- Home

- Archives

SIEMENS News & Analysis

Here you will find all the research and views on SIEMENS that we post on Equitymaster. Use the tools to customize the results to suit your preference!

SIEMENS 2022-23 Annual Report Analysis

Sep 30, 2023 | Updated on May 2, 2024Here's an analysis of the annual report of SIEMENS for 2022-23. It includes a full income statement, balance sheet and cash flow analysis of SIEMENS. Also includes updates on the valuation of SIEMENS.

SIEMENS Fact Sheet, SIEMENS Financial Results - Equitymaster

May 2, 2024 | Updated on May 2, 2024Check out SIEMENS fact sheet and SIEMENS financial results online at Equitymaster.

SIEMENS Quarterly Results - Equitymaster

Apr 30, 2024 | Updated on Apr 30, 2024Check out latest SIEMENS Quarterly Results online at Equitymaster.

SIEMENS Share price, NSE/BSE Forecast News and Quotes| Equitymaster

Apr 30, 2024 | Updated on Apr 30, 2024SIEMENS: Get the latest SIEMENS Share price and stock price updates, live NSE/BSE share price, share market reports, financial report, balance sheet, price charts, financial forecast news and quotes only at Equitymaster.com.

Top 5 Largecap Stocks that Could Skyrocket in Modi's Next 5 Years

Top 5 Largecap Stocks that Could Skyrocket in Modi's Next 5 Years

Mar 29, 2024

Looking for largecap stocks for the long term? Check out these five that have BIG potential if Modi returns to power for one more term.

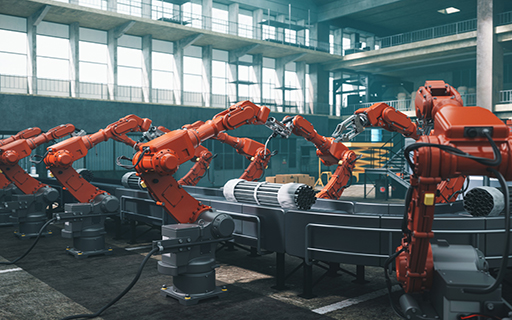

Top 8 Robotics Stocks to Watch Out in India's Deep Tech Revolution

Top 8 Robotics Stocks to Watch Out in India's Deep Tech Revolution

Mar 17, 2024

A comprehensive overview of India's robotics landscape, highlighting drivers of change and investment potential.

How China's Pivot Could Boost the Fortunes of these 5 Indian Companies

How China's Pivot Could Boost the Fortunes of these 5 Indian Companies

Nov 4, 2022

How the new China is creating wealth building opportunities in India.

The US$ 1 Trillion Sector of 2025: 4 Stocks to Watch Out for

The US$ 1 Trillion Sector of 2025: 4 Stocks to Watch Out for

Oct 26, 2022

Let's look at an important sub-sector and its stocks helping the manufacturing sector grow to US$ 1 tn over the next 5 years.

SIEMENS HEALTHCARE Share price, NSE/BSE Forecast News and Quotes| Equitymaster

Mar 21, 2011 | Updated on Mar 21, 2011SIEMENS HEALTHCARE: Get the latest SIEMENS HEALTHCARE Share price and stock price updates, live NSE/BSE share price, share market reports, financial report, balance sheet, price charts, financial forecast news and quotes only at Equitymaster.com.