- Home

- Views On News

- Feb 7, 2024 - Best Drone Stock: Ideaforge Technology vs Droneacharya Aerial

Best Drone Stock: Ideaforge Technology vs Droneacharya Aerial

Drones have been in use for more than two centuries now, but in India, the foundation for the growth of the drone industry was laid in 2021 when the government announced the new Drone Rules 2021.

After that, there was no looking back.

With a high possibility of drones becoming a part of everyday life in the future, the industry has high growth prospects.

From all the companies involved in this industry, we are comparing the two pure play top drone companies, Ideaforge Technology and Droneacharya Aerial Innovations.

Business Overview

#Ideaforge

Ideaforge is engaged in the business of developing and manufacturing manufacture vertical take-off and landing (VTOL) UAVs (unmanned aerial vehicles).

It also offers software and solutions to use UAVs in multiple sectors.

Currently, the company's drones are used in construction and real estate. They are also used in defence for conducting Intelligence Surveillance and Reconnaissance (ISR) operations along the borders.

Ideaforge has one manufacturing facility spanning 21,000 square feet, where it undertakes the manufacturing and testing of its products.

Apart from India, it has operations in Oman, Nigeria, and Bhutan.

The company is a leading player in the Indian unmanned aircraft systems market and also has the largest operational deployment of indigenous UAVs across India, with an Ideaforge-manufactured drone taking off every five minutes for surveillance and mapping.

It is also ranked 5th globally in dual-use category (civil and defence) drone manufacturers as per the report published by Drone Industry Insights.

# Droneacharya Aerial Innovations

Droneacharya Aerial Innovations is a pure-play drone company incorporated in 2017.

It provides a high-end ecosystem of drone solutions for multi-sensor drone surveys, data processing of drone data using robust high-configuration workstations, drone pilot training, and specialised GIS (Geospatial Information Systems) training.

The company's offerings are broadly divided into four categories, namely, training, services, surveillance, and others.

It has operations in India, the USA, the Netherlands, Dubai and Thailand. It is expanding its footprint further to several other countries.

Droneacharya is also setting up its own manufacturing unit to manufacture agriculture drones and drones for surveying and surveillance in the next two years.

| Particulars | Ideaforge | Droneacharya |

|---|---|---|

| Market Cap (in Rs billion)* | 33.0 | 4.4 |

| Order Book (in Rs billion)** | 1.7 | NA |

Between the two, Ideaforge has a higher market cap of Rs 33 billion (bn), as compared to Droneacharya, which has a market cap of Rs 4.4 bn.

Ideaforge also has an order book of Rs 1.7 bn from Indian defence, central armed police forces, state police forces, and private players.

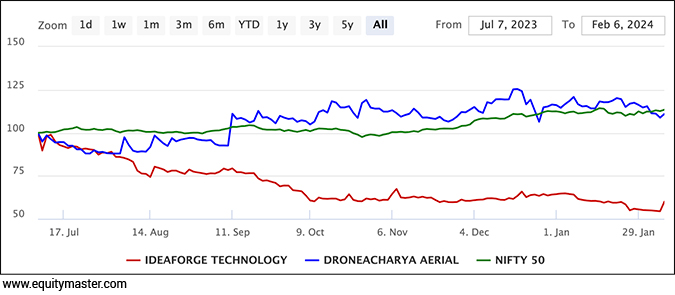

If we compare the performance of the two companies on the stock market in the last six months, then both companies have underperformed the benchmark Nifty 50.

Droneacharya Aerial gave a return of 11%, while Ideaforge fell by 40%.

# Revenue

In terms of revenue, Ideaforge has a higher revenue than Droneacharya Aerial Innovations.

Being a market leader in drone manufacturing has helped Ideaforge report higher revenue than its competitors.

Revenue

| Net Sales (in Rs m) | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 |

|---|---|---|---|---|---|

| Ideaforge | 182 | 140 | 347 | 1,594 | 1,860 |

| Droneacharya | NA | NA | NA | 36 | 186 |

If we see last year's revenue growth, Ideaforge's revenue has grown by 16.7% year-on-year (YoY), whereas Droneacharya's revenue has grown by 416.7%.

A high growth in revenue is primarily due to growth in its pilot training revenue. The company has tied up with reputed institutions to establish a DGCA-certified remote pilot training organisation (RPTO).

Droneacharya is now one of the most recommended DGCA-certified drone pilot training organisations in India.

It also introduced the franchisee model to set up drone training organisations across the country, which is helping the company grow its revenue at a faster pace.

# Profitability

In terms of profitability, Ideaforge is leading ahead of Droneacharya. The earnings before interest tax and depreciation of Ideaforge are almost ten times higher than Droneacharya.

The primary reason behind this is the high-margin tenders received by the company.

However, if we look at Droneacharya's profit numbers, the company has seen its profit grow at a high growth rate in the last three years.

Moreover, within five years of incorporation, the company turned profitable, which is a noteworthy achievement.

