Is it Time to Go Back to Value Investing?

Over the past one month, every night from Monday to Friday, my family and I have been hooked on to Shark Tank India.

The innovative ideas coming from every part of India with such limited means is fascinating to say the least.

Seeing the pace and zeal of innovation, it won't be long when India will be called the land of dreams and opportunities.

After all, we have the best demographics in the world thanks to our young population. And we Indians are known for their 'Jugaad' mind-set.

However there is one thing that makes me uneasy every time I watch the show. If you've have been reading my articles, you might guess which aspect of the show I'm referring to.

It's the valuations at which these start-up companies on Shark Tank are initially valued by the entrepreneurs making the pitch. It's baffling to see how the valuations are cut by almost half in many cases by the Sharks.

On a lighter note, the valuation of companies which some of the sharks own, too deserve to be cut by more than half.

I find it uncomfortable when entrepreneurs like Ashneer Grover talks about profits when Bharat Pe's losses are just growing manifold.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

----------------------------------------

Never mind. Let irrationality prevail for some more time.

After all, if Ashneer Grover's Bharat Pe can spend Rs 2.3 bn to generate a revenue of Rs 60 m, then all these young SME and MSME entrepreneurs have a right to ask for such lofty valuations.

In this circus of massive liquidity and low interest rates, the start-up bubble is getting bigger.

And the repercussions are going to be massive when the bubble pops.

In fact, the bubble has already started to show signs of popping looking at the stock prices of Paytm, CarTrade, Zomato, and Policy Bazaar.

In my previous articles, I have written enough about why I don't like loss making tech IPOs. I cautioned readers after these listings and even after the 30-50% fall in most of these stocks.

The valuations of the listed as well as the unlisted companies will get butchered when interest rates go up and free money from Santa Claus, the US Federal Reserve, comes to an end.

The dilemma that investors face these days is...

a) Jump on the bandwagon of price and momentum

b) Focus on value

The tug of war between growth and value has been going for many years.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

What You Need to Know Before Investing in Small Businesses

Read this letter before you invest in small companies

Read Now

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

A part of the last decade belonged to growth while the other to value. The last couple of years belonged to growth, while value stocks lagged.

However, things are changing...

Let's look at the US market.

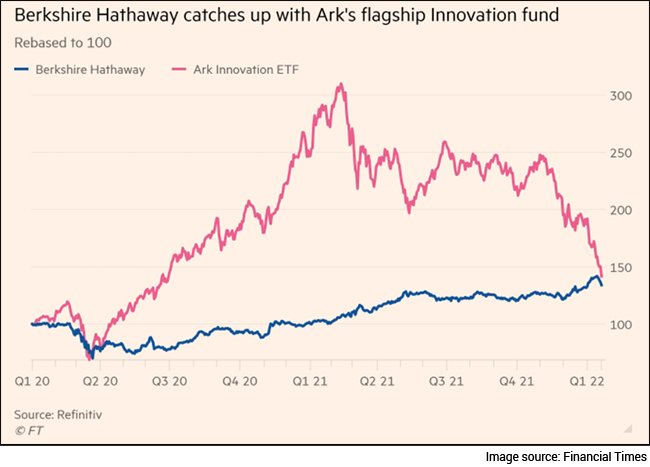

Cathy Woods (Growth) V/s Warren Buffett (Value)

Cathie Woods' ARK innovation fund takes aggressive bets on high growth disruptive companies. It beat a majority of its competition in 2020. This led to its asset under management growing to US$61 bn at its peak.

However, the past 6 months have been characterised by outflows from ARK Invest. In fact, the fund has tanked 45% since the start of 2022.

Definitely not a pleasant new year for Cathie Wood.

On the other hand, legendary investor Warren Buffett's Berkshire Hathaway, a flagbearer of value, has bridged the gap. In fact, he is up 2% since the start of 2022.

