- Home

- Todays Market

- Indian Stock Market News January 27, 2017

Sensex Ends Up 174 Points; Wipro Among Top Losers Fri, 27 Jan Closing

Share markets in India finished the day on positive note helped by a rally in power, consumer durables and banking stocks. At the closing bell, the BSE Sensex closed higher by 174 points, whereas the NSE Nifty finished higher by 39 points. The S&P BSE Midcap index and the S&P BSE Small Cap index finished up by 0.6% & 0.5% respectively.

Asian markets finished mixed today. The Nikkei 225 gained 0.34% and the Shanghai Composite rose 0.31%. The Hang Seng lost 0.06%. European markets are trading lower today with shares in France off the most. The CAC 40 is down 0.68% while Germany's DAX is off 0.3% and London's FTSE 100 is lower by 0.08%.

The rupee was trading at Rs 68.10 against the US$ in the afternoon session. Oil prices were trading at US$ 53.67 at the time of writing.

IT stocks ended the day up by 0.3%. Mphasis Ltd and Moser Baer India were among the top gainers in the IT space. According to an article in The Economic Times, Wipro Ltd has signed a pact to acquire Brazilian IT firm InfoSERVER SA for US$ 8.7 million to expand its presence in Latin America. InfoSERVER is an IT services provider focused on the Brazilian market and provides custom application development and software deployment services.

Reportedly, InfoSERVER will help Wipro in expanding its presence in the country's highly traditional and competitive banking, financial services and insurance market. Apart from this, it will provide invaluable domain and process knowledge about the sector.

This acquisition closely lines up with Wipro's vision to localise, expand its presence in the Latin American market and also become a significant partner of choice and an end-to-end IT services provider in the area. Going forward, whether the acquisition will provide Wipro the scale and key client relationships, especially in the BFSI domains will be the key thing to watch out for.

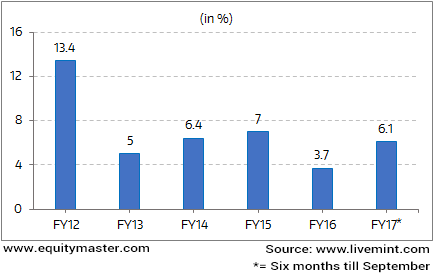

Also, Wipro's revenue growth has been in single digits for the past five years. Being in a low-growth rut appears to have compelled the company to make aggressive acquisitions over the years.

Wipro's year-on-year growth in dollar revenues

The IT industry is facing several headwinds on the demand front. The Banking Financial Services & Insurance (BFSI) segment, that contributes significantly to the revenues of IT companies, has been under rough weather. Madhu Gupta, Managing Editor of ResearchPro, is of the opinion that the IT industry will continue to witness pain with the evolving technology and changing business dynamics (Subscription required). Here's what she has to say:

- "Therefore, companies that are equipping themselves with the emerging product and process skills will be in a better position to adapt to the fast-changing requirements of the global IT industry. One way is through acquisitions of niche players operating in the disruptive technology space such as Wipro's recent acquisition of Appirio, a leader in cloud applications."

Wipro share price ended the day down by 1.6%.

Moving on to the news from stocks in engineering sector. It was reported that, Larsen & Toubro's (L&T) construction arm, L&T Constructions has bagged orders worth Rs 12.9 billion across various business segments.

Reportedly, L&T's Heavy Civil Infrastructure Business has bagged orders worth Rs 10.7 billion. Further, a major innovation order in the underground metro space has been secured from Metro-Link Express for Gandhinagar and Ahmedabad (MEGA) Company for the design and construction of underground stations and associated tunnels.

Another order has been bagged for the construction of an iron ore berth at Paradip, Odisha. An order has also been won for the construction of a technology-driven intake well structure at Purushotapatnam, Andhra Pradesh. Under the Building & Factories Business, the company has received an order worth Rs 2.2 billion for the construction of a paint manufacturing facility at Vizag, Andhra Pradesh.

Diversification continues to help L&T (Subscription Required) negotiate and get better terms and margins for projects. Apparently, this is because it is less desperate to win orders compared to companies present only in a couple of sectors.

Its reputation, extensive technical prowess, and large skilled workforce have enabled L&T to command a certain premium from customers and vendors alike. Whether, further addition to these new projects will provide a boost to its profitability, will be the interesting thing to watch out for going forward.

Subscribers can access to L&T's latest result analysis(subscription required) and L&T stock analysis on our website.

And here's a note from Profit Hunter:

Today let's take a glance at the Larsen and Toubro (L&T) chart.

The entire financial market fraternity tracks the 200-day moving average. In fact, a technical analyst uses moving averages for many different things. But the most widely-accepted use is as a 'support and resistance' tool.

And although the 200 EMA does not work for every stock in the market, it works amazingly for some of them.

The Larsen and Toubro chart is one such chart that works well the 200 EMA.

Plotting the 200 EMA on L&T's chart from 2008, it is evident that the EMA has provided support and resistance at various instances (marked by arrows). This shows the importance of 200 EMA every time the price approaches it.

Now, the L&T is trading very close to its 200 EMA. What is that indicating to us? A sustained close on either side of the average could show us the next trend. So keep an eye on the chart to see what the next move will be.

L&T's Respects its 200 EMA

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends Up 174 Points; Wipro Among Top Losers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!