A 'Zero to One' Approach for Multibagger Returns

After almost 6 months, with lockdowns getting over, I travelled from my hometown to Mumbai.

I was excited to break the routine of working from home. And also about shifting to a new apartment that I got a good deal on post the lockdown.

I was in the process of donating my books to a nearby library. You see, the idea of re-reading a book, even the ones I like, doesn't excite me. Shifting them from one place to another seemed quite a hassle.

While packing them in the carton, I book I kept back making an exception for re-reading, was an orange coloured - Zero to One by Peter Thiel.

Thiel is the founder of PayPal, co-founder of a billion-dollar company, Palantir Technologies, and a significant investor in Facebook.

For anyone bitten by an entrepreneurial bug, this book is a must read. It's a guiding light to the path of value, wealth, and business creation.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Golden Buying Window to Enter India's Potentially Decade-Long $10 Trillion Bull Run...

The last time it opened... Investors got chance to make 200-300% gains in just 5 years.

And now it's opening up again... offering you a chance to enter india's potentially decade-long $10 trillion bull run...

See This Page for More Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Conventional business books tell you that successful businesses are created with hard work, brick by brick, and need a lot of patience.

I agree with that.

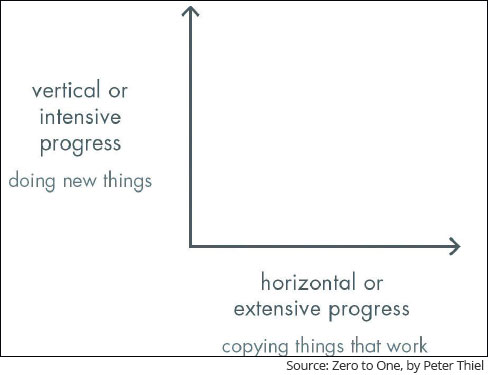

But in the book, another idea that resonated strongly with me is about horizontal versus vertical progress.

Thiel defines horizontal progress as going from one to n.

It's like setting up a second hotel in the vicinity of one already doing well. Or let's say when a company decides to expand across value chain or across different markets.

Vertical progress, on the contrary, is going from Zero to One.

It's about breaking new ground. To do something radical with little or no precedents. To follow a path with no signboards and footprints.

It's like doing something that no one has thought of doing. Getting to a place where no one has been. It's unique and original.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

A Closed Group of Equitymaster Subscribers Have Been Getting Priority Access to Our Research on Emerging Businesses Stocks

And You're Invited to Join Them

I'm interested

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Think of companies like Google and entrepreneurs like Mark Zuckerberg and Bill Gates.

While Thiel sets all this in the context of doing business, it's equally relevant in the world of investing.

The recent market rally has brought with it a wave of stock market experts.

Earlier it used to be your broker or CNBC. Now even your friendly neighbor or grocery shopkeeper knows about the next best IPO or multibagger stock.

What is unique about them?

Nothing.

They're learning about these companies because they are well-known. Or some big investor has already invested in them and is making a case for it in the media.

So what does it do to your potential returns?

Well, if you are lucky, you may make a moderate profit. In some cases, as there is already so much interest in the stock, it may have run up past its real value.

And by the time you bet your money, it may be too late to make big gains.

So how can you skip this and invest 'Vertically' i.e. 'Zero to One'?

This is only possible when you are among the first few to spot a potential multibagger.

This means identifying great companies with stocks that have low or zero institutional holding and are hardly known in the markets.

Where can you find these stocks?

Largecaps, midcaps, and even well-known smallcaps are out of question.

You will find these opportunities where no one else is looking- in the least liquid segment in the stock markets. I call it the secret segment.

I have been exploring this space for almost four years now. I've followed an approach that is different to chasing super investors.

In the secret segment, the question I ask is not what great company or stock someone is buying or holding.

What I look for is a great company someone is building and no big investor is holding.

My goal has been to capture value as it gets created. Instead of following big investors, I expect the big money to follow my recommendations.

This offers a chance to earn not only the vertical returns - Zero to One - but also one to n when the stock gets rerated.

In short, in the secret segment, I aim to find great businesses well before others do.

Qualitative analysis and management meetings are of paramount importance and a big challenge for companies in this universe.

Investing in this space needs a highly selective approach - so much so that I end up rejecting over 90% of the stocks that capture interest in the first place.

These are the challenges I face as an analyst, but they are worth it given the return potential.

For investors in this secret segment, the biggest challenge is - owning these stocks doesn't give one immediate gratification or bragging rights in the short term.

You see, this approach is not everyone's cup of tea. It needs experience, patience, and most importantly, a solid temperament to make it to the end and reap the rewards.

Hence, we open this service every year only to a few subscribers.

Warm regards,

Richa Agarwal

Editor and Research Analyst, Hidden Treasure

Recent Articles

- Stocks Profiting from the Rise of the Luxury Class in India April 26, 2024

- These stocks benefit the most from the growing opulent class in India.

- A Rare Opportunity to Profit from Pharma Stocks April 25, 2024

- This opportunity can create a lot of wealth. Keep an eye on it.

- Why CE Info and Netweb Technologies Can Go Where NVIDIA Can't... April 24, 2024

- A 100-day programme will look for companies that can fortify India's deeptech foray.

- Can Your Stocks Benefit from Higher Inflation? April 23, 2024

- Higher Inflation is good for these companies.

Equitymaster requests your view! Post a comment on "A 'Zero to One' Approach for Multibagger Returns". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!