Of Jhunjhunwala, Indian Stock Markets, and the Unthinkable

- In this issue:

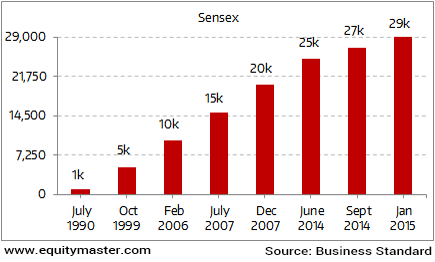

- » Sensex Market Cap Zoomed 300 Times in 30 Years

- » Has the rural India really moved away from the farm jobs?

- » ...and more!

What does billionaire Indian investor Rakesh Jhunjhunwala - more commonly known as the Big Bull - think of the Indian stock markets right now?

Here are some excerpts from a recent interview on NDTV...

- Vikram Chandra: You were the first person...or one of them...to talk about the structural bull market in India. Do you still hold that view? Do you feel that Indian stock markets still have a long way to go up?

Rakesh Jhunjhunwala: I can tell you that 98%...or 97% of my wealth is still in equities. I think we have not seen the India of our dreams at all. We are getting there. I am extremely bullish, Vikram. As far as markets are concerned I'm extremely bullish, especially in the longer term.

Vikram Chandra: That's an interesting insight coming from you that people have been really wondering about. So you still do believe that India is a great story to invest and that stock market investors should be enthusiastic.

Rakesh Jhunjhunwala: Absolutely! See God can do anything. But barring some absolutely unforeseen... unthinkable circumstances, I don't think that India's bull run as a country can be stopped ever...and as a consequence, the bull run in the equity markets. Don't forget one thing...the bull run in the equity markets is a product of the bull run in the economy.

After I saw this interview last week, it left me lingering with many counter-questions.

I think that Mr Jhunjhunwala's views are not only flawed, but also irresponsible...because I believe there are many gullible investors out there who take his words seriously...who may see this as a signal to rush into Indian equities. And then what?

Will Mr Jhunjhunwala tell them when to sell? Will he tell them what to be careful about? Will he guide them with the asset allocation, or does he hint that all investors should put 98% of their savings into equities?

While Mr Jhunjhunwala didn't elaborate his economic thesis, he believes that we still haven't seen the India of our dreams...and that we are getting there.

What is the India of our dreams? Are we really getting there?

The only disclaimer in his interview was: God can do anything.

According to him, only something unforeseen and unthinkable can stop India's bull run.

I have some major disagreements with the Big Bull.

For nearly a year, I have been working and researching with one of Mumbai's foremost economic thinkers Vivek Kaul. And I can tell you that we are living in a world of toxic money...where 'unthinkable' events are fast becoming a norm.

Even if you were to ignore the catastrophes lurking in the global financial system, back home in India, the economic prospects are not as bright as Mr Jhunjhunwala portrays them to be. Vivek believes that we have many nightmares to confront on our way to the 'India of our dreams'. And many of these nightmares are neither unthinkable, nor unforeseeable. They're right in front of us. They're already affecting our incomes and lives.

Mind you, Mr Jhunjhunwala is not going to come and tell you about the crises India is staring at. He has little to worry about. Even if 98% of his wealth gets wiped out, he will still have enough for his future generations.

But can we afford to do that? Can we afford to lose our wealth and livelihood to the so-called unforeseen and unthinkable events? I don't think so.

We ought to think about the unthinkable before it hits us.

By the way, if you missed seeing Vivek's 58-minute video about "The Next Big Indian Crisis", we have just released an abridged transcript of the interview. You can read it at your own pace and catch up on all these serious issues which we can almost guarantee will NEVER be covered in the mainstream media.

So, don't delay and read on for the transcript of our conversation...

02:60 Chart of the day

Sensex Milestones Over Last 30 Years

1986 was the year when Sensex was compiled. Corporate scams, political unrest, macro factors, asset bubbles and so on have been part of Sensex's journey over the years. As reported in Business Standard, Sensex' market capitalisation has zoomed from Rs 148 billion to Rs 47.8 trillion. The index is up 300 times in 30 years.

But which companies have led this surge? And which have fallen behind?

It is widely believed that investing in index stocks is the safest way to invest in equities. But that's not the case. Of the original thirty Sensex constituents in 1986, only seven companies viz; ITC, Hindustan Unilever, Reliance Industries, Tata Motors, Tata Steel, Mahindra & Mahindra, and Larsen & Toubro continue to remain part of Sensex presently.

The old businesses that failed to upgrade their products with the changing life style, preferences and demand have faded into oblivion. While the Sensex will continue to scale new highs, not all the stocks will continue to be part of it.

Sometime back, my colleague Tanushree asked a potent question in an edition of The 5 Minute WrapUp:

When Will You Start Owning Sensex 2030 Stocks?

Here's what Tanushree wrote...

