- Home

- Views On News

- Dec 19, 2023 - Top 5 Growth Stocks that Could Bounce Back in 2024

Top 5 Growth Stocks that Could Bounce Back in 2024

Growth stocks are once again becoming the most talked about stocks these days. These are young, ambitious, and volatile companies that outpace the market by growing at a faster pace compared to peers.

However, not all growth stocks can stand the test of time.

You see, 2023 was a year filled with brutal market corrections, not to mention the several wars that took place separating wheat from chaff in the growth stock arena. However, it's also a breeding ground for opportunity!

Driven by strategic management, focus on R&D, and market leadership in niche segments, there are some hidden gems that are primed for a strong rebound in 2024.

Let's take a look at the top 5 growth stocks that could possibly make a comeback in the year 2024.

Please note, these stocks are filtered using the Equitymaster stock screener.

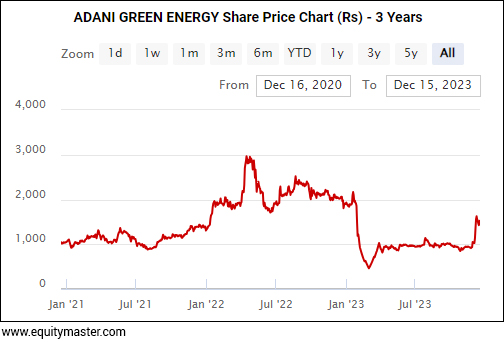

#1 Adani Green Energy Ltd

Adani Green Energy (AGEL) is a significant player in India's renewable energy sector, with an operational capacity of 4,763 megawatts (MW) for solar power plants and 647 MW for wind power plants as of September 2023.

One of the best performing stocks in the market, AGEL saw a steep decline in its value from its 52-week high in January 2023 due to Hindenburg allegations and premium valuation.

All this while its fundamentals remained weak. Back then, the company made losses in 4 of the past 5 years with a balance sheet loaded with debt.

Recent developments suggest that the Adani group company has made a spectacular comeback by scrapping acquisitions, pre-paying debt to address concerns about cashflows and borrowings and scaling back its pace of spending on new projects.

AGEL's revenue grew by 40% and net income surged by a staggering 149.7% in Q22024. This performance was backed by AGEL's commitment to invest US$ 100 billion (bn) in green transition over the next 10 years.

The company has made several strategic decisions that favor its growth prospects in 2024.

Recently, it secured US$ 1.4 bn senior debt facility from an international banking consortium to build the world's largest renewable park in Gujarat.

The company is exploring multiple options for its bonds due in 2024, such as refinancing them with new notes or taking out a loan.

AGEL was also ranked first in Asia and among the top 10 renewable energy companies globally for ESG (Environmental, Social, and Governance) performance.

The US government concluded Hindenburg reports allegation irrelevant and extended a loan of US$ 553 million (m) to conglomerate's Adani Ports & Special Economic Zone arm and Florida based GQG partners continues to back the conglomerate.

The influx of capital and strategic investment made in the growing renewables sector makes it a potential growth stock for 2024.

However, investors should also consider the risks associated with AGEL. The company's share price has been highly volatile over the past three months.

Moreover, its Price to Earnings (P/E) ratio (185.2x) is significantly higher than the industry average (18.7x).

| Consolidated | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue (Rs, bn) | 77.9 | 51.3 | 31.2 | 25.5 | 20.6 |

| Net Profit (Rs, bn) | 9.1 | 4.9 | 1.8 | -0.6 | -4.7 |

| EPS | 5.4 | 2.4 | 0.7 | -0.7 | -3.6 |

| BVPS | 37.4 | 7.6 | 5.0 | 4.6 | 5.5 |

| ROE | 16.6 | 41.1 | 24.4 | -3.0 | -56.4 |

| Debt to Equity | 9.0 | 43.9 | 27.2 | 18.5 | 12.7 |

#2 Gujarat Gas Ltd

Second on the list is Gujarat Gas Ltd.

Established in 1980, Gujarat Gas is India's largest City Gas Distribution (CGD) company in terms of sales volume, operating in 44 districts in 6 states.

The stock is currently trading near its 52-week low, hammered by consistently falling revenue and profit. Industrial customers ditching pricier RLNG for cheaper alternatives like propane are behind the volume slump and price cuts.

