- Home

- Todays Market

- Indian Stock Market News May 28, 2016

Major Global Indices end the week on a firm note Sat, 28 May RoundUp

Barring Brazil (down 2.1%) and China (0.2%), the major global indices closed on a positive note. The US markets posted biggest weekly gain since March 2016. Recently, Federal Reserve Chairwoman Janet Yellen has indicated possibility of interest-rate increase in the coming months if the US economy continues to show signs of improvement.

Crude prices surged and touched US$ 50 per barrelmark during the week. Profit growth for China's industrial firms slowed in April. This was in line with other data released during the month suggesting weak growth. For the January-to-March period, China's economy grew by 6.7% YoY, registering slowest quarterly pace since 2009.

Back home, Indian markets closed the week on a strong footing. The BSE Sensex surged over 5%. Expectation of good monsoon and firm global cues fueled buying activity in the Indian indices. Over and above, the March quarter of 2016 (4QFY16) has shown signs of improvement for some companies. Consequently, sharp surge was seen in the stocks that declared results above the street estimates.

Talking about the positive sentiments, most of you would have read about Rahul Shah's prediction of a 70% upside in the Sensex. Now we did not pull that number out of a hat. It comes from constantly tracking the performance of hundreds of listed companies versus their long-term track record. Our research suggests strong reasons why the 70% earnings upside in stocks can be for real.

And in the next couple weeks, we will release a report exclusively for our StockSelect subscribers called Sensex 40,000: 4 Stocks to Profit from the Coming Stock Market Wave. Do keep an eye out for it.

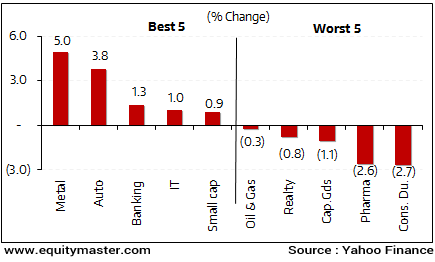

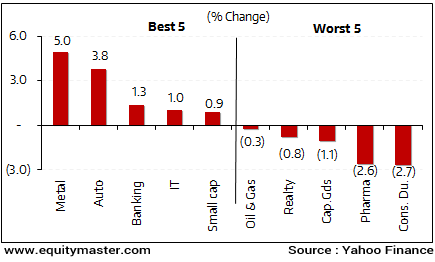

BSE Indices During the Week

Among the sectoral indices, major sectors witnessed buying interest from the investors. Stocks from capital goods and banking sectors, led among the pack of gainers.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

Crude oil prices have shot up from their record low levels in January. The rise is backed by expectations that markets will rebalance with a fall in inventory levels, thereby countering the prolonged supply glut. Also, estimates about rising consumption of oil by motorists and other oil users have aided this rally.

One shall also note that the US Energy Information Administration (EIA) during last week stated that demand for oil worldwide is set to grow by 270,000 barrels per day (bpd) in 2016. Also, reports last week reported a slowdown in US drilling and an increase in Chinese crude refinery processing. These developments led to an uptrend and crude oil prices rose to fresh 2016 highs during the last week.

The giant weather phenomenon that drove global temperatures to new highs has come to an end. Reportedly, an update from Australian Bureau of Meteorology (BOM) on Tuesday said that the 2015-16 El Nino weather event in the Pacific Ocean has ended.

Now, with the ocean's surface cooling, El Nino is likely to be replaced by its opposite La-Nina. A strong La Nina typically means more rainfall. This will be good news for India, especially after two years of poor rainfall.

Further, Indian Meteorological Department (IMD) predicted above normal rains in the upcoming monsoon season. The agency stated that the monsoon rainfall will be 106% of the long period average and there is a 94% probability that monsoon will be normal to excess. Reportedly, the monsoon is considered normal when the rainfall is 96 to 104% of the Long Period Average (LPA) and is considered above normal when it is 105% to 110% of LPA.

A normal monsoon will lead to higher disposable income in the hands of farmers, which in-turn will boost the rural consumption. To add to this, a normal monsoon will also help to keep the inflation at low levels. The possibility of a good monsoon would also increase the chances of the country's central bank retaining its easy money policy. However, there have been many instances in the past when the forecasts have gone wrong.