- Now, in August 2016, we saw the passage of another landmark reform. Experts call the Goods and Services Tax (GST) the most important reform since '91. The bill could be a driver for the economy for a very long time. And one may assume that fundamentally well-placed stocks today could go on to unleash the big gains expected from a post-GST market. The sentiments today are reminiscent of Sensex '92. The blue chips of today may not be the blue chips of tomorrow.

Of course that does not mean one should not be investing in any Sensex stock today. We see steep earnings upside in few big blue chips over next three to four years. Hence, these could be amongst the safest investments for the medium term.

If you are interested to know more about the companies that have caught the StockSelect team's attention, do read this special report - Sensex 40,000: 4 Stocks to Profit from the Coming Stock Market Wave that is still available for download.

One of the most leading theories in development economics is the Lewis model. This relates to shift from the farm to the non-farm sector involving a transition from low-productivity jobs to high productivity ones.

The last employment survey conducted by the National Sample Survey Office (NSSO) suggested a positive development in the Indian economy in this regard. As per the survey, between 2004-05 and 2011-12, India's rural population has left farm jobs to take the up the non-farm occupations, mainly in the construction sector.

The NSSO data release was thus interpreted as the beginning of transformation in the country, where major population had moved to construction jobs.

However, the authenticity of this data has recently come under question. As an article in Livemint, suggests two labour economists, Jayan Jose Thomas and M.P. Jayesh of the Indian Institute of Technology (IIT) Delhi have raised the questions on the Lewisian transformation of the Indian economy. Their view is backed by the data reported in Census. As per the Census, farm workforce has increased between 2001-2010. While NSSO reports decline.

These contradictions just indicate the shoddy statistical standards followed in India. Data and the analysis based on it lays the foundation of economic policies. And when that is unreliable, we wonder how India will manage to assess its challenges and adapt itself to face them.

Anyway, for readers, it's a fresh reminder that all the theories and claims of development must be taken with the pinch of salt.

Apurva's First Ever Training Session

For those into technical analysis, we have some good news for you. Apurva Seth, the Managing Editor of Swing Trader, our popular charting service, will be conducting his first ever training session today at 5.00 PM.

You can attend the session from the comfort of your home or office and access it on your desktop or mobile. And before you ask...the video session is completely free. Yes, you read that correctly. Apurva wants the maximum number of people to benefit from the session. So we are inviting everyone who is interested in trading to attend.

And what's going to be the main agenda? Well, Apurva is calling it his Secret Profit Signal. Here's Apurva in his own words.

- Well, the Secret Profit Signal is a method I designed after years of tracking the markets. This signal has helped me identify numerous money-making opportunities in the markets. It has stood the test of time and delivered solid returns across market conditions.

During 2016, this signal has helped me identify numerous trading opportunities and delivered returns such as 11.15% in ten days, 18.24% in nineteen days, 15.79% in six days, and so on.

With this method, I have guided numerous mutual funds, insurance companies, and foreign institutional investors (FIIs) to solid profits. And since joining Daily Profit Hunter two years ago, I have been using the same method and guiding our subscribers to solid profits.

And now I want all our readers to benefit from it. That's why I am conducting this session and revealing my Secret Profit Signal.

Well, that's not all. There's also a surprise gift for everyone who attends - his 66-page PDF guide, Profit Triggers.

But this guide is only for those who are really serious about trading and attend Apurva's session, please book your seat for this training session immediately. The session will be live today post 5 PM.

In the meanwhile, Indian share markets continue to trade near the dotted line during the noon trading session amid mixed international markets. Major sectoral indices are trading mixed with stocks from metal and IT sector are leading the losses. While oil & gas stocks are leading the gains. At the time of writing, the BSE Sensex is trading higher by 64 points (up 0.2%) while the NSE Nifty is trading higher by 20 points (up 0.2%). The BSE Mid Cap index and BSE Small Cap index are both trading up by 0.8%.

04:50 Investing mantra

"Cash combined with courage in a crisis is priceless." - Warren Buffett

Today's Premium Edition.

Will India's Demographic Dividend Turn into an NPA?

Disruptive changes, more than the demographic dividend, should be the focus of investors.

Read On...

| Get Access

Recent Articles

- All Good Things Come to an End... April 8, 2020

- Why your favourite e-letter won't reach you every week day.

- A Safe Stock to Lockdown Now April 2, 2020

- The market crashc has made strong, established brands attractive. Here's a stock to make the most of this opportunity...

- Sorry Warren Buffett, I'm Following This Man Instead of You in 2020 March 30, 2020

- This man warned of an impending market correction while everyone else was celebrating the renewed optimism in early 2020...

- China Had Its Brawn. It's Time for India's Brain March 23, 2020

- The post coronavirus economic boom won't be led by China.

Equitymaster requests your view! Post a comment on "Of Jhunjhunwala, Indian Stock Markets, and the Unthinkable". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!