- Home

- Views On News

- May 9, 2024 - Rs 18 to Rs 47: This Penny Stock Jumps 157% in 10 Days

Rs 18 to Rs 47: This Penny Stock Jumps 157% in 10 Days

It's easy to get distracted by the day-to-day price action of stocks.

I usually don't let that happen.

But lately, I've been eyeing one penny stock that continues to surge along with the market.

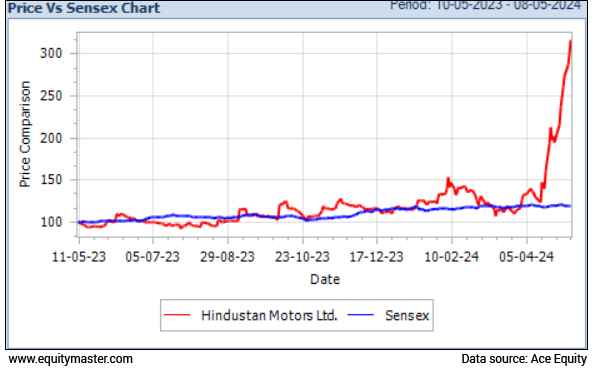

In the past 10 days, the stock has gone up by 157%... that's an 15.7% average per day!!

Meanwhile, the BSE Sensex barely makes that per year.

Sensex vs Hindustan Motors - 1 year

So, what does this recent price movement suggest?

Are we looking at a MAJOR turnaround in the company?

Because make no mistake... Hindustan Motors was the company that made the famous Ambassador cars... which were the mainstay on Indian roads until the 1970s and 80s.

Let's take it from the top to understand why Hindustan Motors share price is rising and what comes next.

Why Hindustan Motors Share Price is Rising

# Turnaround on the Cards?

The rally in Hindustan Motors shares started when the stock rallied 10% in a single day in the last week of April 2024.

What followed was the CK Birla owned company shooting up as high as 150% in a span of 10 days.

According to media reports, the company's management is looking to tie-up with partners and strategic investors for a potential investment... who can introduce new products and infuse capital.

The car maker is reportedly considering measures including alternative use of fixed assets to generate revenue.

Make no mistake... the company had zero revenues for the past two years.

The maker of India's Ambassador car suspended its operations on 24 May 2014. In a letter to the Bombay Stock Exchange (BSE), the reason mentioned by the company was 'very low productivity, growing indiscipline, critical shortage of funds, lack of demand for its core product... and large accumulation of liabilities.'

Even if you look at its quarterly results, it has posted a slew of losses until September 2023.

This changed in December 2023 when Hindustan Motors turned to black and posted a net profit of over Rs 100 million (m).

All these reasons combined have made investors hopeful about the company's turnaround and its Q4 earnings.

# Surplus Land Sale

As mentioned above, the company is also looking to pare some of its fixed assets to generate revenue.

It recently signed a MOA (Memorandum of Agreement) wherein the company will be handing over part of surplus land at Uttarpara for upcoming projects.

However, the project is stalled for now due to a notice.

The company has already filed an application, seeking relief against the state government order for resumption of its land.

# Potential Joint Venture in the EV Space?

Remember when we wrote what could happen if we combine a penny stock with the EV sector?

That's exactly what's happening with Hindustan Motors at the moment.

According to media reports, the company is in developed stages of discussion for a joint venture (JV) with a company involved in the electric vehicle (EV) segment.

Last year, Hindustan Motors did inform that it has been trying to revive its legacy as an automaker and looking at entering the EV segment.

Later on, it joined hands with Europe's Peugeot and made its foray into the two-wheeler EV space.

So, could this new JV turn out to be Hindustan Motors' entry in the lucrative four-wheeler EV space?

We'll know more as the details come out in the next couple of days.

What Next?

Back in October 2023, the company was in news for selling scrap and obsolete equipment amounting to Rs 655 million.

There could be more such fixed asset sales in the coming months as it looks at alternate options for generating revenue.

All eyes will be on Hindustan Motors' Q4 earnings... as investors would be excited to see what the legacy car maker reports this time... after a good December 2023 quarter.

Back in 1982, it would have been difficult not to consider Hindustan Motors as an investment proposition.

The auto industry was just taking off, with companies reporting the highest sales volumes year after another.

Given its early mover advantage and being the market leader, Hindustan Motors was in a unique position.

As things are now, we're in the same situation if we look at the sectoral outlook... EV sales are booming... monthly car sales numbers are off the charts, rising month after month... and majority of OEMs have announced major expansion plans.

The only concern is Hindustan Motors will have to spend a lot more time to regain its lost glory.

While the company has no sales or profits to show right now, this could change soon on the back of these speculative news about its EV venture.

In conclusion... the EV opportunity is here to stay. And several stocks in the EV ecosystem have long runway ahead of them.

But piling on to stocks like Hindustan Motors without fundamentals, purely due to the herd mentality reminds me of the fate of stocks like Vakrangee.

No doubt, the company clocking a profit in Q3 after a slew of losses indicates a turnaround and improving financials. But one must follow these developments for at least the next 3-4 quarters to see whether this is a one-time effect or not.

How Hindustan Motors Share Price has Performed Recently

In the past 5 days, Hindustan Motors share price is up 23%.

In a month, the stock has rallied over 128%.

Hindustan Motors has a 52-week high of Rs 46 touched yesterday and a 52-week low of Rs 13 touched on 25 July 2023.

In the past one year, the stock price has rallied 217%!

Here's a table comparing Hindustan Motors with its peers -

Comparative Analysis

| Company | Hindustan Motors | M&M | Maruti Suzuki | Mercury Metals |

|---|---|---|---|---|

| ROE (%) | 0.0 | 16.2 | 14.1 | 3.5 |

| ROCE (%) | -51.9 | 18.5 | 17.8 | 3.1 |

| Latest EPS (Rs) | 0.5 | 82.3 | 420.1 | 0.1 |

| TTM PE (x) | 101.3 | 26.5 | 29.9 | 570.7 |

| TTM Price to book (x) | -140.2 | 5.4 | 4.7 | 16.3 |

| Dividend yield (%) | 0.0 | 0.7 | 1.0 | 0.0 |

| Industry PE | 28.5 | |||

| Industry PB | 5.0 | |||

About Hindustan Motors

Hindustan Motors manufactures and sells vehicles, spare parts of vehicles, steel products and components, etc. It also does trade of spare parts of vehicles.

The company currently manufactures the Ambassador (1500 and 2000 cc diesel, 1800 cc petrol, CNG and LPG variants) in the passenger car segment and light commercial vehicle 1-tonne payload mini-truck Winner (2000 cc diesel and CNG) by the name of Winner, at its Uttarpara and Pithampur plants.

Did you know that Hindustan Motors' manufacturing plant was the first integrated automobile plant in India? The Uttarpara factory was popularly known as Hind Motor, and it also manufactures automotive and forged components.

To know more, check out Hindustan Motors' financial factsheet.

Happy Investing.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Rs 18 to Rs 47: This Penny Stock Jumps 157% in 10 Days". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!