Steel Stocks Deserve a Place in Your 2023 Watchlist

The lithium gold rush in India has just begun. Like I explained last week, the implications of the gold rush could be both positive and negative.

But apart from lithium, pretty much every metal that goes into smartphones is grabbling limelight these days.

Reason?

The impact of China+1 on the smartphone manufacturing sector.

Apple Inc's partner Foxconn Technology plans to invest about US$ 700 m on a new plant in India to ramp up local production.

This underscores an accelerating shift of manufacturing away from China as tensions with the US grows. The Taiwanese company plans to build its new smartphone factory in the state of Karnataka.Now, it's not certain whether Foxconn will import key components of the smartphone. Especially the rare metals not readily available in India.

But investors expect the PLI benefits for the sector to attract massive investments. And therefore the demand for the key metals could explode.

For its not just Apple but several other US brands that are seeking alternative production units in India. It's a rethink of the global supply chain that's accelerated during the pandemic first and the Ukraine war later.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

----------------------------------------

There is a possibility that India becomes a global electronics manufacturing hub. And this is the key drive of the investor rush towards these metals.

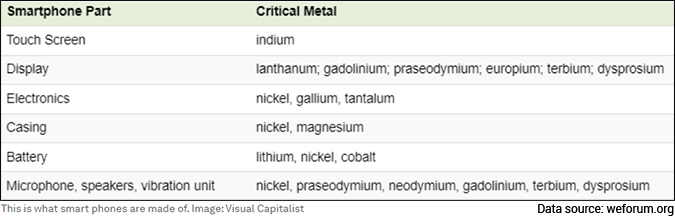

Unlike popular perception, lithium and cobalt are just two of the many metals that go into the smartphone. So seeking investment opportunities in the others is both complicated and speculative.

Metals Needed for Smartphones

Meanwhile, a boring metal that typically has few takers is showing strong signs of an upsurge in demand. The undercurrents are so strong that the price of the metal has gone up by almost 50% in the last 18 months.

Steel prices in India may have been on a tear. However, globally, low demand has caused prices to crash by nearly 40% in the past year. By December 2022 prices had crashed to nearly US$ 590 per tonne from the early-April peaks of US$ 1,000 per tonne.

The reason for the crash is primarily low demand from China. But India is expected to emerge as a saviour for flagging global steel demand. Over next few years, China's massive construction sector may remain stagnant.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

What You Need to Know Before Investing in Small Businesses

Read this letter before you invest in small companies

Read Now

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

The US and Europe are likely heading into recessions. Thus India is poised to capture most of the steel demand thanks to a massive infrastructure and corporate capex boom.

The Indian government is seeking to modernise roads, rail networks, and ports to compete with China as a manufacturing hub.

So, according to the World Steel Association, India's steel demand could soar to 200 m by 2030. This will make India the highest steel consumer among major economies.

Add to that the demand for steel in the aftermath of earthquakes in Turkey. Rebuilding and reconstruction of Turkey after the devastating earthquakes is expected to cause global massive demand for steel.

In 2021, Turkey's crude steel production exceeded 40 million tonnes (m). Of this, more than 22 m was exported, making it an important player in the world steel trade.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

This Silvery-white Metal is a Potential Fortune Maker

This silvery-white metal goes inside almost all the electronic gadgets that you use: mobile phone, laptop, Bluetooth speakers.

Not only that... this metal also goes inside equipment used by large data centres, telecom towers, railways, planes, EVs.

We're talking about Lithium. Lithium is the new oil.

Our research has found the best way to tap into this rising demand of lithium in India.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

After the earthquake not only will the nation be unable to meet its own demand. But Turkey may also seek to import. This will stoke both volumes and prices for largest steel producers globally.

So, understandably, the undercurrents for demand of steel and much stronger than the fancier metals needed for smartphones. The visibility is much higher. And Indian steel makers are much better placed to cater to the demand, both domestically and for exports.

So, investors should keep the fundamental demand drivers in mind rather than getting swayed by speculative bets.

You should keep the best steel stocks in India on your watchlist. I suggest using the Equitymaster Stock Screener to filter these stocks.

Warm regards,

Tanushree Banerjee

Editor, StockSelect

Equitymaster Agora Research Private Limited (Research Analyst)

Recent Articles

- Multibagger Stocks for the Next 10 Years April 28, 2024

- What are the potentially top 10 multibagger stocks for the long term? Find out...

- This Transformer Stock is About to Hit Rs 10,000. Is it Still Value for Money? April 27, 2024

- To scale up renewable energy generation in India, this company is looking to open more centres in India.

- Stocks Profiting from the Rise of the Luxury Class in India April 26, 2024

- These stocks benefit the most from the growing opulent class in India.

- A Rare Opportunity to Profit from Pharma Stocks April 25, 2024

- This opportunity can create a lot of wealth. Keep an eye on it.

Equitymaster requests your view! Post a comment on "Steel Stocks Deserve a Place in Your 2023 Watchlist". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!