ARK Innovation Fund Back to Square One

While Cathie Wood was hailed as the modern day Warren Buffett, we all know who will have the last laugh.

I'm ready to put my neck out and bet on value over the next couple of years.

My conviction is based on the fact that a growing company's stock tends to have its PE ratio re-rated higher.

The whole assumption of higher growth is based in an environment when the macro environment supports it i.e. is low interest rates and high liquidity.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

This Silvery-white Metal is a Potential Fortune Maker

This silvery-white metal goes inside almost all the electronic gadgets that you use: mobile phone, laptop, Bluetooth speakers.

Not only that... this metal also goes inside equipment used by large data centres, telecom towers, railways, planes, EVs.

We're talking about Lithium. Lithium is the new oil.

Our research has found the best way to tap into this rising demand of lithium in India.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Investors generally pay a higher premium for growth. This is because we tend to extrapolate the present into the future much more than it's feasible.

You must have heard this saying, 'As long as there is growth, any multiple is justified'.

In today's slang, it's called BAAP - Buy at any Price.

Now let me show you how a stock can de-rate like a falling knife when growth disappoints even marginally.

The Jubilant Foodworks Stock Crash

When same store sales growth (SSSG) was strong and beating the consensus estimates, the market gave Jubilant Foodworks, a forward PE ratio of 80 times.

Every increase in the PE ratio gave the stock price a strong upside. There always comes a point when growth starts to moderate. After all, no company can outsmart its own environment.

So when growth slows down mildly, the stocks with astronomical PE ratios crash as if there is no tomorrow.

The same happened here in January. Growth slowed down marginally with respect to the market's expectations. The stock fell 25% in less than a month.

The thumb rule is to be wary of high PE stocks without super normal growth.

So why I think value investing will be back in flavour?

To understand why value will be back in flavour, let us look at why growth will be out of flavour.

Rising Interest Rates: Biggest Party Spoiler

Low interest rates leads to high liquidity, which leads to easier access to credit, which leads to higher demand, which leads to higher inflation, which leads to higher interest rates.

Here's some food for thought. A barrel of crude oil in 2008 at its peak was trading at US$148 with an exchange rate of Rs 43/$. That comes out to a crude oil price of Rs 6,364 per barrel.

Today, crude oil is at US$90. It hasn't reached the peak but the exchange rate has climbed to Rs 74/$. This translates in to a per barrel cost of Rs 6,808.

Imagine the inflation it has already added and is likely to add if the price touches US$100 or more.

During such times, money shifts to stocks which have a margin of safety in valuations.

In a rising interest rates scenario, the pecking order should be as follows.

# Choice 1: Cheap valuation + Growth prospects

# Choice 2: Fairly valued + Growth prospects

# Choice 3: Richly Valued + Very strong growth prospects

Completely avoid the following stocks:

- Very high valuations: PE in excess of 50-60 or P/B in excess of 6-8.

- Growth: Historical Growth at 10-15%.

With the rising interest rates there is no way you can justify holding these stocks.

In conclusion...

In an inflationary environment pick the producers and not the consumers.

Warm regards,

Aditya Vora

Research Analyst, Hidden Treasure

PS: If you're a retail investor and interested in making VC-like returns, click here for exciting opportunities.

Recent Articles

- Stocks Profiting from the Rise of the Luxury Class in India April 26, 2024

- These stocks benefit the most from the growing opulent class in India.

- A Rare Opportunity to Profit from Pharma Stocks April 25, 2024

- This opportunity can create a lot of wealth. Keep an eye on it.

- Why CE Info and Netweb Technologies Can Go Where NVIDIA Can't... April 24, 2024

- A 100-day programme will look for companies that can fortify India's deeptech foray.

- Can Your Stocks Benefit from Higher Inflation? April 23, 2024

- Higher Inflation is good for these companies.

Equitymaster requests your view! Post a comment on "Is it Time to Go Back to Value Investing?". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!