- Home

- Archives

L&T News & Analysis

Here you will find all the research and views on L&T that we post on Equitymaster. Use the tools to customize the results to suit your preference!

L&T 2020-21 Annual Report Analysis

Mar 31, 2023 | Updated on May 8, 2024Here's an analysis of the annual report of L&T for 2020-21. It includes a full income statement, balance sheet and cash flow analysis of L&T. Also includes updates on the valuation of L&T.

L&T Fact Sheet, L&T Financial Results - Equitymaster

May 8, 2024 | Updated on May 8, 2024Check out L&T fact sheet and L&T financial results online at Equitymaster.

L&T Quarterly Results - Equitymaster

May 7, 2024 | Updated on May 7, 2024Check out latest L&T Quarterly Results online at Equitymaster.

L&T Share price, NSE/BSE Forecast News and Quotes| Equitymaster

May 7, 2024 | Updated on May 7, 2024L&T: Get the latest L&T Share price and stock price updates, live NSE/BSE share price, share market reports, financial report, balance sheet, price charts, financial forecast news and quotes only at Equitymaster.com.

Top 5 Companies Anticipating Over 15% Revenue Growth

Top 5 Companies Anticipating Over 15% Revenue Growth

Mar 16, 2024

Worried about the market swings? These five stocks with ambitious growth plans can help outpace the market.

Tata Sons IPO: All You Need to Know

Tata Sons IPO: All You Need to Know

Mar 9, 2024

Investors see value unlocking in these Tata group stocks from the potential upcoming Tata Sons IPO.

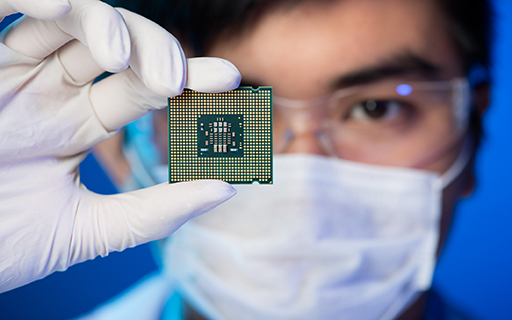

Top Semiconductor Shares in India 2024: Semiconductor Manufacturing Companies to Add to Your Watchlist

Top Semiconductor Shares in India 2024: Semiconductor Manufacturing Companies to Add to Your Watchlist

Mar 9, 2024

Realizing the need to break away from China and other geographies for semiconductor chips, India is setting up fab units at a breakneck pace.

The Long Term Upside in India's Defence Exports Megatrend

The Long Term Upside in India's Defence Exports Megatrend

Feb 8, 2024

Should you consider Indian defence stocks now? Find out...

Top 5 Data Centre Stocks to Add to Your Watchlist in 2024

Top 5 Data Centre Stocks to Add to Your Watchlist in 2024

Jan 4, 2024

Critical infrastructure like data centres could see massive investments in the coming years. Here are the top 5 stocks to watch out.

Top 5 Biggest Gainers of 2023. Will Their Dream Run Continue?

Top 5 Biggest Gainers of 2023. Will Their Dream Run Continue?

Jan 2, 2024

These five largecaps have delivered the highest returns to investors in 2023. What Next?

Modi's Massive Spending Could Lift these Top 5 Roads and Highway Stocks

Modi's Massive Spending Could Lift these Top 5 Roads and Highway Stocks

Dec 21, 2023

The government aims to elevate the road infrastructure to match that of the US within the next five years. Here are five stocks to watch out for.

Top 5 Green Hydrogen Stocks to Watch Out in Nifty's Run to 40,000

Top 5 Green Hydrogen Stocks to Watch Out in Nifty's Run to 40,000

Nov 22, 2023

As Nifty inches towards new highs, these green hydrogen stocks could also benefit given their massive investments in the green energy sector.

Does L&T have what it Takes to Become India's Next Favourite Stock?

Does L&T have what it Takes to Become India's Next Favourite Stock?

Nov 1, 2023

How sticky is L&T's business? And will it be successful in becoming the next wealth creator like HDFC? Read on to find out...

Top 5 Renewable Energy Stocks to Watch Out in Nifty's Run to 40,000

Top 5 Renewable Energy Stocks to Watch Out in Nifty's Run to 40,000

Sep 21, 2023

As Nifty inches towards new highs, these renewable energy stocks could also benefit given their massive investments in the green energy sector.

L&T's First Ever Share Buyback: Here's What Investors Can Expect...

L&T's First Ever Share Buyback: Here's What Investors Can Expect...

Jul 22, 2023

This is the first buyback of shares in the firm's 85-year history. Here's what the street is expecting from the engineering major.

5 Stocks Paying More Than 1,000% Dividend in August 2023

5 Stocks Paying More Than 1,000% Dividend in August 2023

Jul 16, 2023

These five companies are paying big dividends soon. Do you have any of them in your portfolio?

L&T's Next Big Leap in The Green Hydrogen Space

L&T's Next Big Leap in The Green Hydrogen Space

Jun 2, 2023

In line with its commitment to a sustainable future, L&T is poised to make significant strides in the green hydrogen landscape. More details inside.

Why L&T Share Price is Falling

Why L&T Share Price is Falling

May 13, 2023

After rallying non-stop on the back of significant and growing order-book, L&T shares have hit a roadblock. What next?

5 Stocks Hitting 52-Week High. What's Driving the Rally?

5 Stocks Hitting 52-Week High. What's Driving the Rally?

Apr 13, 2023

These five stocks have shown that if the fundamentals are strong then the company can survive even during bad and uncertain situations in the long run.

Top Gainers and Losers of March 2023

Top Gainers and Losers of March 2023

Apr 5, 2023

Here are the stocks that moved the most last month.