- Home

- Todays Market

- Indian Stock Market News December 3, 2016

Global Markets Ended on a Negative Note Ahead of Key Economic Events Sat, 3 Dec RoundUp

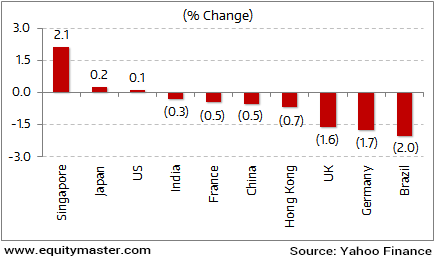

Global Markets took a cautious stance before Italy's referendum on constitutional reform on Sunday and the US payrolls data later on Friday, which may cement the case for a Federal Reserve rate increase. Strong economic data from the US, including upbeat manufacturing activity and construction spending, have bolstered the view that the Fed will tighten monetary policy faster than expected to keep inflationary pressures in check. The strong US data have boosted interest rate expectations, which have already been running high due to anticipated inflationary pressures from rising oil prices and President-elect Donald Trump's promises of fiscal stimulus. The DJI Index was up marginally by 0.1% for the week gone by.

Investors in Europe remain nervous ahead of a constitutional referendum in Italy and a presidential election in Austria this weekend. Stock markets in Germany and France were down by 1.9% and 0.5% for the week gone by.

China's economy was also in focus this week over the release of activity monitoring indices for the manufacturing and services sectors. China's manufacturing sector expanded more than expected in November, and at the fastest pace in more than two years, an official survey showed on Thursday.

The PMI stood at 51.7 in November, compared with the previous month's 51.2. The Shanghai Composite Index was down marginally by 0.5% for the week gone by.

Japan's Nikkei, which jumped to an 11-month high on Thursday, closed down 0.5% on Friday, but still posted a weekly gain of 0.2%.

Global benchmark Brent futures jumped to a 16-month high of US$54.53 a barrel on Thursday after the Organization of Petroleum Exporting Countries (OPEC) agreed its first output cuts since 2008. Russia also agreed to reduce production for the first time in 15 years. Crude Oil posted a weekly gain of 11.6% with crude oil closing at US$51.7.

Back home, Negative global indices, along with caution ahead of US non-farm payrolls data and profit booking, suppressed the Indian equities markets during the week. Besides, the political logjam in Parliament over the government's demonetisation decision continued to erode investors' sentiments.

The BSE-Sensex ended on a negative note and was down marginally by 0.3%.

Going ahead, the market will be influenced by the RBI action on market stabilisation scheme (MSS) as well as the rate decision in the ensuing policy meeting. The US Fed meet mid-month will also be keenly watched. While a rate hike is widely expected, the market will watch out for Fed comments accompanying the decision.

Key World Markets During the Week

Source: Yahoo Finance

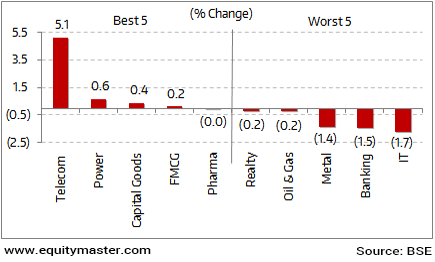

On the sectoral indices front, Telecom and Power stocks led the gainers this week. On the other hand, stocks from IT and Banking witnessed selling pressure.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

The Reserve Bank of India (RBI) has asked banks to keep all incremental deposits gathered between September 16 and November 11 with the central bank. With this, banks will be parking about Rs 3,240 billion with the central bank.

Also, with this announcement, banks will pay a savings account rate of at least 4% on these deposits but get nothing in return from the central bank for the same. The move will impact the income levels of banks and that would be the key things to watch out for in the coming days.

Similarly, the RBI has announced that withdrawals from Jan Dhan accounts would be capped at Rs 10,000 per month. As per an article in the Economic Times, the central bank said that fully KYC compliant holders may withdraw Rs 10,000 from their account every month. The RBI further added that the branch managers may allow further withdrawals beyond Rs 10,000 with 'current applicable limits' for normal accounts only by ascertaining the genuineness of such withdrawals along with proper documentation.

While demonetisation is being hailed as the panacea to suck out the black money from the system, the move has come at a cost to the economy in many ways. As one of our latest editions of The 5 Minute WrapUp says, 'We have all been caught up in what is seen. There's not enough attention being paid on what is unseen.' The article explains some of the unseen effects of demonetisation on corporate profitability, real estate, interest rates, stock markets, etc.

The current economic situation in India is unprecedented. The need of the hour is competent, honest and unbiased views on the government's war on cash aka demonetisation.

We believe, Vivek Kaul has done an excellent job in this regard. You could do no better than read Vivek Kaul's insightful little report on this subject, Demonetisation: The Good, Bad and Ugly. It has some great information on how demonetisation could impact things like your investment and your property.

