- Home

- Outlook Arena

- Your Ultimate Guide to Penny Stock Investing

Your Ultimate Guide to Penny Stock Investing

Download Now: 7 Unstoppable Growth Engines of India's $10 Trillion Bull Run...

Wilfred Pareto, an Italian economist, was once out in his garden.

As he observed his pea plants, he saw an interesting pattern emerge.

Nearly 80% of his peas came from just 20% of his plants.

This odd fact lay buried in his mind only to be dug up later when on an important assignment.

A friend had asked him to study the land ownership in Italy.

Lo and behold, he saw the same pattern emerge yet again. Nearly 80% of the land was owned by 20% of the population.

This time, he did not let his discovery go into hibernation. As he explored the idea further, this ratio kept appearing again and again.

If you look around, you'd be shocked at the amazing regularity with which this pattern emerges in our day to day lives as well.

80% of our calories come from 20% of the food we eat.

80% of our happiness is determined by 20% of the people in our lives.

80% of wealth is owned by 20% of the population.

80% of the clothes we wear form only 20% of our wardrobes.

80% of the wealth we have made comes from 20% of the decisions we make.

Phew. It is as if this rule is some iron-clad law of nature.

80% of Results Come From 20% of Causes

Guess what, this ratio, called the Pareto Principle, pays off in the case of studying potential stock investments, including penny stocks, as well.

Here's Seth Klarman, one of the world's most successful and recognizable investors on the same ratio.

Information generally follows the well-known 80/20 rule: the first 80 percent of the available information is gathered in the first 20 percent of the time spent. The value of in-depth fundamental analysis is subject to diminishing marginal returns.

It therefore follows that when it comes to penny stocks, there are two ways one can invest in them.

Do a detailed due diligence on the company and come up with as thorough a report as possible.

OR

Follow the 80/20 principle; look for those 20% insights that give you 80% of the information on your stocks.

I have been increasingly drawn towards the second approach in recent years.

I am now of the belief that doing in-depth research on stocks could prove to be counterproductive.

Instead, you should only look at the 4 or 5 things that matter, and then buy the stock at such a deep discount that if anything goes wrong, the downside is limited, but if things go right, there's huge upside for the taking.

Little wonder, this is the approach I recommend for investing in something as rewarding - and at the same time as dangerous if not handled carefully - as penny stocks!

Zero in on 4 or 5 indicators that you think matter the most and once the stock flashes green on most of these signals, check whether it is available at a deep discount to its readily ascertainable intrinsic value.

If yes, it is time to pull the trigger. That's it.

That's the secret sauce to investing in penny stocks right there. Stocks that trade at a low price of Rs 50 per share or below and have a basic business model and are not outright speculative.

I call this secret sauce my SOLID framework for investing in penny stocks - a framework that doesn't take too much of your time and yet delivers fabulous long-term results.

Now, chances are you may not have heard of a company named Star Paper Mills.

Or for that matter Tamilnadu Petroproducts.

How about Graphite India Ltd?

Does the name Tanla Platforms ring a bell?

These are penny stocks alright. But these aren't your run of the mill penny stocks. These are the stocks my penny stock screener zeroed in on at various times over the last few years.

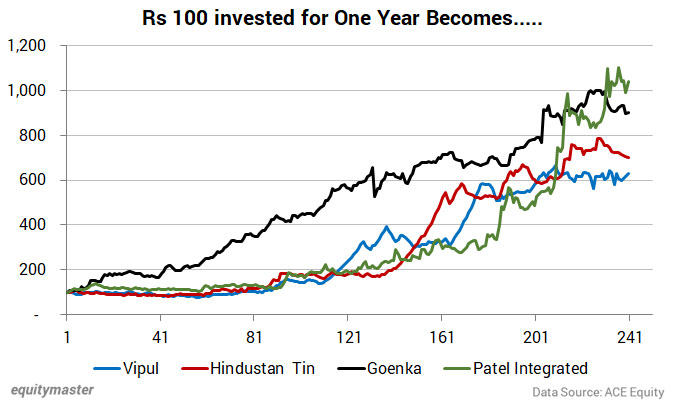

Here's what they returned over a one year period.