However, there are some potential catalysts for a significant rebound in shares of Gujarat Gas.

The company has posted a revenue and net profit CAGR growth of 16.3% and 29.6% over the past five years. The PE ratio is 24.6x against the peer average of 69.8x.

For the first time in 5 years the company is debt free.

The company reduced its input gas cost by improving the gas transportation from its Mundra port and thus increased the margin.

By using its internal cash flow, the company plans to spend Rs 10-12 bn in each of the next 4 years to expand in new and existing states.

This expansion plan is expected to drive significant volume growth.

The company has focused on a balanced business portfolio and remains the least vulnerable to EV moves, given that more than 65% of its volumes are still from the internal combustion segment.

However, slower ramp up volumes from new area, sustained weakness in LPG (Propane) prices and sudden spike in LNG prices remain as key concerns that investors need to be prepared for.

| Consolidated | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue (Rs, bn) | 167.6 | 164.6 | 98.5 | 103 | 77.5 |

| Net Profit (Rs, bn) | 15.2 | 12.9 | 12.8 | 12.0 | 4.2 |

| EPS | 22.2 | 18.7 | 18.6 | 17.4 | 6.1 |

| BVPS | 102.1 | 81.8 | 65.5 | 48.2 | 32.1 |

| ROE | 21.7 | 22.9 | 28.3 | 36.1 | 19.0 |

| Debt to Equity | 0.0 | 0.1 | 0.2 | 0.6 | 1.0 |

#3 United Phosphorous Limited (UPL)

UPL is the world's #5 agrochemical player and #4 seed giant, reaching 140+ countries and 90% of the food basket.

In a year, the agri-giant has seen its stock price plummet over 20% amid a confluence of headwinds: supply chain disruptions, surging raw material costs, and concerns around its hefty debt pile.

The company's operating profit has been declining over multiple past quarters as well.

However, the company is poised for a return in 2024.

The company has significantly reduced its debt and is trading at a PE ratio of 24.7x which is significantly lower than its peers.

The company boasts a robust global footprint, spanning over 140 countries, offering resilience against regional challenges.

Its diversified product portfolio caters to the entire crop lifecycle, from seeds to post-harvest solutions, minimising dependence on any single segment.

Moreover, its acquisition of Nufarm bolsters UPL's presence in high-growth markets like Australia and Brazil, opening doors to new avenues for expansion.

The company is a global sustainability leader and secured a coveted spot Dow Jones sustainability world and emerging market indices.

| Consolidated | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue (Rs, bn) | 535.8 | 462.4 | 386.9 | 357.6 | 218.4 |

| Net Profit (Rs, bn) | 42.6 | 43.0 | 34.5 | 21.8 | 15.6 |

| EPS | 45.8 | 45.9 | 36.4 | 23.2 | 19.5 |

| BVPS | 432.6 | 344.1 | 282.3 | 256.3 | 356.2 |

| ROE | 13.3 | 16.7 | 16.0 | 10.9 | 10.1 |

| Debt to Equity | 0.9 | 1.2 | 1.3 | 1.8 | 2.0 |

#4 Indraprastha Gas

Indraprastha Gas (IGL) is #1 natural gas distribution in Delhi and surrounding areas, supplying CNG to the transport sector and PNG to industrial, domestic and commercial customers.

It has over 1.8 m domestic and commercial customers.

The company's shares have experienced a significant downturn since December 2022 due to fear of sharp decline in CNG demands because of Delhi government's ambitious electric vehicle policy.

Despite these challenges, IGL is poised for potential growth in 2024.

IGL boasts of robust fundamentals. It reported a YoY net profit surge of 29.5% for Q2FY24. The stock is trading at a PE ratio of 15.5x against the peer average of 68.5x.

It holds a near-monopoly in piped natural gas (PNG) distribution in Delhi and is actively expanding its presence in industrial and commercial PNG segments which offer higher margins and are less vulnerable to EV disruptions.

Initiatives like the Pradhan Mantri Urja Ganga Yojana and the focus on cleaner fuels bode well for IGL's long-term prospects.

The company is investing in technologies to improve efficiency.

