- Home

- Outlook Arena

- What is Options Trading?

What is Options Trading?

An option is a derivative instrument based on the value of underlying security in the equity, forex, or commodities market.

An options contract grants the holder the right but not the obligation to buy or sell - depending on the type of contract they hold - the underlying security.

Options are versatile financial products that are traded with a specific expiration date by which the holder must exercise their option. The price of an option depends on the strike price which traders select to trade.

There are two types of options widely traded - American and European.

American options are traded in the US markets and can be exercised any time before the expiration date. It is denoted by “CA - Call American” and “PA - Put American”.

European options can only be exercised on the expiration date or the exercise date. Exercising means utilising the right to buy or sell the underlying security. It is denoted by “CE - Call European” and “PE - Put European”.

In India, European options are used with the expiry on the last Thursday of the month in stock markets. In case of a holiday, it is preponed to Wednesday.

There are also weekly option chains which expire on every Thursday. The contracts for the Nifty Financial Service index expires on Tuesdays.

In commodities markets, expiration depends on the commodity being traded.

Types of Options - Call and Put

Call option contracts gives the holder the right, but not the obligation, to buy a specified amount of an underlying security at a specified price within a specified time.

Put option contracts gives the holder the right, but not an obligation, to sell a specified amount of an underlying security at a specified price within a specified time.

Trading Options

To trade options, a trader needs to understand some basic tools. Here are some which can go a long way into you becoming a successful trader.

Expiry Date

The expiry date in Indian share markets is the last Thursday of every month. It will change with the instruments you are trading. The expiry date is defined by the exchange mechanism and the trader can find it before initiating the trades.

There are multiple expiry contracts to trade as well as scripts which give traders an option to choose from the near-month contract or far-month contract.

Strike Price

Strike price is also known as the exercise price.

The buyers and sellers decide the strike price based on their analysis of the price the options will be exercised on the expiry day.

Lot Size

Lot size is the minimum quantity traded or in multiple of that in the contract. The lot size may vary from instrument to instrument.

Options Greeks - The Mechanism to Calculate the Option Pricing

The "Greeks" is used to describe the dimensions of risk involved in taking an options trade. The reason it is called Greeks is because they are associated with Greek symbols.

Delta

Delta (?) represents the rate of change of the option's price with every rupee change in the underlying asset’s price.

Delta of a call option has a range between zero and one, while for the put option it ranges between zero and a negative one.

Theta

Theta means Time in options trading. It represents the rate of change between the option price and time.

The options writers (i.e. sellers) use this tool to find an option's time decay. Theta indicates the amount an option's price would decrease as the time to expiration decreases, all else being equal.

Gamma

Gamma represents the rate of change between an option's delta and the underlying asset's price. This is called second derivative of price sensitivity.

Vega

Vega represents the rate of change between an option's value and the underlying asset's implied volatility.

This is the option's sensitivity to volatility. Vega indicates the amount an option's price changes given a 1% change in implied volatility.

Rho

Rho represents the rate of change between an option's value and a 1% change in the interest rate. This measures sensitivity to the interest rate.

Moneyness of Options Contract

Moneyness in options is defined as the relationship between the strike price and the price of the underlying security.

There are three main classifications to describe the moneyness of options contracts.

At-The-Money (ATM)

The strike price which is nearest to the Spot price is called ‘At the money’. It is commonly known as ATM.

For example: Consider the underlying asset Nifty50 is trading at 18,070 and the strike price at in the multiple of 100.

The immediate Call or Put Option will become the ATM option. In this case, 18,100CE and 18,000PE will be the ATM.

Mr A buys the 18,100CE strike price at Rs 20 when the underlying asset Nifty was trading at 18,070 just two days ahead of expiry.

On the expiry day, if Nifty closes at 18,200, Mr A will make a profit of Rs 80.

Here’s how the calculation goes:

Buy Price - 20

Expiry Price - 18,200

Strike Price - 18,100

Net Change from Expiry: 18,200-18,100 = 100

Gains from the trade: 100-20 = 80

In the Money (ITM)

The strike price which is trading below the underlying asset for calls and above for puts is termed In the Money (ITM) options.

These options have a higher correlation with delta as they trend in sync with their underlying asset.

For example, if the underlying asset Nifty is trading at 18,100, all the strikes below 18,100 will be termed as ITM for calls and above for the put option contracts.

If Mr B buys the 18,000CE strike price at 115 when the underlying asset is trading at 18,100.