- A 4-bagger in Star Paper Mills (Year 2016)

- A near 10-bagger in Graphite India (Year 2017)

- A 3-bagger in Tamil Nadu Petroproducts (Year 2017) and

- A near 10-bagger in Tanla Platforms (Year 2020)

These are extraordinary returns. They highlight the incredible money-making potential in penny stocks provided one has the right approach.

My SOLID framework is an attempt to zero in on exactly such an approach and as you can see, the results have been extremely encouraging.

Now, what exactly is this framework? What are its constituent parts and what does each letter in the acronym stand for?

It is time to raise the curtains on this framework and reveal the full details...

There are five ideas that I consider extremely important to hone in on the right penny stock.

Known as SOLID for easy recall, it is practically the blueprint for separating the men from the boys in the penny stock universe.

Here are the details of each component of my SOLID system for picking penny stocks

S is for Strong Balance Sheet

One of the main reasons companies fail is because they take on too much debt. Debt serves them well during good times but when the cycle turns and business slows down, the chickens of leverage come home to roost. The same debt that helped them create new profit records turns into an albatross around the necks, making survival difficult.

I think Peter Lynch was right - It is hard to go bankrupt when you have no debt.

Consistently low debt in comparison to the equity means the company is doing few important things right. Things like funding its growth internally, generating good profits through a complete market cycle and allocating capital well.

With low debt signifying so many positive things, is it any wonder a strong balance sheet is one of the important components of SOLID framework of investing in penny stocks.

Check out the debt-to-equity history of the stock under consideration. If it is consistently below one, the company's got one big tick mark against its name.

O is for Owner-Operators

Given a choice, what would you rather invest in, a company where management has no skin in the game or a company where management owns a sizeable stake?

It will be the latter, isn't it? Companies where managements have significant ownership tend to operate in a way where long-term shareholder wealth creation gets a lot of importance.

The idea also enjoys academic support.

An article on Seeking Alpha cites a study done in the US that discovered that when CEOs own 10% or more of the company they run, a portfolio of such companies reportedly outperforms the market by 5% annually between 1988 and 2010. This indicates a higher performance than 95% of the mutual funds in the US that are actively managed by experienced fund managers.

I am sure a similar study in India would throw up equally impressive market beating results.

Which is why for my penny stocks universe, I get really interested if the promoter ownership in the company is 30% or more. Anything less than that and I may not be interested.

L is for Long Term Business Viability

This is perhaps the only component of the framework that's more qualitative than quantitative. In other words, it is difficult to reduce this to a number. Besides, it is also future looking and doesn't draw information from the facts of the past like other components do.

Here I am not looking for companies that are the fastest growers. I don't think I have any special ability to do so. Instead, I am looking for companies whose business models are likely to be around at least few years from now.

If the company is from a dying industry and has been consistently reporting falling revenues, it is going to be a big red flag.

On the other hand, I won't mind a company that's growing slowly than the others or is exposed to the vagaries of the business cycle. As long as it has a sustainable business model and is here to stay, it will have my vote. This component of the framework is mainly to ensure that one doesn't get involved with a value trap in a dying or a declining industry.

I is for Income Generating

The company should have a history of making profits on a consistent basis at the bottom-line level. An odd year of losses is fine. However, if the past history shows that the company incurs losses on a regular basis, it should be discarded right away.

Besides, if the stock is not making any profits right now but is a high growth company and promises to make big profits in the future, even such stocks should be avoided in my view. Buying such stocks fell strictly in the realm of speculation and we should be strictly against buying them as long-term investments.

A similar approach needs to be taken for penny stocks as well. No matter how bright the future, the company should be consistently profitable at the time of investment. Failing this, investment in such companies should be avoided at all costs.

D is for Deep Discount in Valuations

The great physicist Richard Feynman was of the view that if all knowledge got destroyed in a nuclear holocaust and if there is just one statement that was allowed to live on, it will have to be the atomic hypothesis that all things are made of atoms that move around in perpetual motion, attracting each other when they are a little distance apart and repelling upon being squeezed into one another.

I am strongly of the view that if the investment world had such an option to pass on just one statement, it would have been the principle of margin of safety.

Different people have different methods of valuing a company and arriving at the margin of safety. At the core of it all though is a simple premise of buying the stock at a discount to its intrinsic value just so that if something goes wrong, the downside is limited and if things go right, there are strong gains for the taking.

