Why this Stock Market Recovery May Not Last

The first half of 2022 is done and dusted. And it hasn't been a good one for stock market investors. This especially after the euphoria of 2020 and 2021.

But then, that's the stock market for you. It never goes up in a straight line. It will go up a great deal and then fall with equal intensity and then go up again.

And it's through these frequent rises and falls that it creates a new high every few years.

So, will the second half of 2022 be one such period? Will the benchmark indices create a new high in the second half or will they continue with their downward journey and pile more misery on investors?

Well, it's said that in the stock market, history does not repeat itself, but it does rhyme.

Which is why looking into the rear-view mirror may not be such a bad idea after all.

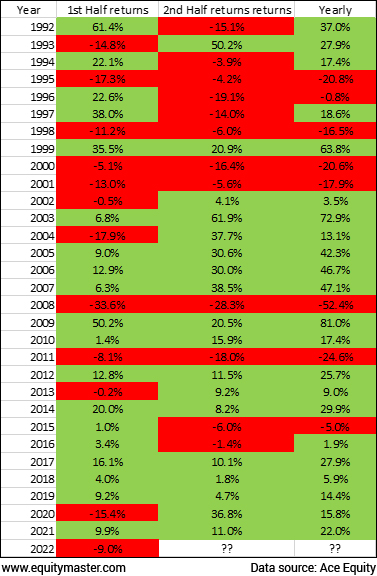

Here is a snapshot of the historical returns generated by the Sensex over the last 30 years.

The Highway to Prosperity: More Green Signals than Red

One thing that stands out as far as the yearly returns are concerned is that we can see more green than red. In fact, green dominates red by 4:1.

In other words, markets have been up four years for every year that they have been down. I think this is a great reminder for those investors who stay out of the market because they are constantly worried about some or the other macro factors.

You see, there's no doubt that fear is one of the strongest emotions. However, giving into your fears constantly is not the way to make money in stocks.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

----------------------------------------

In the stock market, it pays to stay more greedy than fearful because although stocks do correct every now and then, they eventually recover and go on to give great long-term returns.

Now, does the stock market recover in the second half after a correction in the first half?

Well, the news is not good to be honest.

The benchmark indices were down 9% in the first half of 2022.

Before 2022, there have been 11 instances where the index gave negative returns for the first half of the year. Out of these 11, only in the year 1993 and the year 2020 did the Sensex return more than its long-term average of 15%-16%.

In all the other 9 instances, Sensex ended up with poor returns and even closed in the negative six times out of the 9.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Choose Your Pick

Unnecessarily Risky Small Caps vs Small Caps Brimming with Opportunity

Discover the Small Cap Strategy Thousands of Equitymaster Subscribers Use

I'm interested

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Thus, if history is anything to go by, there isn't a very strong chance of the Sensex making a recovery and closing the year significantly in the positive. In other words, there's a stronger chance of the markets having a poor outing in the second half of 2022 as well.

Another way of looking at it is from the returns angle. You see, the Sensex will have to go up by at least 26% in the second half to earn a respectable return of 15% for the full year.

Is this possible? Well, nothing is impossible.

But given where the broader market valuations are placed and the macro-economic situation in India and across the globe, it's a tall ask to be honest.

Therefore, even from this perspective, the second half of 2022 doesn't look all that exciting.

Now, let's discuss one's investment strategy. You see, I'm not a believer in being 100% invested at all times. I'm of the view that if one must earn market-beating, long-term returns, then one has to take calculated risks.

In fact, one has to take advantage of the crowd's tendency to give in to emotions of fear and greed.

Thus, if the crowd is being too greedy, you should be fearful and move into the safety of cash. And if the crowd is being too fearful, you should be greedy and use the cash reserves to move into stocks.

So what do you think is the market crowd feeling right now?

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

India's Lithium Megatrend is an Emerging Opportunity for Investors

We all know how oil producing countries made fortunes in the last century.

But now, the world is moving away from oil... and closer to Lithium.

Lithium is the new oil. That's the reason why India is focusing heavily on expanding its lithium reserves.

If you can tap into this opportunity, then there is a potential to make huge gains over the long term.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

I think the crowd is fearful compared to the recent past but we have not reached the point of maximum pessimism. Thus, it would be wise to have one's investment corpus split 50:50 between cash and stocks.

If the markets go down further in the second half, one can move gradually into more stocks. The idea is to turn greedy when others are fearful. If the markets go up a lot, then consider moving in the opposite direction.

Of course, there are different ways to earn market beating returns in the stock market. But this is the one I found to be easy to apply. It has also worked quite well in the past.

So, in a nutshell, whether the markets recover or not in the second half doesn't matter too much. What matters is the steps you are going to take in your portfolio and if those steps make sense from a long-term perspective.

If they do, then follow them without worrying about what others are thinking or doing. This is how fortunes are built in the stock market.

Happy Investing!

Warm regards,

Rahul Shah

Editor and Research Analyst, Profit Hunter

PS: If you want to know why it matters to have one eye on the broader market and the other eye on individual stocks, check out this YouTube video where I predict that 70% of your investments may go down in 2022.

Recent Articles

- Multibagger Stocks for the Next 10 Years April 28, 2024

- What are the potentially top 10 multibagger stocks for the long term? Find out...

- This Transformer Stock is About to Hit Rs 10,000. Is it Still Value for Money? April 27, 2024

- To scale up renewable energy generation in India, this company is looking to open more centres in India.

- Stocks Profiting from the Rise of the Luxury Class in India April 26, 2024

- These stocks benefit the most from the growing opulent class in India.

- A Rare Opportunity to Profit from Pharma Stocks April 25, 2024

- This opportunity can create a lot of wealth. Keep an eye on it.

Equitymaster requests your view! Post a comment on "Why this Stock Market Recovery May Not Last". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!