- Home

- Todays Market

- Indian Stock Market News February 13, 2017

Sensex Finishes on a Dull Note, Bank of Baroda Plunges 10% Mon, 13 Feb Closing

Share markets in India trimmed their initial losses and finished the trading day on a flat note ahead of January inflation data (CPI) later today.

At the closing bell, the BSE Sensex stood higher by 17 points, while the NSE Nifty finished up by 12 points. Meanwhile, the S&P BSE Mid Cap finished down by 0.4% & the S&P BSE Small Cap finished down by 0.6%. Gains were largely seen in IT and power sector. Meanwhile, realty, PSU and consumer durables' sector led the losses.

Asian markets finished higher today with shares in China leading the region. The Shanghai Composite is up 0.63% while Hong Kong's Hang Seng is up 0.58% and Japan's Nikkei 225 is up 0.41%. European markets are higher today with shares in Germany leading the region. The DAX is up 0.62% while France's CAC 40 is up 0.47% and London's FTSE 100 is up 0.06%.

The rupee was trading at Rs 66.97 against the US$ in the afternoon session. Oil prices were trading at US$ 53.44 at the time of writing.

Idea cellular share price slipped 2.7% on the BSE after the company posted a consolidated net loss of Rs 3.85 billion during the December 2016 quarter compared with a consolidated net profit of Rs 6.55 billion a year ago. Revenue fell 3.79% to Rs 86.62 billion, as data and voice rates fell and its subscriber base shrank.

The Indian telecom industry witnessed an unprecedented disruption in the quarter of October to December 2016, primarily due to free voice and mobile data promotions by the new entrant in the sector. Consequently, revenue key performance indicators and financial parameters for all mobile operators have sharply declined.

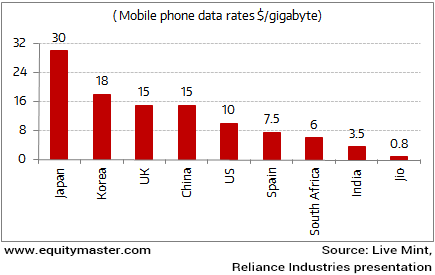

Jio, backed by India's richest person Mukesh Ambani, started commercial operations on September 5 with a free voice and data offer. Rivals including Bharti Airtel and Vodafone India were forced to slash effective data rates and offer free voice calling on some plans across price segments to prevent subscribers from migrating. Telcos had started cutting tariffs even before Jio's launch, hurting key operational metrics such as average revenue per user and average revenue per minute.

Jio's Data Pricing to Disrupt the Telecom Apple Cart

Idea, for the first time, witnessed a decline of 5.5 million mobile data customers on sequential quarter basis because of free data promotions by Jio.

However, Vodafone and the Aditya Birla group that owns Idea Cellular stated that they were in talks to form a joint venture with equal rights in an all-share deal. The talks involve Vodafone buying fresh shares in Idea and deconsolidating its India unit.

A Vodafone-Idea combination would have about 390 million users, exceeding current market leader Bharti Airtel's 266 million. The combined entity will also be the largest by revenue market share.

Meanwhile, Idea Cellular recently raised Rs 10 billion by selling corporate bonds. Prior to this, in the last two months, the company raised Rs 55 billion via similar route.

Moving on to news from banking sector. Bank of Baroda share price plunged 10% in today's trade after reports of most brokerages downgrading the stock as non-performing assets (NPAs) continued to mount amid fall in loan growth.

Despite posting a decent set of numbers, the market seems to be worried about the disposal of non-performing assets. Bank of Baroda turned profitable for the quarter ending December 31 by posting a net profit of Rs 2.52 billion against a huge loss of Rs 33.42 billion in the same quarter last year. Profits were largely supported by decline in the provisioning figure.

Bank witnessed a NII growth of 15.85% which was boosted by trading and fee income in Q3. CASA saw a whopping jump of 43.19% on a yearly basis after the windfall gains from the demonetisation deposits received.

Slippages for the quarter stood at Rs 41.4 billion against Rs 26.9 billion a year ago. Loan growth continued to remain under pressure which fell 9% from a year ago as loans worth Rs 10 billion linked to FCNR (B) deposits matured.

As a result, overseas long book declined 20% year on year. Due to the demonetisation drive, retail and small and medium enterprises loans fell 1% and 8%, respectively, year on year.

PSU Stocks languished in red today with Indian Bank and Bank of Baroda leading the losses.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Finishes on a Dull Note, Bank of Baroda Plunges 10%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!