In the universe of penny stocks, I seek for a big, fat margin of safety. Ideally, I would love to look at stocks trading at a big discount to not just its book value but what Benjamin Graham used to call net nets i.e. stocks trading at a 20% discount to net current assets less all liabilities.

All the four stocks mentioned above were net nets at the time the framework zeroed in on them. Which is why when things started turning into their favor, they ended up giving big gains.

Buying stocks with a margin of safety is easy in theory but I've seen so many investors losing the plot when applying it in practice. They either end up using the wrong metric or are quite liberal in choosing an appropriate multiple for metrices like the earnings of the company or its book value.

The idea is to not get carried away unless one knows one is getting a good deal. Which is why I insist on considering a stock only if it is trading at a big discount to its book value, preferably a discount to its net-net value i.e. net current assets less all liabilities.

This is it then. This is the SOLID framework right here. Simple yet highly effective. Any resemblance to the principles of deep value investors like Ben Graham and Walter Schloss is not purely co-incidental.

I am highly influenced by these legends and have therefore tried to copy their investment approaches as much as I can.

Their ruthless focus on minimizing the downside even before one start focusing on the upside will hold us in good stead in something that's as high risk as penny stocks.

However, it would be naive to assume a 100% hit rate on penny stocks using the SOLID framework. As Peter Lynch says, in this business no one can be right 10 times out of 10.

If you are right 6 times out of 10, it will be a great achievement and this is precisely what our endeavor will be. Besides, losses to the tune of 40%-50% on few of the penny stocks are unavoidable.

However, since there are likely to be more winners than losers and few big winners like the ones highlighted earlier, the long term returns from such an approach is likely to be excellent.

Are Penny Stocks Safe for the Small Investor?

Well, penny stocks are risky if you invest in just any penny stock hoping to make quick returns.

However, the stocks I prefer are not just any penny stocks. These are penny stocks that have passed through my stringent SOLID filtration criteria and I expect a vast majority of them would have both reliability as well as the potential to deliver substantial gains in just 1-2 years.

Just to put things in perspective, at any point in time, my SOLID framework rejects more than 90% of the penny stocks in the market.

And then even from the ones that get through the first stage, I end up liking only 1-2 stock that I analyse. Stocks like the ones we saw earlier and which went on to give fabulous returns over the next 12 months.

How much should one invest in Penny Stocks?

Penny stocks are inherently riskier than blue-chip or mid cap stocks.

On the brighter side, they present a huge growth potential. It is not unusual for a good penny stock to turn a multibagger in a matter of months. But on the flipside, there is a high risk attached.

Subscribers should note that not all penny stocks tend to be outperformers.

In fact, we have seen penny stocks plunge 80-90% when things turn sour.

That is the reason penny stocks are not recommendable to those having a low risk profile. Even for subscribers having an appetite for slightly more risk, we recommend not more than 5%-7% of one's portfolio be invested in penny stocks.

This means that the corpus that one sets aside for penny stocks should not be more than 5%-7% of the total money allocated towards equities.

Which are the Best Penny Stocks to Buy Now?

Well, we can't make any stock recommendations through this article.

However, had you used the SOLID filter to zero in on the right penny stocks over the last few months, you would have come across stocks like Bodal Chemicals, Thirumalai Chemicals, Ashiana Housing, S Chand & Company, Gulshan Polyols etc.

These are the stocks that have given returns of 60%-70% in a matter of few months alone, thus confirming the strength of our SOLID framework in honing in on the right penny stocks.

The fact is we have read hundreds of books...analyzed piles of research reports...and been through almost every investing strategy out there.

We have even tried several of these strategies.

And after all this, we have arrived at the most-simple, effective rules to decide which penny stocks are REALLY worth buying.

And we have packed all of this into our SOLID framework.

We strongly believe that this framework offers one of the easiest ways to make money from penny stocks.

Happy Penny Stocks Investing

Rahul Shah

Editor, Profit Hunter

Equitymaster Agora Research Private Limited (Research Analyst)

FAQs on Penny Stocks

1. What are penny stocks?

Penny stocks are shares of listed companies with low share prices.

