 2,419 | 1,607 |

#5 Debt to equity (D/E) ratio

A company uses both equity and debt to run a business. However, the amount of debt it uses indicates its fixed obligations. Higher the leverage, higher will be the fixed charges such as interest expense which will lower the profitability.

One must look for a debt to equity ratio of one or less than one.

Here’s a list of top textile companies in India with low debt to equity ratio.

| (Rs m) | Total Debt | Debt to Equity (X) | Free Cashflow |

|---|---|---|---|

| Page Industries Ltd. | 0.0 | 0.00 | 2,131 |

| Vedant Fashions Ltd. | 0.0 | 0.00 | 3,534 |

| K.P.R. Mill Ltd. | 4,179 | 0.16 | 3,657 |

| Trident Ltd. | 15,706 | 0.41 | 4,509 |

| Lakshmi Machine Works Ltd. | 0.0 | 0.00 | 4,720 |

| Welspun India Ltd. | 13,078 | 0.38 | 4,413 |

| Garware Technical Fibres Ltd. | 796 | 0.08 | 577 |

| PDS Ltd. | 88 | 0.05 | 580 |

| TCNS Clothing Co. Ltd. | 0.0 | 0.00 | 346 |

| Kewal Kiran Clothing Ltd. | 766 | 0.16 | 517 |

#6 Return on Capital Employed (ROCE) ratio

Along with a low debt to equity ratio, a one must look for a high return on capital employed (ROCE).

Return on capital employed measures how much profits the company is generating through its capital. The higher the ratio, the better.

An ROCE of above 15% is considered decent for companies that are in an expansionary phase.

Here’s a list of top textile companies in India with more than 15% in ROCE. We have also mentioned other return rations for reference.

| Company Name | ROE (%) | ROCE (%) | ROA (%) |

|---|---|---|---|

| Page Industries Ltd. | 54.4 | 75.2 | 28.2 |

| DCM Nouvelle Ltd. | 50.0 | 42.0 | 24.9 |

| Vedant Fashions Ltd. | 28.4 | 40.4 | 14.3 |

| PDS Ltd. | 39.6 | 38.2 | 29.7 |

| K.P.R. Mill Ltd. | 32.2 | 37.7 | 25.0 |

| Nitin Spinners Ltd. | 45.3 | 36.4 | 18.6 |

| Indo Rama Synthetics (India) Ltd. | 57.5 | 34.9 | 15.9 |

#7 Valuations

Two commonly used financial ratios used in the valuation of metal stocks are -

Price to Earnings Ratio (P/E) - It compares the company’s stock price with its earnings per share. The higher the P/E ratio, the more expensive the stock.

To find stocks with favorable P/E Ratios, check out our list of stocks according to their P/E Ratios.

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out our list of stocks according to their P/BV Ratios.

#8 Dividend yields

There is no consistent trend of dividends across the textile industry, with different companies having different dividend policies.

Here’s a list of top textile companies in India that score well on dividend yield and dividend payout.

| Company | DPS (Rs) | Dividend Yield (%) | Dividend Payout (%) |

|---|---|---|---|

| Kewal Kiran Clothing Ltd. | 19.0 | 9.5 | 143.4 |

| PDS Ltd. | 23.9 | 1.4 | 93.0 |

| Page Industries Ltd. | 370.0 | 0.9 | 76.9 |

| Cheviot Company Ltd. | 60.0 | 5.3 | 45.5 |

| Vedant Fashions Ltd. | 5.0 | 0.5 | 39.4 |

| Gloster Ltd. | 35.0 | 3.2 | 26.3 |

| RSWM Ltd. | 25.0 | 6.1 | 24.5 |

| Lakshmi Machine Works Ltd. | 40.0 | 0.4 | 23.8 |

| Trident Ltd. | 0.4 | 0.7 | 22.5 |

For more details, check out the top stocks offering high dividend yields.

List of Textile Stocks in India

The details of listed metal companies can be found on the NSE and BSE website. However, the overload of financial information on these websites can be overwhelming.

For a more direct and concise view of this information, you can check out our list of textile stocks.

You can also check out the latest textile sector results.

Best Sources for Information on the Indian Textile Sector

Indian Brand Equity Foundation Textile Sector Report - https://www.ibef.org/industry/textiles

Ministry of Textiles - http://texmin.nic.in/

Department of Industrial Policy and Promotion - https://dpiit.gov.in/

So there you go. Equitymaster's detailed guide on the best textile stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

Here's a list of articles and videos on the textile sector and top textile stocks in India. This is a great starting point for anyone who is looking to explore more about textile stocks and the textile sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() Why Swan Energy Share Price is Falling

Why Swan Energy Share Price is Falling

Mar 14, 2024

Swan Energy tanks 25% in five days. Here's what's causing this dip?

