- Home

- Todays Market

- Indian Stock Market News April 15, 2024

Sensex Today Tanks 700 Points | Nifty Below 22,350 | Tata Steel & Sun Pharma Drop 2% Each Mon, 15 Apr 10:30 am

Shares in Asia slipped Monday, tracking a fall in US equities, as markets grappled with ratcheting tensions after Iran's unprecedented attack on Israel at the weekend.

Equity benchmarks in Japan, South Korea and Australia all declined while Hong Kong stock futures also fell.

US stocks tumbled following a mixed start to earnings season. The stock markets were also rattled by worries about potentially escalating tensions in the Middle East.

Here's a table showing how US stocks performed on Friday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 159.19 | -1.6 | -1.00% | 161.7 | 158.6 | 161.7 | 103.27 |

| Apple | 176.55 | 1.51 | 0.86% | 178.36 | 174.21 | 199.62 | 161.42 |

| Meta | 511.9 | -11.26 | -2.15% | 520.19 | 509.33 | 531.49 | 207.13 |

| Tesla | 171.05 | -3.55 | -2.03% | 173.81 | 170.36 | 299.29 | 152.37 |

| Netflix | 622.83 | -5.95 | -0.95% | 633.12 | 618.92 | 639 | 315.62 |

| Amazon | 186.13 | -2.92 | -1.54% | 188.38 | 185.08 | 189.77 | 98.71 |

| Microsoft | 421.9 | -6.03 | -1.41% | 425.18 | 419.77 | 430.82 | 275.37 |

| Dow Jones | 37983.24 | -475.84 | -1.24% | 38319.14 | 37877.3 | 39889.05 | 32327.2 |

| Nasdaq | 18003.49 | -304.5 | -1.66% | 18166.49 | 17952.09 | 18464.7 | 12724.24 |

At present, the BSE Sensex is trading 735 points lower and NSE Nifty is trading 225 points lower.

Hindalco, ONGC and Nestle are among the top gainers today.

BPCL, Coal India and Tata Motors the other hand are among the top losers today.

For a comprehensive overview of key players in the financial sector, check out list of Fin Nifty Companies.

For impact of the Bank Nifty companies and comprehensive overview of the index, check out Equitymaster's Bank Nifty Companies list.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

----------------------------------------

Broader markets are trading on positive note. The BSE Midcap index is trading 2.3% lower and the BSE Small Cap index are trading 3.4% lower.

Sectoral indices are trading negative, with socks in power sector, energy sector and realty sector witnessed selling pressure.

The rupee is trading at Rs 83.4 against the US dollar.

In commodity markets, gold prices are trading marginally higher at Rs 71,946 per 10 grams today.

Meanwhile, silver prices are trading 0.3% higher at Rs 83,122 per 1 kg.

Now track the biggest movers of the stock market using stocks to watch today section. This should help you keep updated with the latest developments...

Speaking of stock markets, Co-head of Research at Equitymaster, Rahul Shahin the latest video explores how different investor mindsets can lead to varying valuations of the same stock, using Exide Industries as an example.

It also highlights the importance of having a clear exit strategy.

Tune in to the below video:

Adani Enterprises to Acquire Stake in Adani Esyasoft

Adani Enterprises on Friday, 12 April said its subsidiary Adani Global Ltd will acquire a 49% stake in Adani Esyasoft Smart Solutions Ltd, Abu Dhabi.

Adani Global, based in Mauritius, has entered into a Shareholders' Agreement (SHA) to acquire a 49% stake in the company from Esyasoft Holding, UAE.

The agreement, executed on Friday, 12 April, aims to pave the way for the development of smart solutions such as smart metering software, load forecasting, revenue maximisation, and other efficiency-based software products and solutions for utilities, both in India and globally.

Under the terms of the agreement, Adani and Esyasoft Holding will hold 49% and 51% shareholding, respectively, in Adani Esyasoft Smart Solutions.

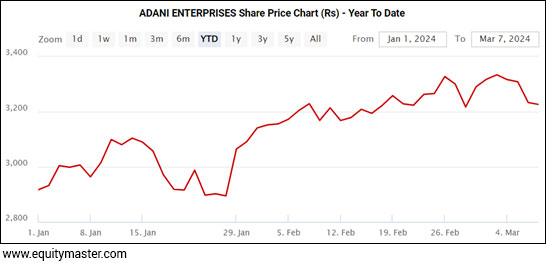

Since the beginning of 2024, Adani Enterprises has been on an upward trend, moving up from Rs 2,917 to Rs 3,222 in March 2024.

Adani Enterprises Share Price in 2024

For more, check out our editorial, Is Adani the New Reliance? Decoding the Rise of Adani Enterprises.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Choose Your Pick

Unnecessarily Risky Small Caps vs Small Caps Brimming with Opportunity

Discover the Small Cap Strategy Thousands of Equitymaster Subscribers Use

I'm interested

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Varun Beverages Expands Up North

Varun Beverages, a leading bottler of beverage major PepsiCo, on Saturday said it has started commercial production of soft drinks and energy drinks from its production facility at Gorakhpur, Uttar Pradesh.

The Jaipuria family-promoted firm will also start juices and value-added dairy products from the Gorakhpur facility.

VBL said it is investing about Rs 11 bn for the greenfield project.

VBL said it is expanding production capacities in the juices and value-added dairy products segments in 2024.

VBL operates across six countries. Three markets of the Indian Subcontinent, India, Sri Lanka, and Nepal contributed 83 per cent of its net revenues, while three African countries, Morocco, Zambia, and Zimbabwe, contributed the remaining 17 per cent in 2023.

VBL accounts for more than 90% of PepsiCo's beverage sales volume in India.

It manufactures, markets, and distributes a range of PepsiCo-owned products, which include carbonated soft drinks, carbonated juice-based beverages, juice-based beverages, energy drinks, sports drinks, and packaged drinking water.

The company is the largest franchisee of PepsiCo in the world.

It manufactures and distributes a wide range of carbonated and non-carbonated drinks, which are sold under the PepsiCo trademark.

It is among Top 5 Largecap Stocks that Could Skyrocket in Modi's Next 5 Years.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

India's Lithium Megatrend is an Emerging Opportunity for Investors

We all know how oil producing countries made fortunes in the last century.

But now, the world is moving away from oil... and closer to Lithium.

Lithium is the new oil. That's the reason why India is focusing heavily on expanding its lithium reserves.

If you can tap into this opportunity, then there is a potential to make huge gains over the long term.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Wipro Makes Another CEO Change

Wipro has appointed Malay Joshi as the CEO of its Americas 1 strategic market unit, effective immediately.

Joshi succeeds Srini Pallia, who was appointed as CEO and MD of Wipro recently. Joshi will also join Wipro's executive board. He will be based out of Wipro's New York City office.

Last week, the Bengaluru-headquartered IT major announced the resignation of Thierry Delaporte as CEO and named Srinivas Pallia as the new Chief Executive Officer, with immediate effect.

Joshi was previously the senior vice president and business unit head, leading communications, media, tech, retail, travel, which make up one of Wipro's largest business units globally.

In this role, he was responsible for helping clients drive successful enterprise transformations among other duties, enhancing client experience, strengthening delivery, and ensuring consistent revenue growth in the sectors he led.

Joshi oversees a diverse array of industry sectors, assumes responsibility for the unit's profit and loss.

Joshi joined Wipro in 1996 and has had an extensive career spanning over 28 years in various leadership roles.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Tanks 700 Points | Nifty Below 22,350 | Tata Steel & Sun Pharma Drop 2% Each". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!