Recognizing the EV challenge, IGL is proactively adapting. It's venturing into EV charging infrastructure, partnering with Ola Electric to set up charging stations across its vast network.

In conclusion, IGL's near-term challenges are undeniable. However, its strong fundamentals, diversification efforts, and strategic adaptability make it a compelling bounce-back story.

| Consolidated | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue (Rs, bn) | 141.5 | 77.1 | 49.4 | 64.8 | 57.6 |

| Net Profit (Rs, bn) | 13.9 | 12.8 | 10.5 | 10.9 | 7.6 |

| EPS | 23.4 | 21.5 | 16.8 | 17.8 | 12.0 |

| BVPS | 113.3 | 108.4 | 90.5 | 76.5 | 61.7 |

| ROE | 20.7 | 19.8 | 18.5 | 23.3 | 19.5 |

| Debt to Equity | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

#5 Laurus Labs

Laurus Labs is a fully integrated pharmaceutical and biotechnology company, with a leadership position in generic active pharmaceutical ingredients (APIs).

The company has carved a niche for itself by supplying antiretroviral or ARVs (used to fight infections caused by retroviruses like HIV) and oncology (cancer) drugs.

Despite being a relatively new player, its clients include giants like Pfizer, Teva Pharmaceutical Industries, and Merck.

The company's stock price has struggled in recent months, more so post-December 2022 due to intense competition and declining off-take in the antiretroviral segment.

The company reported an 84.1% YoY drop in consolidated net profit at Rs 372 m in the September 2023 quarter.

However, Laurus Labs could possibly stage a comeback as soon as 2024 due to following reasons:

Laurus boasts a strong order book spanning diverse therapeutic areas, offering growth opportunities beyond ARVs. Its foray into high-growth segments like biologics and specialty APIs can significantly boost revenue.

Its collaboration with global pharma giants like Eli Lilly and Novartis validate its capabilities and unlock new revenue streams.

Laurus remains a frontrunner in operational efficiency and cost-control. Its recent expansion into Hyderabad further strengthens its manufacturing prowess.

The company's diversified pipeline, operational strength, and strategic partnerships offer a compelling comeback narrative.

A relatively new entrant in the pharma space, it has a goal to invest up to 10% of profits on disruptive technologies.

The company has been investing a part of its capital to incubate businesses dedicated to disruptive technologies.

One such incubation - ImmunoACT, recently got the approval of India's first (indigenously developed) CAR-T cell therapy - NexCAR19, from the Central Drugs Standard Control Organization (CDSCO).

It's an innovative cancer therapy that only a few countries that have access to. What makes it more special is that it is available at one tenth of the cost at which it is provided by foreign players.

Laurus will in-license few gene therapy assets of ImmunoACT and owns rights to launch these products in various geographies.

Gene therapy could be the new frontier to fight diseases. And Laurus Labs is pioneering this revolution.

| Consolidated | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue (Rs, bn) | 60.4 | 49.4 | 48.1 | 28.3 | 22.9 |

| Net Profit (Rs, bn) | 8.0 | 8.3 | 9.8 | 2.6 | 0.9 |

| EPS | 14.7 | 15.4 | 18.4 | 23.9 | 8.8 |

| BVPS | 75.2 | 62.5 | 48.5 | 165.5 | 146.4 |

| ROE | 19.6 | 24.7 | 37.9 | 14.4 | 6.0 |

| Debt to Equity | 0.5 | 0.5 | 0.5 | 0.5 | 0.6 |

Snapshot of Growth Stocks on Equitymaster's Stock Screener

Here's a list of top growth stocks on Equitymaster's stock screener.

Please note these parameters can be changed according to your selection criteria.

In Conclusion

The year 2023 has been a challenging one for many growth stocks, as they faced headwinds from the pandemic, regulatory pressures, and rising interest rates.

However, the above stocks have strong fundamentals, competitive advantages, and growth potential that could help them rebound in the expected bull run of 2024.

Bear in mind that the upcoming year 2024, being an election year, introduces an element of uncertainty. These events usually add volatility to the stock markets.

Changes in government policies and regulations resulting from the elections tend to impact the business environment, potentially affecting the performance of companies.

Happy Investing!

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here.

Equitymaster requests your view! Post a comment on "Top 5 Growth Stocks that Could Bounce Back in 2024". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!