If it expires at 18,300, Mr B will make a profit of Rs 185 per contract.

Here’s how the calculation goes:

Buy Price - 115

Expiry Price - 18,300

Strike Price - 18.000

Net Change from Expiry: 18,300-18,000 = 300

Gains from the trade: 300-115 = 185

Out of the Money (OTM)

The strike price which is trading above the underlying asset for calls and below for the puts is termed Out Money (ITM) options.

These option contracts have high time decay if the underlying asset doesn’t have any momentum.

Option sellers trade these contracts to gain from time decay.

If Mr C buys the 17,900PE strike price at Rs 15 and the underlying asset is trading at 18,100.

If the contract expiry at 17,950, the option buyer will be at loss of Rs 15 even if the underlying asset fell by 150 points.

Whereas the option seller will make Rs 15 as the contract expired above the strike price.

![]() BHEL Shares Rally on Short Covering Bets. What Next?

BHEL Shares Rally on Short Covering Bets. What Next?

Aug 23, 2023

This could be the reason why BHEL share price is rising.

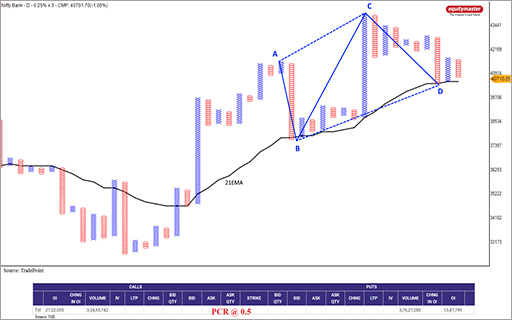

![]() Bank Nifty: It's Worth a Shot

Bank Nifty: It's Worth a Shot

Feb 21, 2023

Continue reading to find out the current best strategy for trading in Bank Nifty.

![]() An Option Strategy Nifty Traders Shouldn't Miss Out On

An Option Strategy Nifty Traders Shouldn't Miss Out On

Sep 15, 2022

Options traders can look for strangle short strategy for next week or monthly expiry.

![]() What the Interest Rate Hike Means for Traders

What the Interest Rate Hike Means for Traders

Jun 20, 2022

How should you trade the market now? Find out in this video...

![]() Bearish Momentum Resumes in the IT Index

Bearish Momentum Resumes in the IT Index

Apr 25, 2022

IT stocks are a 'short on rise' opportunity as most of them are in future & options (F&O) segment.

![]() What Ails the Market?

What Ails the Market?

Jul 8, 2021

Let me tell you why the bulls are finding it difficult to push the market higher.

![]() How to Make Passive Income by Writing Options

How to Make Passive Income by Writing Options

Jul 8, 2020

Professional traders rely on options writing to generate passive income. Its time you did too.

NPS Adds Two New Investment Options. Are They Worth Your Funds?

Sep 26, 2016

PersonalFN evaluates the 2 new investment options offered by NPS for your retirement planning.

![]() Top 5 High Quality Penny Stocks to Add to Your Watchlist

Top 5 High Quality Penny Stocks to Add to Your Watchlist

Mar 21, 2023

With so many options out there, it can be challenging to find high-quality penny stocks that are worth adding to your portfolio.

![]() Trading Strategy for Budget 2023

Trading Strategy for Budget 2023

Jan 19, 2023

In this video, I'll show you an options strategy for Budget 2023. I also discuss sectors I'm bullish on leading up to the Budget.

![]() Options Writers Should Grab the Opportunity in the Nifty this Week

Options Writers Should Grab the Opportunity in the Nifty this Week

Aug 23, 2022

The Equitymaster proprietary TruStop (TM) system indicates the Nifty is likely to consolidate.

![]() A Trading Strategy that Guarantees You Never Lose Money?

A Trading Strategy that Guarantees You Never Lose Money?

Apr 28, 2022

What if you could use a strategy to almost guarantee you don't lose money on a trade? Read about this smart trading strategy here...

![]() REITs: The Big Investment Theme of 2022

REITs: The Big Investment Theme of 2022

Feb 15, 2022

As more REITs list over time, there will be more options available. Retail investors need to track this space in 2022.

![]() Profit from a Rangebound Nifty

Profit from a Rangebound Nifty

May 6, 2021

Find out how you can make trading profits in the market when the Nifty is stuck in a range.

The Badla Financier is Dead. Or is He?

Jun 19, 2019

The evolution of the stock financier in India.