GST Approved: Time to Buy Stocks by the Fistful?

- In this issue:

- » Consumer confidence in India shines through

- » Private sector output in India on the rise

- » ...and more

It is not often that stocks don't react to headlines. But as I write, the Sensex is down a sedate 55 points. The market seems oblivious to the goings on in parliament.

In what is touted as the single biggest reform since 1991, India took a big stride forward yesterday. Amid a rare show of unity, the Congress and BJP approved the landmark goods and services act, allowing it to go through Rajya Sabha with uncharacteristic ease.

The tax is far from a done deal yet. Half the states still need to approve the legislation. Besides, the GST council, a very important part of the process, will also need to be set up. It is this entity that will determine the GST rate and institute a dispute resolution mechanism. However, very few would disagree that the biggest stumbling block is well and truly out of the way.

Having said that, the GST won't see the light of the day until April 1, 2017. And even this deadline might be ambitious if experts are to be believed. Allow another two to three years for people to get used to it. The actual ground reality is only likely to emerge a full four or five years from now.

It is in this context, the sedate reaction from the stock markets seems justified after all.

However, it's not too early to consider the potential benefits for investors and consumers. Considering the gap between the current tax rates on most goods and services and the likely uniform rate under GST, it would be a safe bet to assume overall tax rates will indeed come down. And if companies decide to pass this benefit on to the end user, it means lower prices and more purchasing power for consumers.

And don't worry about the lower taxes depleting government coffers. The losses will be more than offset by curbed tax evasion and increased transparency.

Consider other Indirect benefits such as reduced paperwork, greater economic efficiencies, and consolidation of supply chains. Therefore, all put together you could add another 1-2% to GDP growth every year on a sustainable basis. With a US$2 trillion economy, that's nothing to scoff at.

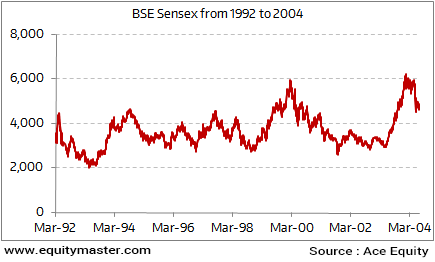

So how should investors approach the whole thing? For context, let us go back to GST's predecessor in terms of the sheer size of the reform. And the only comparable event is the reforms of 1991.

We recently analysed the stock market returns after this single most important economic legislation post-Independence. And here's what we found out.

Investors who bought stocks by the fistful without regard to valuations were in for a rude shock. Despite an unpreceded unleashing of animal spirits, it took twelve long years for the stock markets to reach their post-liberalisation levels.

So while GST may be great news for the economy as well as corporate earnings, do watch out what you pay for a stock. Even a good stock can turn into a bad investment if you overpay.

Will the passage of the GST bill change your strategy? Let us know your comments or share your views in the Equitymaster Club.

| Advertisement | ||

| EXPOSED: The Crony Socialism of Narendra Modi... | ||

While crony capitalism has taken a beating under Narendra Modi, crony socialism is alive and kicking. While crony capitalism has taken a beating under Narendra Modi, crony socialism is alive and kicking.Yes, the public sector is back and so are the HUGE losses! And in case you thought that this is a problem which we've always had...well, you are in for a surprise. The public sector is burning money at probably the fastest pace ever. And Vivek Kaul reveals it all in his latest Special Report - "The Crony Socialism of Narendra Modi". A must read for everyone who is interested in the present state of the country and where it is headed...Plus, it's Absolutely Free! So, don't delay...Click here to download this Special Report right away! | ||

03:15 Chart of the day

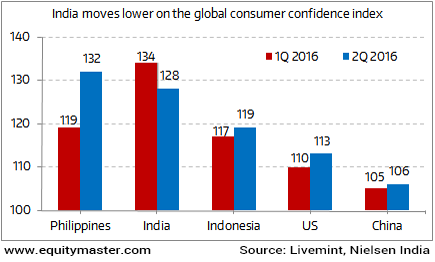

India hasn't been that great on consumer confidence in recent times. But compared to most of the rest of the globe's sagging economies, India has shone out. In terms of Nielsen's global consumer confidence index, it has topped the charts for eight consecutive quarters. But that was only until the March 2016 quarter.

The June quarter gone by has seen Indian consumer confidence fall as today's Chart of the Day shows. This has also meant it giving up the top slot to Philippines. Nonetheless, it still remains far ahead of many of its larger peers like US and China.

The crude rise and inflation inching higher once again have been some of the reasons cited for confidence falling lower. Apart from that, nearly half of the respondents of Nielsen's survey also believed that they were still in the grip of recessionary sentiments.

Consumer confidence in India slips in June quarter

But the news is not all bad. While consumer sentiment has left a lot to be desired, the month of July has seen private sector output and business expectations improve. Reports highlight that the Nikkei India Composite Output PMI (purchasing managers index), which indicates both manufacturing and services private sector output, climbed to a 3 month high during the month.

New orders in manufacturing and fresh business in services are seeing growth. Further, the index also shows that business expectations in the services sector are now at their highest since March.

Perhaps the good monsoon, pay revision for government employees and the goods and services tax (GST) bill moving forward have been key drivers of these improving expectations from the days to come.

The Indian stock markets were trading flat today despite all the celebrations on the GST front. At the time of writing, the BSE-Sensex was trading down by around 3 points. Gains were being seen in

04:56 Investment mantra of the day

"The difference between successful people and really successful people is that really successful people say no to almost everything." - Warren Buffett

This edition of The 5 Minute WrapUp is authored by Rahul Shah (Research Analyst).Today's Premium Edition.

Is SP Apparels a Better Business than Kitex Garments?

S P Apparels has recently come up with an IPO. Is the company fundamentally strong compared to its listed peer?

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "GST Approved: Time to Buy Stocks by the Fistful?". Click here!

1 Responses to "GST Approved: Time to Buy Stocks by the Fistful?"

Gnostic

Aug 4, 2016Every time is a good time to buy stocks,provided one is sure about the projected growth in the top & bottom line and what price one is paying for them, GST or no GST !!!