It's Time You Discovered the Multibagger Secret of VCs

Zomato was a 1,000-bagger for its early investor, InfoEdge.

It was the classic case of a venture capital (VC) like investment by a listed company.

But are there more InfoEdge like companies? Can there be more Zomato-like fortunes in store over the coming years?

And can individual investors get on board such profit vehicles and discover the secret to VC like returns?

My colleague Richa and I, set out to find the answers to these questions a few years back. This was well before startup listings became a hot topic in Indian markets.

Richa and I poured over the balance sheets of several companies that were showing a unique trend.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

India's Potentially Decade-Long $10 Trillion Bull Run...

Our Co-Head of Research Tanushree Banerjee believes India is going on a decade-long $10 trillion bull run.

And she has discovered 7 mega trend that could potentially be among the top wealth creators in this upcoming bull run.

At our upcoming event, Tanushree will reveal all the details of this mega opportunity, including the golden buying window to enter India's potentially decade-long $10 trillion bull run.

Click Here to Get Full Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Most listed companies are linear growth companies. Very few of them have the potential to grow fast like startups.

But something has changed over the last few years.

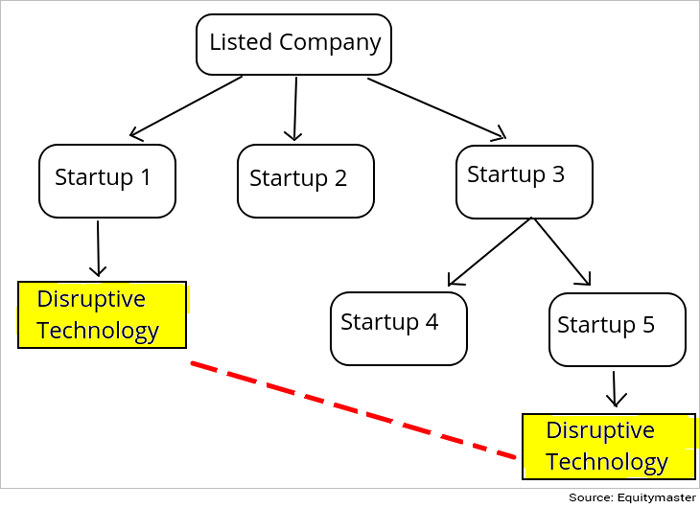

Some forward-thinking listed companies are either investing in disruptive technologies or are acquiring fast-growing startups. They're incubating startups or riding startups at early stages just as venture capitalists do.

This picture will give you a rough idea of what's happening beneath the surface...

This is a simplified version of what actually occurs. In reality, this maze of interconnections is much wider and deeper.

However, once you decode this maze, a whole new world opens up to you.

You start seeing opportunities that are invisible to others. You start spotting companies that are turning from linear to exponential growth companies.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Equitymaster's Premium Research:

Discover the Lucrative Opportunities in India's Emerging Business space

Read This Letter

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

One of the companies we were studying surprised us. It had been backing many high potential startups for a few years. These startups are in businesses across sectors.

And many could do to the fortunes of the listed stock what Zomato did for InfoEdge.

VC Like Exposure to Startups

| Business Segment of the Startup | Stake |

|---|---|

| Business Accounting Software | 27% |

| Legal Tech Platform | 11% |

| Transport Management | 25% |

| Invoice Discounting and Factoring | 8% |

| Enterprise Resource Planning Software | 100% |

| Distribution and Salesforce Management | 16% |

| Shipping Operations Automation | 26% |

| Autonomous Procurement Platform | 26% |

| Inventory and Warehouse Management | 26% |

| E-commerce business for Industrial and Business Supplies | 26% |

| Freight and fleet management software | 17% |

But can we blindly go ahead and invest in a listed stock that takes stakes in startups?

Absolutely not!

Rather, Richa and I spent months to create a proprietary framework called V.A.S.T to identify only the best stocks for disruptive tech investing.

Despite their allure, many such startups can be extremely dangerous to your portfolio...

...Unless you're discerning about cash flows the addressable market... and a lot more.

Our V.A.S.T framework simplifies this whole process for us.

What is this framework all about? And how do we find the best disruptive tech stocks?

Well, last evening Richa and I were live at a very special online event: Equitymaster Venture. We discussed VC-like investing in-depth. We also talked about the top 20 stocks to own for VC-like gains.

The event was a big success. In case you missed it you can watch the replay here.

Warm regards,

Tanushree Banerjee

Editor, StockSelect

Equitymaster Agora Research Private Limited (Research Analyst)

PS: Watch the replay of the Equitymaster Venture here.

Recent Articles

- A Rare Opportunity to Profit from Pharma Stocks April 25, 2024

- This opportunity can create a lot of wealth. Keep an eye on it.

- Why CE Info and Netweb Technologies Can Go Where NVIDIA Can't... April 24, 2024

- A 100-day programme will look for companies that can fortify India's deeptech foray.

- Can Your Stocks Benefit from Higher Inflation? April 23, 2024

- Higher Inflation is good for these companies.

- Hidden Potential: Can This Mid-cap Stock Double Your Money? April 22, 2024

- This mid-cap stock could soar if things go right.

Equitymaster requests your view! Post a comment on "It's Time You Discovered the Multibagger Secret of VCs". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!