Movers and Shakers During the Week

| Company | 20-May-16 | 27-May-16 | Change | 52-wk High/Low |

| Top Gainers During the Week (BSE A Group) | ||||

| L&T | 1,258 | 1,475 | 17.3% | 1886/1017 |

| SBI | 171 | 196 | 14.1% | 292/148 |

| Tech Mahindra | 476 | 536 | 12.6% | 582/408 |

| Biocon Ltd | 622 | 699 | 12.5% | 717/397 |

| Multi Commodity Exchange | 858 | 962 | 12.2% | 1189/726 |

| Top Losers During the Week (BSE A Group) | ||||

| Hindustan Copper | 50 | 45 | -9.7% | 70/42 |

| Cummins India | 861 | 785 | -8.8% | 1247/747 |

| Jaiprakash Asso | 6 | 6 | -8.8% | 19/6 |

| Dish TV | 94 | 87 | -7.5% | 122/65 |

| Britannia | 2,934 | 2,719 | -7.3% | 3435/2471 |

Let's have a look at some quarterly results announced by companies this week

Oil and Natural Gas Corporation (ONGC) reported its results for the quarter ended March 2016. The net profits grew by 12.2% YoY to Rs 44.1 billion. The growth in the profits was on the back of reversal of impairment charges due to a rebound in the oil prices.

The oil prices have rebounded to the levels of US$ 50 from the lows of US$ 30 a few months back. The company had taken an impairment charge of Rs 39.9 billion because of an oil price slump in the preceding quarter. However, the rise in the oil prices led to a reversal of this provision.

In addition to this, the company had booked an impairment charge of Rs 15.8 billion on account of the Krishna Godavari asset, stating that the development of field was un-viable. The company reversed this impairment charge too during the quarter.

ONGCs revenue declined by 24.3% YoY to Rs 164.2 billion during the quarter. Further, ONGC Videsh Ltd, the overseas arm of the company, slipped into the red for the first time in about a decade, reporting a loss of Rs 20.9 billion in the 2015-16 fiscal on account of impairment provisions on some of its assets.

Larsen & Toubro (L&T) reported 18.5% increase in consolidated net profit for the March quarter. Consolidated net profit in the three months ended March was up 18.5% YoY. Net sales also rose 18.5% YoY.

About 54% of the total revenue in the quarter came from its infrastructure business (Subscription Required), in which revenue rose about 19% YoY. L&T garnered fresh orders worth Rs 1.3 trillion at the group level during the quarter, which constituted 62% of domestic and 32% of international orders. The consolidated order book of the group rose 7% to Rs 2.5 trillion for the year ended 31 March, with international orders constituting 28% of the total. Reportedly, the company is expecting 12-15% increase in revenues and a 15% growth in its order inflows for 2016-17. The company is looking at countries like Mozambique, Tunisia, Kenya, Uganda, Tanzania, Algeria, Botswana and Zimbabwe for its international business.

The engineering industry in India has grown tremendously over the years. But that growth has been marked by extreme volatility. Over the last eight years, the sector has seen numbers ranging from an output growth of 48% YoY in one year, to a contraction of 6% YoY in another. In our recent edition of the The 5 Minute Wrap Up Premium, we explain what factors to look for when picking an engineering stock (Subscription Required).

Now let us move on to some of the key corporate developments in the week gone by.

National Aluminum Co Ltd (NALCO) has decided to buy back 644.3 million shares or 25% of the paid up capital from the public shareholders. The share buy-back will help the government raise funds and reduce the fiscal deficit for 2016-17.

Further, the company has fixed the buy-back price at Rs.44 per share. The buy-back will unlock a minimum value of Rs 22.9 billion for the government. The stock has touched a high of Rs 49.60 and low of Rs 28 in the past 52 weeks.

The Government has set an ambitious disinvestment target of Rs 565 billion for 2016-2017. It is noteworthy that it missed its target for disinvestment by a huge margin in the fiscal year 2016.

Dr. Reddy's Laboratories has entered into the branded consumer health arena through the acquisition of six over-the-counter (OTC) brands from Ducere Pharma, including Doan's, Bufferins, Nupercainal Ointment, Cruex Nail Gel, Comtrex and Myoflex.

These legacy products enjoy strong brand equity built over several decades. The company is extremely excited to enter the branded consumer health arena through these brands and embarking upon the next avenue of growth for our OTC business in the US.

Going ahead, the global markets are expected to remain volatile on uncertainty over rate hike by the US Fed. We recommend investors should not get swayed away by short-term trends. Instead they should pick up fundamentally strong businesses when they are selling at attractive valuations.

And here's an update from our friends at Daily Profit Hunter...

The index ended the week with a loss of 0.83% at 7,750. The index slipped outside the 100-point range of 7,800 to 7,900 in the latter half of the week. It had traded in this range over the last 10 days and seems like bears are gain an edge. However, 7,700 is a major support level to watch out in the coming week.

Indian Stock Markets Slip into the Red

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Major Global Indices end the week on a firm note". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!