![]() Why Raymond Share Price is Falling

Why Raymond Share Price is Falling

Nov 30, 2023

With over 10% wealth erosion in a week, Raymond shares are in the limelight for all the wrong reasons.

![]() Veteran Fund Manager Picks Stake in Smallcap Textile Company. Stock Zooms 20%

Veteran Fund Manager Picks Stake in Smallcap Textile Company. Stock Zooms 20%

Jun 15, 2023

Find out why this fund manager turned bullish on the largest producer of PV dyed yarn in Asia.

![]() Smallcap Textile Company Sets Record Date for Buyback. Participate or Not?

Smallcap Textile Company Sets Record Date for Buyback. Participate or Not?

May 9, 2023

This textile company's share price zooms 20% in five days after announcing share buyback. More details inside...

![]() Why Axita Cotton Share Price is Falling

Why Axita Cotton Share Price is Falling

May 5, 2023

After delivering multibagger returns of 400% in a year, the stock slipped 54% in five days. Here's why.

![]() Stocks and Strategies for Investing in Uncertain Times

Stocks and Strategies for Investing in Uncertain Times

Apr 27, 2023

It's been more than a decade since the Titanic sank. Yet, the appeal of this story refuses to fade away. Here's what investors could learn from this disaster.

![]() Dolly Khanna Turns Bearish on these 3 Stocks. Do You Own Them?

Dolly Khanna Turns Bearish on these 3 Stocks. Do You Own Them?

Jan 12, 2023

The Chennai based investor sold stake in these three companies in the December 2022 quarter. Find out why.

![]() Why Textile Stocks Will Make a Strong Comeback in 2023

Why Textile Stocks Will Make a Strong Comeback in 2023

Dec 30, 2022

Find out what 2023 has in store and how the traditional investing approach may not work.

![]() Why Did Dolly Khanna Increase Stake in this Leading Branded Apparel Smallcap Stock?

Why Did Dolly Khanna Increase Stake in this Leading Branded Apparel Smallcap Stock?

Nov 14, 2022

The ace investor picked additional stake in this textile company, which is also a beneficiary of government's PLI scheme.

![]() The Shift in Global Supply Chains Could Unlock Huge Opportunities in These Three Smallcaps

The Shift in Global Supply Chains Could Unlock Huge Opportunities in These Three Smallcaps

Sep 19, 2022

Forget economic cycles and commodity cycles... Here's a structural shift that could help you with sustainable investing returns

![]() The New Indian Textile Boom: 3 Stocks for Your Watchlist

The New Indian Textile Boom: 3 Stocks for Your Watchlist

Mar 5, 2024

Which textile stocks look good in a competitive sector? Find out...

![]() Dolly Khanna's Big Bet on These 2 Stocks: What Investors Should Know

Dolly Khanna's Big Bet on These 2 Stocks: What Investors Should Know

Jul 19, 2023

Dolly Khanna has increased her stake in these two companies. Do you own them?

![]() 5 Undervalued Textile Stocks to Add to Your Watchlist

5 Undervalued Textile Stocks to Add to Your Watchlist

May 20, 2023

These textile stocks are trading at mouth-watering valuations. But is the risk reward set up in investors' favor?

![]() Why TCNS Clothing Share Price is Falling

Why TCNS Clothing Share Price is Falling

May 8, 2023

TCNS Clothing share price crashes 19% in a day, the biggest single-day drop since its IPO. Here's why.

![]() Vijay Kedia and Sunil Singhania Increase Stake in this Smallcap Textile Stock

Vijay Kedia and Sunil Singhania Increase Stake in this Smallcap Textile Stock

Apr 29, 2023

Two ace investors pick additional stake in this smallcap textile company. What's brewing?

![]() Why Trident Share Price is Falling

Why Trident Share Price is Falling

Mar 22, 2023

Textile companies have grabbed market share from China in the export market. But Trident has fell short of expectations and hasn't lived up to the hype.

![]() Why Page Industries Share Price is Falling

Why Page Industries Share Price is Falling

Jan 2, 2023

Here's why shares of the company have fallen over 9% in a month.

![]() Comeback Sectors of 2023

Comeback Sectors of 2023

Dec 22, 2022

Find out what 2023 has in store and how the traditional investing approach may not work.

![]() 5 Ways a Weaker Indian Rupee Benefits You...and Hurts You

5 Ways a Weaker Indian Rupee Benefits You...and Hurts You

Sep 29, 2022

A falling rupee doesn't mean you need to suffer in silence. There are ways to profit from it too.

![]() The Megatrends I Like the Most... And Stocks that are Riding Them

The Megatrends I Like the Most... And Stocks that are Riding Them

Sep 13, 2022

A lot of print space and prime time is wasted on predicting macros and cycles and taking cues from it to pick stocks. This is a complicated exercise that no one has been consistently good at.