Profitability

| EBITDA (in Rs m) | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 |

|---|---|---|---|---|---|

| Ideaforge | -89 | -124 | -106 | 746 | 481 |

| Droneacharya | NA | NA | -1 | 6 | 50 |

| PAT (in Rs m) | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 |

| Ideaforge | -103 | -134 | -146 | 440 | 320 |

| Droneacharya | NA | NA | -1 | 4 | 34 |

| Gross Profit Margin | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 |

| Ideaforge | -48.9% | -88.4% | -30.6% | 46.8% | 25.8% |

| Droneacharya | NA | NA | -1488.0% | 16.0% | 27.0% |

| Net Profit Margin | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 |

| Ideaforge | -56.5% | -96.0% | -42.1% | 27.6% | 17.2% |

| Droneacharya | NA | NA | -1489.0% | 11.3% | 18.5% |

# Financial Efficiency

A company's financial efficiency can be measured using two ratios, namely, return on capital employed (RoCE) and return on equity (RoE).

Both measure a company's ability to generate profits from invested capital.

Financial Efficiency

| ROCE | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 |

|---|---|---|---|---|---|

| Ideaforge | -10.5% | -19.7% | -14.1% | 46.6% | 15.8% |

| Droneacharya | NA | 2290.0% | -14.1% | 3.7% | 7.1% |

| ROE | Mar-2019 | Mar-2020 | Mar-2021 | Mar-2022 | Mar-2023 |

| Ideaforge | -13.0% | -20.6% | -28.6% | 29.6% | 10.9% |

| Droneacharya | NA | 255.6% | -14.3% | 2.8% | 5.2% |

In terms of RoCE and RoE, Ideaforge is leading with a higher number when compared to Droneacharya.

# Debt Management

Both Ideaforge and Droneacharya are debt-free drone companies. They have capex plans, which they plan to fund through internal accruals.

Ideaforge is planning to develop new products to widen its portfolio further and retain its position as a market leader with a healthy market share.

Driven by its high investment in research and development (R&D), the company was granted seven new patents in Q4 FY2024.

Droneacharya, on the other hand, is investing in building its new manufacturing facility where it intends to produce drones.

It has tied up with Gridbots Technologies, an Ahmedabad-based company, to manufacture drones and other allied products.

The company also acquired a 51% stake in a drone manufacturing start-up to expand its manufacturing facilities further.

Given the company's high liquidity and high-interest coverage ratio of 141.7x, it can easily fund all the capex through internal accruals. The interest coverage ratio of Ideaforge is 8x.

# Dividend

Both Ideaforge and Droneacharya don't pay dividends to their shareholders.

Given the high growth prospects of the drone industry, the companies are focussing on reinvesting the profits rather than distributing them to the shareholders.

# Valuations

The real worth of a company can be measured through valuation ratios. They give us an idea of whether the share is overvalued or undervalued.

The most commonly used valuation ratios are price-to-earnings (P/E) and price-to-book value (P/Bv).

A high ratio in comparison to the peers indicates the company is overvalued, whereas a low ratio indicates it's undervalued.

Looking at a company's valuation ratios helps us make investing decisions.

| Valuations | Ideaforge | Droneacharya |

|---|---|---|

| P/E (x) | 103.6 | 61.3 |

| P/B (x) | 5.2 | 6.6 |

In terms of P/E ratio, shares of Ideaforge are highly overvalued compared to Droneacharya. However, in terms of the P/Bv ratio, shares of Droneacharya are overvalued.

If we see each company individually, both the companies are overvalued given the high growth prospects of the Indian drone industry in the next five years.

# Future Prospects

The Indian drone industry is in its infancy stage compared to the drone market in the USA, China, and Israel.

However, it is one of the fastest-growing drone markets in the world, growing at a CAGR of 10.3% between 2023 and 2028.

With the government's aim to make India a global drone hub by 2030, the Indian drone market is expected to reach Rs 2.5 trillion by 2030.

This growth is supported by the use of drone technology in multiple sectors, including defence, agriculture, logistics, mining, infrastructure, and oil and gas.

To add to this, several government schemes such as 'Drone Rules, 2021', the Product Linked Incentive (PLI) Scheme, and the Drone Shakti Scheme are encouraging the manufacturing and usage of drones in India.

It's no wonder that Indian drone companies attracted an investment of US$ 50 m in the financial year 2023.

With such a huge opportunity for growth lying ahead of them, both Ideaforge and Droneacharya are well-equipped to benefit from it.

Which Drone Stock is Better?

In terms of revenue, profitability and financial efficiency, Ideaforge is ahead of Droneacharya.

However, Droneacharya has an edge when it comes to revenue growth.

The company's franchisee model ensures pan-India expansion with limited investment.

In the case of Ideaforge, its vast product portfolio differentiates it from the competitors. The company's extensive investment in new product development is helping it boost revenue and profit.

While both companies have the capabilities to benefit from the growth, Ideaforge is ahead of Droneacharya as it is already manufacturing drones.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Best Drone Stock: Ideaforge Technology vs Droneacharya Aerial". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!