Bank Stocks in 2022 Mirror Warren Buffett's 1989 Wells Fargo Investment

American bank Wells Fargo was one of Berkshire's largest holdings for nearly a decade. But that is not intriguing.

What's intriguing is the year of purchase of the stock: 1989.

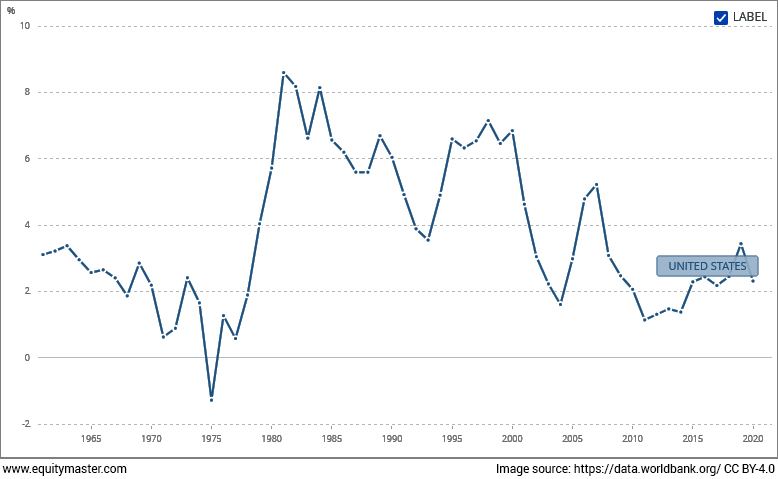

It was the year when the US Fed rate was hovering close to 10%.

Yes, you read that right, 10%.

After having seen the US Fed rate linger close to zero percent for over a decade, it is difficult to believe that the rates were once in high double digits.

In late 1980s, the US Fed had taken interest rates to as high as 12% to 15% in a bid to fight inflation.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Golden Buying Window to Enter India's Potentially Decade-Long $10 Trillion Bull Run...

The last time it opened... Investors got chance to make 200-300% gains in just 5 years.

And now it's opening up again... offering you a chance to enter india's potentially decade-long $10 trillion bull run...

See This Page for More Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

So, in 1989 when the interest rates in the US were at the cyclical peak, Buffett took a call.

With his understanding of high interest rates, Buffett chose to take an exposure to Wells Fargo. And over the years took his exposure significantly higher.

Now, what was the logic behind his thinking?

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

A Closed Group of Equitymaster Subscribers Have Been Getting Priority Access to Our Research on Emerging Businesses Stocks

And You're Invited to Join Them

I'm interested

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Interest rates are just one part of economic jigsaw that your portfolio needs to solve. At the end of the day what you need in your portfolio is market beating returns.

For that, what you really need to make sure is that whether it's the bonds in your portfolio or the stocks, they qualify in two aspects:

- Have limited downside risks

- Compensate sufficiently for the risk taken

So, in 2022, as interest rates in India move significantly higher...say to 7% or 8%, it is not just the higher fixed income that may lure you. The fact that fixed income assets have relatively lower degree of risk compared to stocks, is also noteworthy.

Warren Buffett once famously said...

- Interest rates are to asset prices what gravity is to the apple.

Therefore, you should not be surprised to see stock markets correcting in response to a meaningful rate hike by the US Fed or the RBI.

Most investors are keen to buy the so-called cheap stocks after they have corrected significantly in response to interest rate hikes. What they do not realise is that steep interest rates can even kill certain kinds of businesses.

So, to buy stocks that don't just survive but thrive in a period of high interest rates, they must know the ways in which interest rates can affect their returns.

For instance, take cost of capital. For banks, the cost of capital includes cost of debt and equity.

Now in a rising interest rate scenario, banks are the only entities that do not see their cost of capital eating into shareholder returns. This is because the deposit rates move up only with a lag after lending rates have moved up meaningfully.

This results in bigger margins. And this boosts shareholder returns.

Next is leverage funded growth. While all other entities with leverage see their cash flows drying up in a high interest rate scenario, banks rake in higher margins on their already leveraged balance sheet.

Being able to deploy cash judiciously in higher yielding treasuries allows banks to make the most of their other income when rates are moving up.

Provisions that the banks make to avert NPAs in higher rate cycle could move higher temporarily. However, being able to keep asset quality intact also allows them to write back the provisions when the rates move lower.

This provides a much-needed kicker to their bottomlines.

So, if Buffett's buy in 1989 was a sign of things to come, bank stocks in India have massive compounding tailwinds coming their way.

All you need to ensure is that you buy the correct 'Indian' Wells Fargo.

For this focus on banks with solid lending skills as well as good corporate governance. Both are must haves.

Warm regards,

Tanushree Banerjee

Editor, StockSelect

Equitymaster Agora Research Private Limited (Research Analyst)

Recent Articles

- Stocks Profiting from the Rise of the Luxury Class in India April 26, 2024

- These stocks benefit the most from the growing opulent class in India.

- A Rare Opportunity to Profit from Pharma Stocks April 25, 2024

- This opportunity can create a lot of wealth. Keep an eye on it.

- Why CE Info and Netweb Technologies Can Go Where NVIDIA Can't... April 24, 2024

- A 100-day programme will look for companies that can fortify India's deeptech foray.

- Can Your Stocks Benefit from Higher Inflation? April 23, 2024

- Higher Inflation is good for these companies.

Equitymaster requests your view! Post a comment on "Bank Stocks in 2022 Mirror Warren Buffett's 1989 Wells Fargo Investment". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!