These stocks usually have low share prices, typically less than Rs 100 and often less than Rs 50.

In the US market, these stocks trade for less than a dollar i.e. for pennies. Hence the name.

These stocks, in general, have poor liquidity in the market i.e. their trading volumes are low. It's common to see penny stocks trade less than a thousand shares a day.

You can see the list of Indian penny stocks and how they are performing here...

2. Should you invest in penny stocks?

Whether you invest in penny stocks depends entirely on your risk appetite in the stock market. Penny stocks are the most volatile and most illiquid of all the stocks the market.

Thus, they present many challenges to an investor that are absent in other stock categories.

These stocks are notorious for delivering multibagger returns in a few months only to come crashing down and give up all the gains within the next few weeks.

Due to their illiquid nature, it's very difficult to build a sizeable position in penny stocks. This is the reason why fund managers mostly avoid them.

Their low trading volumes also make them vulnerable to market operators who buy these stocks with the sole intention to drive up the price.

When gullible retail investors follow them into the stock, they dump their shares. Thus, the operators book handsome profits and leave the retail investors with huge losses.

On the other hand, penny stocks have the potential to deliver the biggest profits compared to all other stocks in the market.

Well-chosen fundamentally strong penny stocks have the potential to deliver profits greater than 1,000% within 1-3 years. This is almost impossible in the case of largecaps.

This is the main reason for their popularity.

Thus, in the stock market, penny stocks belong to the category of, 'highest possible risk for the highest potential return'.

This is the reality you must accept when investing in penny stocks.

3. How much should you invest in penny stocks?

Penny stocks are inherently riskier than bluechips or midcaps.

They present a huge growth potential. It is not unusual for a good penny stock to turn a multi bagger in a matter of months. But on the flipside, there is a high risk attached. It's common to see penny stocks plunge 80-90% when things turn sour.

That is why penny stocks are not suitable to those having a low risk profile.

Even if you have a high risk profile, we believe not more than 5% of one's stock portfolio be invested in penny stocks.

4. How to select multibagger penny stocks?

Penny stocks are the investment world's deadly double-edged swords.

While they present potentially the biggest upside potential of any group of stocks, they can also erode wealth faster than any other group.

You can start you're search with Equitymaster's stock screener to find the best multibagger penny stocks.

Specifically, look for these qualities...

- Strong balance sheet: Look for low debt, high cash balance, & a current ratio greater than 1 i.e. current assets greater than current liabilities. Equitymaster's stock screener can help you find debt free companies.

- High promoter holding: The higher the better. It shows the promoter has skin in the game. Promoters buying shares from the market is a good sign. Use Equitymaster's stock screener to find stocks where promoters are increasing stake.

Avoid companies with promoter pledging. Equitymaster's stock screener has you covered - Stocks with high promoter pledging. - Quality of the business: Ask these questions. Is it a good business? Are the fundamentals strong? Will it be around after a few years? Is it making profits? Use Equitymaster's stock screener to find profit making penny stocks.

- Cash flows: Does the business generate cash from its operations? If yes, then is it growing? How is the cash being used?

- Cheap valuations: It's always a good idea to buy penny stocks when they are cheap. Check if the stock is trading below its book value. A margin of safety of at least 20% below book value is a good entry point.

Equitymaster's stock screener will help you find the most undervalued companies. A very handy screener for penny stocks is the low price to book stocks.

5. How not to go wrong with penny stocks?

You need a very strong framework to pick the best penny stocks.

A framework that not only enables you to zero in on the right penny stock at the right price but also helps you avoid the big losers.

Here are a few pointers...

- Avoid all penny stocks with high debt. A debt to equity ratio greater than 0.5 is a strict no.

- Avoid all loss making penny stocks. Check out Equitymaster's stock screener for high debt companies.

- Avoid all penny stocks with low promoter holding (below 40%) and penny stocks with promoter pledging.

- Avoid all penny stocks that are not generating cash flow from operations.

- Avoid all penny stocks where the business is at high risk due to some external factor like a change in government regulation.

- Avoid all penny stocks that are not available cheap. Insist on buying at least 20% below book value.

Feel free to check out Equitymaster's Stock Screener to find the best penny stocks. The screener allows you to screen stocks based on your own criteria.