Global banks and rating agencies, including Fitch Ratings, Deutsche Bank and DBS Bank, have downgraded India's growth in the wake of demonetisation of high-value notes. Fitch Ratings stated that demonetisation will have a "negative" impact on growth in the short run but for the full fiscal, the GDP decline would be "relatively moderate". The ratings agency, however, expects India's GDP growth to trend higher than China's in the medium term, adding that it would accelerate next fiscal on the back of reforms and monetary policy easing.

Meanwhile, Deutsche Bank said India's real GDP growth is expected to slow to 6.5% in the current fiscal on the likely impact of demonetisation, while muted inflation may open room for additional rate cuts. Economic growth will see a moderation in the near term and would gradually recover to 7.5% in the next financial year.

It said the government is expected to increase public spending from the next fiscal year to offset the likely lingering impact of a slower growth in the informal economy. Moreover, the RBI is also likely to keep monetary policy accommodative for a prolonged period, which will help private consumption to recover once again in the next fiscal year, especially in the second half.

Talking about GDP, the Indian economy grew at a higher than expected 7.3% in the second quarter aided by a bump up in agricultural growth. This is higher than the 7.1% growth recorded in the previous quarter. The latest second-quarter GDP growth was, however, lower than the 7.6% growth in the same quarter last fiscal. Agricultural output growth came in at 3.3% for the quarter under review against 2% in the same quarter last fiscal. The first quarter had seen an agricultural growth of 1.8%. Manufacturing growth slowed to 7.1% against 9.1% in the first quarter, mining was down 1.5% against a 0.4% fall in the first quarter. Construction was up 3.5%.

GDP numbers do not reflect the effect of the Modi-led government's sudden demonetisation move. The impact of demonetisation is widely expected to hit economic growth in the third quarter. The decline in economic activity is expected to lower corporate sales volumes and cash flows.

In another news, according to a report released by Fitch Ratings, India's petroleum product consumption will remain strong at around 5-6% in 2017 but the profitability in the oil and gas exploration and production segment will remain weak.

Fitch expected the operating environment to remain challenging for Indian upstream companies in 2017 at its oil- price assumption of US$ 45 per barrel, and low natural-gas prices. Most domestic gas fields are likely to make losses in 2017. However, at this price level, India's fuel subsidy requirement will also remain low, which is positive for the state-owned oil companies.

Fitch stated that at the current gas price of US$ 2.50 per million British thermal unit in India, Oil India Limited can only recover the cash costs of bringing the gas to the surface, but not the production levies, taxes, and sunk costs.

Fitch, however, said it expects upstream oil companies to continue investing in their current portfolio to maintain production and improve efficiency. On fuel consumption, it said India would see a strong growth of around 5-6% in 2017. Gross refining margins (GRM) of all Indian oil refiners are expected to narrow in 2017, while remaining stronger than the historical levels prior to FY16.

Moving to Gold, according to a leading financial daily, Gold has dropped to its lowest price in nearly 10 months today as the dollar held firm around 9.5 month highs against the yen. The growing odds of the US interest rate hike also added pressure. The metal has been under constant pressure after President-elect Donald Trump's policy plan signalled faster inflation. Subsequent to Trump's victory, the gold has headed back down more sharply. It had its initial rise in the futures market when Trump looked like he was going to win. However, since then, it's reversed course. Since the elections, Gold prices have corrected.

Higher interest rates and a higher dollar affected the prices of gold. The bearish developments prompted some investors to lighten up on the gold positions they had built up during the course of the year. This selling pressure led to further decline of gold prices. Moreover, since 8 November, the US 10-year bond yield increased by as much as 45 basis points, which is from 1.85% to 2.3%. At the same time, the US Dollar Index surged nearly 2% to 100.57, the highest level in 14 years.

Reportedly, a slowing economy, with deflation, would be the biggest reason for weak gold prices. Moreover, India and China are the biggest buyers of gold, together consuming about 50% of the total. After the Modi government forced the exchange of all Rs 500 and Rs 1000 notes to clamp down on the illegal businesses, gold has declined steadily since then. Gold imports are down 59% year-to-date from the same period last year.

Moving on to news from commodities sector. Oil prices shot up after Organization of the Petroleum Exporting Countries (OPEC) and Russia cut a deal to reduce output to drain a global supply glut.

OPEC had agreed on Wednesday its first oil output reduction since 2008 after de-facto leader Saudi Arabia accepted "a big hit" and dropped a demand that Iran also slash output.

The deal also included the group's first coordinated action with non-OPEC member Russia in 15 years. Following the announcements, the price for Brent crude futures, the international benchmark for oil prices, shot up over 10% from below US$ 50 per barrel to US$ 51.92 per barrel.

