Three Essential Stock Types for Your Portfolio...

In this issue:

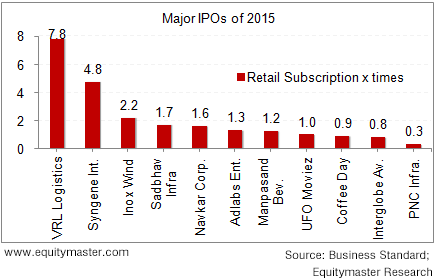

» Retail investors cautious about IPOs in 2015

» Will the Fed hike rates in December?

» ...and more!

00:00 |

|

|

|

The true Buffett admirer would know that among of his many successful investments, Coca Cola certainly figures somewhere near the top. Coca Cola ticks all the right boxes: a great brand with an unbreachable moat, healthy cash flows, a strong balance sheet, and good dividend payouts.

The FMCG sector boasts of many such companies. But companies like the Coca Cola are not always available at cheap valuations. Therefore, it's important to cast the net a bit wider and look for good quality stocks across sectors.

The Financial Times recently published an article related to this. It was about how Carl Stick, manager of the Rathbone Income Fund, evaluates companies on the basis of three risk factors - business, financial, and price - and then places them into distinct categories. They are Compounders, Cash Cows, and Cyclicals - the three 'Cs'.

Let us take a look at each category. The Compounders are high-quality companies that grow consistently and generate sufficient cash flows that can be ploughed back into the business and doled out as healthy dividends as well. These companies also have very strong moats. Companies from the FMCG sector are prime examples. Indeed, these companies have low business and financial risks. But when it comes to price, because of their inherent strengths, these companies typically trade at premium valuations.

Cash Cows are typically big, mature, low-growth businesses. Big utility and tobacco businesses are good examples of companies that fall in this category. Compared to Compounders, the business and financial risks of Cash Cows are higher, and they do not normally command premium valuations.

The last category is Cyclicals. When we talk about Cyclicals, the focus is naturally on quality Cyclicals. These are companies in the energy, commodity, and mining space. Because they are Cyclicals, earnings tend to be volatile. So what matters for these companies is cash flow. And quality Cyclicals have plenty of cash. The business and financial risks of Cyclicals are higher than the other two categories, but the chances of buying them at attractive valuations are also higher.

The common attribute that runs through these categories is that ultimately they are comprised of strong companies with healthy financials and good cash flows. And so it makes sense to have a healthy mix of all three in your portfolio.

Buffett looks to do this. Besides the obvious FMCG companies that he so loves, his purchases over the last few months have been from the cyclical space - Precision Castparts, for example.

What's more, our two ValuePro portfolios lso have a healthy mix of Compounders, Cash Cows, and Cyclicals. Companies across sectors such as FMCG, tobacco, utilities, energy, and metals and mining have found their way into our portfolios - all of them quality companies with strong financials and healthy cash flows.

In a nutshell, it is a healthy practice to consider quality stocks in all these three areas and consider buying them if the valuations are right.

Do you have a healthy mix of Compounders, Cash Cows, and Cyclicals in your portfolio? Let us know your comments or share your views in the Equitymaster Club.

|

--- Advertisement ---

Use Our Secret Investment Strategy For Your Benefit... For over seven years, our secret small cap selection strategy has helped us zero in on several high-potential small cap stocks.

|

03:03 |

Chart of the day | |

|

The not so great experiences during the years 2011 and 2012 still probably rankle in the minds of retail investors. This is when the poor post-listing performance of several IPOs had burnt their fingers. Thus to protect their interest, the Securities and Exchange Board of India (SEBI), had introduced a 'safety net' on the investment. According to this, the company will buy back its shares from retail investors at the IPO price, in case the stock falls sharply during the first six months after the listing. Around 2013, when Just Dial was coming with its IPO, it was forced by the regulator to offer a discount and 'safety net' to retail investors.

However, according to market experts, SEBI seems to have changed this approach recently.

We do not know whether SEBI will be directing more companies to make offers with the safety net provision. But we view this development to be quite fair. This is because such provisions actually do not help the investors. In one of our editions of the 5 Minute WrapUp, here is what we wrote:

The 'safety net' provision in IPO pricing, in all likelihood, will only encourage speculators to invest even in over priced IPOs for listing gains. Investing simply for the sake of a safety net makes no sense in our opinion. Because eventually the stock's value will catch up with its fundamentals. This may happen after the safety net period ends. And if the fundamentals are not too strong, the stock will only burn a hole in the investor's portfolio.

Going by the data above, it is quite evident that retail investors have been selecting IPOs quite cautiously. Long time readers will be aware of our cautious stance while recommending IPOs. Therefore, one needs to evaluate each IPO on its own merits. Choosing companies with strong fundamentals will go a long way in giving better returns than depending on regulators for help.

04:01 |

|

|

As per the recent data released, the US economy has slowed in the last quarter. The growth stood at a tepid 1.5% YoY. This was much below the previous quarter's growth at 3.9% YoY. This was largely due to large stockpiles in the warehouses, leading to a glut. According to experts though other factors show sufficient positive signals and thus, the expectations of rate hike in the upcoming Fed meeting during December have increased.

The impact of this will be felt by Indian stock markets as well. Because if a rate hike takes place, the chances of foreign investors taking money back to the US are much higher. In such a scenario, one cannot rule out the possibility of sharp correction in the Indian stock markets given that influence of FIIs flows remains strong.Having said that, the US Fed so far has refrained from raising rates and we will not be surprised if status quo is maintained in the December meeting as well.

But we would once again like to point out that should a correction occur in the Indian stock markets because of a Fed rate hike, investors should look to take advantage.If equity markets fall, the discerning investor would surely take this opportunity to buy some good quality stocks at attractive prices with the potential to deliver healthy returns in the longer term.

04:45 |

|

|

04:55 |

Today's investing mantra |

Today's Premium Edition.

ONGC: Pricing in the Negatives?q

Does ONGC appear attractive at current valuations?

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Three Essential Stock Types for Your Portfolio...". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!