- Home

- Todays Market

- Indian Stock Market News February 15, 2017

Sensex Closes Down 184 Points, Tata Stocks Plunge Wed, 15 Feb Closing

Share markets in India continued to trade weak in the afternoon session owing to heavy selling in realty stocks, automobile stocks and healthcare stocks.

At the closing bell, the BSE Sensex stood lower by 184 points, while the NSE Nifty finished down by 68 points. Meanwhile, the S&P BSE Mid Cap finished & the S&P BSE Small Cap finished down by 1.2% and 1.5% respectively.

Tata Motors share price plummeted 10%, its steepest fall in three months, after the company reported 96% decline in its net profit during the December quarter. Fall in net profit was due to fall in sales at its British luxury car unit Jaguar Land Rover Automotive Plc. and a wider loss in its domestic business. Sentiments remained weak in other Tata stocks as well with Tata Coffee, Tata Elxsi, Tayo Rolls and Titan Company all finishing down by 3%.

Most Asian stock markets rose in today's trade after U.S. markets hit new highs and Federal Reserve chair Janet Yellen said the U.S. central bank could raise interest rates as soon as next month. The Hang Seng gained 1.23% and the Nikkei 225 rose 1.03%. The Shanghai Composite lost 0.15%. European equity markets are higher today with shares in London leading the region. The FTSE 100 is up 0.49% while Germany's DAX is up 0.44% and France's CAC 40 is up 0.35%.

The rupee was trading at Rs 66.92 against the US$ in the afternoon session. Oil prices were trading at US$ 52.89 at the time of writing.

Free Report on Apurva's Latest Trading Strategy

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free. Click here!

Please read our Terms Of Use.

According to a leading financial daily, the India's gross domestic product (GDP) is likely to grow by 7.4% year-on-year in FY18. This is on the upper end of the 6.75 to 7.5% band estimated in the Economic Survey.

The rating agency India Ratings and Research (Ind-Ra) however revised down GDP growth forecast for FY17 to 6.8% from 7.9% estimated earlier. This downgrade is even lower than Central Statistical Organisation's advanced estimate of 7.1%.

Ind-Ra has said that the gross value added (GVA) of the three production sectors including agriculture, industry and services would grow at 3%, 6.1% and 9.1% year-on-year respectively in 2017-18, backed by consumption demand and government spending.

However, private final consumption expenditure is expected to grow at 8.9%, the government final consumption expenditure is expected to clock 9% growth in the next financial year. For current account deficit it said that it is likely to come at 1% of GDP in FY18 as against 0.9%

Talking about the global scenario, the report said that imports will get hit because of rising protectionism, adding that US President Donald Trump's trade agenda and the current direction of European politics, both have the potential to 'create a global economic and market turmoil' in 2017.

Moving on to news from stocks in banking sector. According to an article in The Economic Times, Bank of Baroda (BoB) expects the rate of growth in bad loans to slow in the coming financial year. The Bank expects gross non-performing loans to total about Rs 450 billion ($6.7 billion) in the current year ending in March.

Reportedly, that would put the bank within the Rs 50 billion rise in bad loans that it had forecast for the current year and incremental bad loans in the next fiscal year are expected to fall further below these levels.

Altogether, Indian banks had a record US$133 billion of restructured debt and bad loans as of last September, according to Indian central bank data. The amount of soured loans surged last year after a clean-up order by the regulator brought more bad debt to light.

BoB also expects lending growth to gather pace going forward. BoB's investments include a stake in UTI Asset Management, which is preparing for an initial public offering. The bank is also selling a stake in India's National Stock Exchange, which is expected to list later this year.

Meanwhile, Bank of Baroda's share price has plunged 15% after most of the brokerages downgraded the stock as non-performing assets (NPAs) continued to mount amid fall in loan growth.

Slippages for the quarter stood at Rs 41.4 billion against Rs 26.9 billion a year ago. Loan growth continued to remain under pressure which fell 9% from a year ago. Due to the demonetisation drive, retail and small and medium enterprises loans fell 1% and 8%, respectively, year on year.

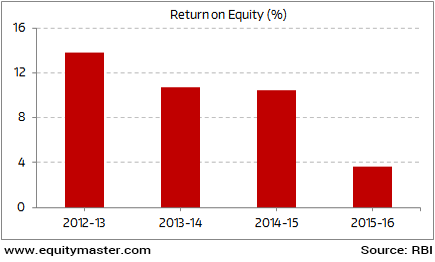

The Reserve Bank of India recently released its Financial Stability Report for 2016. The central bank has, as usual, raised the red flag on quality of loans in public sector banks. The latest NPA numbers show significant levels of stress.

Continuous Deterioration in Banks' Return on Equity

Bank of Baroda share price continued its downward momentum and finished the day down by 3.4% on the BSE.

And here's a note from Profit Hunter:

Tata Motors Ltd. is the most buzzing stock in the market today. It is the top loser in the Nifty-50 Index, down by 10%. Yesterday, it closed with a loss of 5% after it announced its quarterly results.

Let us have a look what the charts have to say.

The stock is approaching towards its strong support zone of Rs 423 to 431. This has proved to be an important zone for the stock in the past. It acted as a support in June 2014, August 2014, June 2016 and December 2016. It also acted as a resistance in November 2015 and April 2016.

As Tata motors is coming close to this important zone one can expect some volatility in coming sessions. If the stock decides to find support from this zone yet again it will be a big relief for the bulls. But if it sustains below this zone then, one can expect some more pain in the near future.

Tata Motors Some More Pain Left?

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Closes Down 184 Points, Tata Stocks Plunge". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!