However, investors remained skeptical as much of the cutbacks could be a reflection of lower seasonal domestic demand amongst crude producers, and thus have a limited impact on seaborne exports. OPEC produces a third of global oil, or around 33.6 million bpd, and under Wednesday's deal, it would reduce output by around 1.2 million bpd from January 2017. That would take its output to January 2016 levels, when prices fell to over 10-year lows amid ballooning supply.

Analysts also expect OPEC and Russia cuts would leave the field open for other producers, especially US shale drillers, to fill the gap. As per the reports, US crude production has already risen by more than 3% this year to 8.7 million bpd, as its drillers have slashed costs in an effort to compete in a lower price environment.

Movers and Shakers During the Week

| Company | 25-Nov-16 | 2-Dec-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE Group A) | ||||

| Adani Power | 25 | 29 | 18.6% | 36/22 |

| Eicher Motor | 20145 | 22699 | 12.7% | 26602/14818 |

| Gitanjali Gems Ltd | 53 | 59 | 11.7% | 94/30 |

| MRPL | 88 | 98 | 11.0% | 104/52 |

| Bharat Electronics | 1304 | 1419 | 8.8% | 1456/1009 |

| Top Losers During the Week (BSE Group A) | ||||

| Union Bank | 153 | 142 | -7.3% | 173/104 |

| Hindalco | 180 | 169 | -6.3% | 185/59 |

| HPCL | 462 | 435 | -5.8% | 486/212 |

| Guj. State Petronet | 157 | 149 | -5.1% | 173/121 |

| NALCO | 57 | 54 | -5.0% | 59/30 |

Some of the key corporate developments in the week gone by.

As per an article in a leading financial daily, Tata Chemicals announced sale of its urea business to Yara Fertilisers India Pvt Ltd for Rs 26.7 billion. The Competition Commission has also approved the proposed acquisition of urea and customized fertilizers business. Under the deal, Tata Chemicals will sell its urea plant in Babrala, Uttar Pradesh, which has an annual capacity of about 1.2 million tonnes. The urea business along with the assets, liabilities, contracts, deeds etc, will be transferred and vested with Yara India on a slump sale basis.

The sale is part of the company's plan to strengthen the fertilizer business by partnerships and transfer of ownership to world-class companies. Moreover, the urea business will now have the benefit of an international network of Yara and its global expertise. Going Forward, whether the divestment of the urea business by Tata Chemicals will unlock value for the company and help to pursue growth potentials and opportunities in line with its strategic directions will be the key things to watch out for.

Bharti Airtel International (Netherlands) has completed the acquisition of Econet Wireless in Airtel Nigeria. As per the deal, Airtel Nigeria will hold Econet Wireless' entire 4.2% shareholding. As a result, Airtel's overall holding in Airtel Nigeria will increase to 83.3%.

In the wake of procuring Zain's telecom business for US$10.7 billion in 2010, Airtel kept running into a debate with Econet Wireless, a minority partner in Zain Telecom. Recently, Airtel had said that its auxiliary had achieved a concurrence with Zain Telecom. According to which Zain has to pay Airtel US$129 million for the settlement of the greater part of Airtel's cases. It also said a separate settlement has been reached between Airtel and Econet.

As the competition keeps on rising, many companies consider international expansion through acquisitions or embarking their own set ups. Some acquisitions can work wonders. While, some companies come under pressure post such expansion. Same is the case with Bharti Airtel. Ankit shah, our Research Analyst has penned an article stating how Bharti Airtel's international operations have been a drag on its overall performance in one of our premium editions of The 5 Minute Wrap Up.

According to an article in The Livemint, Suzuki Motor Corp. plans to invest Rs 26 billion through its unit Suzuki Motor Gujarat (SMG). The company intends to build its second assembly plant in India and an engine and transmission unit.Suzuki Motor Corp. has entered into a contract manufacturing agreement with its local unit Maruti Suzuki India Ltd, under which it will produce and sell vehicles to the latter. With this, Suzuki's total investments in Suzuki Motor Gujarat will increase to Rs 58 billion.

As per the reports, Suzuki Motor Gujarat aims to start production with initial capacity of 250,000 units a year in February 2017 and reach a maximum capacity of 1.5 million by 2030. Suzuki Motor Corp. has a 56% stake in Maruti Suzuki. India accounts for about 45% of Suzuki Motor Corp.'s global sales by volume. Suzuki Motor Corp.'s move will provide much-needed support for Maruti Suzuki, which has been unable to meet demand for its vehicles.

Tata Steel UK has signed a Letter of Intent (LoI) with Liberty House Group to enter into exclusive negotiations for the potential sale of its Specialty Steels business. The deal has been signed for an enterprise value of 100-million-pound subject to due diligence and corporate approvals.

