Does This Mean Indian Stocks Are Now a Screaming BUY?

- In this issue:

- » Will India be amongst the top three economies by 2030?

- » The 'big bull' on demonetisation

- » ...and more!

A report in a business daily throws up some very interesting statistics. Turns out, India's share of world market capitalisation is now lower than its share of world gross domestic product (GDP) by the widest gap in thirteen years. What a way to start the year!

India's share of global GDP is 2.99%. But its share of global market cap is just 2.26%. This 0.73% gap is a wide one indeed. It's also the highest since 2003, when the Indian markets were down in the dumps.

Is this a sign of cheap markets? Should Indian investors now start loading up on stocks?

You'll have to dig a little deeper for the answer...

For one, this gap isn't due to a big fall in the India markets. In fact, the BSE Sensex ended 2016 up about 2%.

Rather, it has to do with the swell in world market capitalisation, led by the US markets. The US benchmark index, the Dow Jones Industrial average (DJIA), zoomed up 15% in 2016 and is now perched at an all-time high:

Further, a rise in the US dollar has made the rupee look 2.6% weaker in 2016. This too has contributed to the fall in India's share of world market cap in dollar terms.

Yet, India's GDP has continued to chug higher during this time.

However, net net, these factors make the gap in India's share of world GDP versus its market cap look very glaring indeed.

The critical point to note in all this is that the gap has widened more due to relative factors than the Indian market itself becoming significantly cheaper.

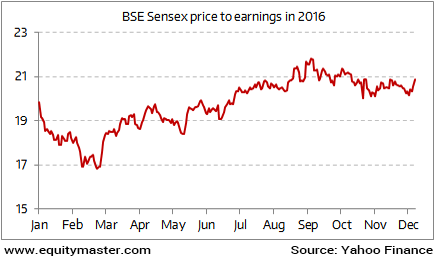

In fact, in absolute terms, rather than fall, valuations actually went up last year. From a price-to-earnings of 19.8x at the start of 2016, they're at 20.9x now:

The dull earnings of corporate India have promptly ensured this outcome.

Here's what is most important to remember: It makes a world of sense to look at the market in absolute terms instead of relative to how they or other markets have performed in the recent past.

When making important investing decisions regarding the Indian share markets, that's always the best way to cut through the noise and put things in perspective.

|

--- Advertisement ---

New Year Resolution to Buy Solid Stocks? Read This... As we enter a new year, we all make resolutions for healthier, wealthier and prosperous new year. Now, at Equitymaster, we strive hard to guide you on meeting that second goal. In other words, a wealthier new year! Yes, if you're looking for solid safe stocks for 2017... We would recommend that you read all about our Blue Chip Recommendation Service - StockSelect. It's a service we began in 2002 and today, it is one of our most popular and best performing services. Click here to know all about Safe Stocks. ------------------------------ |

02:35 Chart of the day

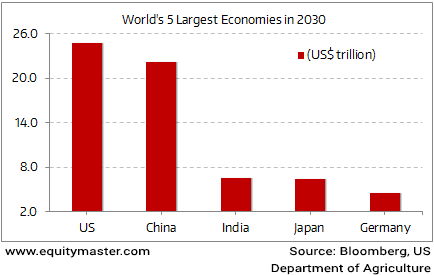

There's a reason the IMF calls India 'the bright spot in the global landscape'. As today's chart of the day highlights, India is likely to have the biggest jump in the economic pecking order by the time the year 2030 rolls around. Currently ranked seventh, India will go on to become the world's third largest economy by 2030. And what will drive this improvement? Well, it is India's workforce that is expected to become the world's largest by then. A 7% growth in GDP from now till 2030 does indeed look achievable. This is what we need to make the prediction come true. In fact, a few bold reforms and we would very well flirt with that magical 10% growth number. And the longer we are able to grow at this rate, the more we will be able to close the gap between us and the world's two largest economies, viz. the US and China.

Having said that, we need to ensure that we don't let our demographic dividend turn into a disaster.

Here's our colleague Vivek Kaul quoting Ruchir Sharma on this make or break issue of our demographic dividend.

- The trick is to avoid falling for the fallacy of the "demographic dividend," the idea that population growth pays off automatically in rapid economic growth. It pays off only if political leaders create the economic conditions necessary to attract investment and generate jobs. In the 1960s and '70s, rapid population growth in Africa, China, and India led to famines, high unemployment and civil strife. Rapid population growth is often a precondition for fast economic growth, but it never guarantees fast growth.

Indeed. The policy makers assume a direct co-relation between population and economic growth at their own peril.

India on Course to Become World's Third Largest Economy by 2030?

He is known as the 'Big Bull' for a reason. Rakesh Jhunjhunwala, one of the most widely tracked Indian investor is of the view that demonetisation is history. And therefore, if you have money, it is time to put it to work in equities. Talking to a leading daily, he opined that the selling in last quarter of 2016 was largely on account of demonetisation, Donald Trump's win and expectations of higher interest rate and a strong dollar. But with demonetisation being history, selling by FIIs is likely to reverse.

Well, we can't predict this short term. But the medium to long term story does look positive to us as well. In fact, we still stand by our prediction that a 40,000 Sensex still looks a strong possibility over the next 2-3 years. Profit margins are at a multi-year low and if they revert to their long term averages in the medium term, then earnings would receive a boost and so would the broader stock markets. Our recipe for profiting remains the same. Invest in fundamentally strong companies run by good management teams and trading at attractive valuations.

Indian markets have started the year 2017 on a subdued note with the Sensex lower by 141 points at the time of writing. BSE Mid and Small Cap indices were however seen bucking the trend. They were up marginally. Amongst sectors, realty and banking were seeing some buying interest.

It's no secret that political parties are a kind of black hole to black money. Much of these donations to political parties, being below the limit of Rs 20,000, happen in cash and remain unaccountable (one must note that political parties are currently not required to publicly disclose contributions of up to Rs 20,000). So while you and I need to show an identity proof while depositing our old Rs 500 and Rs 1,000 notes into a bank account, political parties can continue to receive donations of up to Rs 20,000 in cash. And they need not declare who gave those donations.

There is a scope that we as citizens of India can put an end to this discrimination. My colleague Vivek Kaul is on a mission to get us EQUAL RIGHTS. Vivek has initiated a petition to the President of India to request him to set things right. Thousands have already signed the petition. He needs 25,000 signatures before 6th of January to kick this off. Already, over 5,000 people have signed.

In case you haven't, it's time to do your bit now. Sign the petition, and become an agent of change.

04:56 Investment mantra of the day

"We don't have to be smarter than the rest. We have to be more disciplined than the rest." - Warren Buffett

This edition of The 5 Minute WrapUp is authored by Rahul Shah (Research Analyst).Today's Premium Edition.

Is the Sensex Undervalued?

Are current equity levels attractive from a long-term perspective?

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Does This Mean Indian Stocks Are Now a Screaming BUY?". Click here!

1 Responses to "Does This Mean Indian Stocks Are Now a Screaming BUY?"

R.Thirumurthy

Jan 3, 2017The article 'a' can be deleted in the title to better effect.

About the much talked about demographic dividend : It may become a mirage if western values and ways of life capture the imagination of our youth, and the DINK (Double Income No Kids) syndrome spreads. Please see this quote : "We in the West do not refrain from childbirth because we are concerned about the population explosion or because we feel we cannot afford children, but because we do not like children",

Germaine Greer aka Rose Blight, second wave feminist.

Also please see this vintage vignette - opener of Vicar of Wakefield by Oliver Goldsmith, " I was ever of opinion that the honest man who married and brought up a large family, did more service than he who continued single , and only talked of population."