The announcement is in line with Tata Steel's overall restructuring strategy of its UK portfolio. The letter gives Liberty House the right to enter into exclusive negotiations for the potential sale of steel assets. The LOI covers several South Yorkshire-based assets including Tata's Rotherham electric arc steelworks, the steel purifying facility in Stocksbridge and a mill in Brinsworth, as well as service centers in the UK and China.

Reportedly, Tata's specialty steel business gives Liberty its first operations able to melt down scrap steel to be turned into finished metal for the aerospace, car and the oil and gas industries. The specialty steel business employs around 1,700 people and includes sites in Britain and China.

Malaysia's Axiata is reportedly looking to sell its 20% stake in Idea Cellular. Axiata believes the telecom provider's valuation will remain subdued for at least the next three years. Axiata had originally asked Idea's parent, the Aditya Birla Group, to buy back the holding but was turned down. Axiata has passed a board resolution to sell its stake in the company. The estimated share value of Idea Cellular on Axiata's books has been pegged at Rs 155 apiece.

The Aditya Birla Group owns 42% of Idea while the rest is held by institutional and retail investors. The parent had declined a bid by Axiata to raise its stake from 20% a few years ago.

Idea Cellular is seeking to reposition itself as a data player in response to faster-than-expected 4G adoption. Reliance Jio offering voice services at no cost to customers is likely to hit Idea the worst. Its revenue per data unit has been dropping amid Jio's free trial service.

As per an article in a leading financial daily, Lupin's US subsidiary, Lupin Pharmaceuticals, Inc., has received final approval for its Armodafinil Tablets from the United States Food and Drug Administration (USFDA) to market a generic version of Cephalon, Inc.'s Nuvigil Tablets. The tablets are approved in the strengths of 50 mg, 150 mg, 200 mg and 250 mg. The company shall commence promoting the product in the US shortly. Nuvigil Tablets had US sales of US$515.6 million, as per IMS health sales data September 2016.

Reportedly, Lupin's Armodafinil Tablets 50 mg, 150 mg, 200 mg and 250 mg are the AB rated generic equivalents of Cephalon, Inc.'s Nuvigil Tablets 50 mg, 150 mg, 200 mg and 250 mg. Armodafinil tablets are indicated to improve wakefulness in adult patients with excessive sleepiness associated with obstructive sleep apnea (OSA), narcolepsy or shift work disorder (SWD).

Many pharma companies have been facing regulatory crackdowns from the USFDA, thus getting timely approval has become a challenging task.

Considering the pharma's regulatory distresses, are Indian pharma companies now adapting to the scrutiny by the USFDA? Bhavita Nagrani, our pharma sector analyst, shares her insights in one of our premium editions of The 5 Minute Wrap Up(Subscription required).

According to a leading financial daily, ITC will set up an integrated consumer goods facility and a five-star hotel in Odisha at an investment of Rs 8 billion. Reportedly, the integrated consumer goods manufacturing facility is being built over 700,000 sqft. It will manufacture ITC's food brands such as Aashirvaad, Bingo, Sunfeast, YiPPee! These products, which will be produced in the State, will make a meaningful contribution to the food processing sector in Odisha.

Besides, the group is also setting up a 110-room five-star hotel in Bhubaneswar under its WelcomHotel brand. Moreover, ITC's investment in the processed foods sector in Odisha will add significant value to the state's agricultural potential. ITC believes that food processing sector can make a multi-dimensional contribution to the state. This can be done by enhancing competitiveness of food value chain, encouraging sustainable agriculture, reducing agri-wastages and helping create livelihoods along the entire value chain.

Notably, ITC, which has a diversified business portfolio, is growing presence in Odisha. ITC's FMCG businesses support livelihoods for over 0.7 million people in the state and has been engaged deeply with farmers in Odisha.

Going forward, whether ITC's investment in the processed foods sector in Odisha add significant value to the state's agricultural potential will be the key thing to watch out for.

And here's an update from our friends at Daily Profit Hunter...

Market participants were waiting for the US presidential elections outcome with bated breath but got an unexpected shock when our PM announced a ban on 500 and 1000 Rs notes on Tuesday. On Wednesday our markets opened gap down and came in kissing distance of the 8,000 mark within minutes of opening. One would have expected the markets to remain subdued after that but no they did something completely unexpected. Nifty recovered most of its losses on Wednesday and ended with a cut of just a percent. On Thursday it bounced back even further and recovered all the losses. Just when it seemed that everything was fine. Markets collapsed again on Friday and ended with a loss of more than 200 points.

It seems like bears are likely to control the index as uncertainty and fear looms large on the minds of market participants. Index could trade in a broad range of 8,000 to 8,500 in the coming week.You can read the detailed market update here...

Nifty Logs Around 1.6% Losses

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global Markets Ended on a Negative Note Ahead of Key Economic Events". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!