- Home

- Views On News

- Mar 9, 2022 - Top 4 Real Estate Stocks to Add to Your Watchlist

Top 4 Real Estate Stocks to Add to Your Watchlist

When demonetisation happened in 2016 there was a liquidity crunch in the financial system. The same thing happened again in 2018 during the IL&FS crisis.

Lenders tightened their fund tap thereby making it difficult for real estate companies to access funds. On top of that, lack of demand for homes added to their woes. The double whammy of these factors put the Indian real estate sector in a slump for years.

However, the Covid-19 pandemic brought about a paradigm shift in demand and the sector is back from the dead.

Demand is primarily driven by record low home loan rates bolstered by favourable government policies.

Mumbai, the financial epicentre, and the most expensive property market in India (according to Statista) is leading from the front. In financial year 2021, the city recorded the highest number of registrations in the past 10 years. The momentum seems to be strong in the ongoing financial year as well with no sign of flagging.

Many developers reported record pre-sales and collections for nine months ended December 2021. Besides record sales numbers, average inventory days fell from highs of 60 months in the financial year 2017 to 28 months in 2021.

This indicates robust demand that could continue going forward. Looking at the robust growth prospects of the sector, this article brings you the top 4 listed real estate players that deserves a place in your watchlist.

Here goes...

#1 Godrej Properties

Godrej Group is the single largest landowner in Mumbai. The group owns an estimated 3,400 acres of land in the country's most expensive property market. This land parcel has an estimated development potential worth Rs 1 tn.

Godrej Properties, the real estate arm of the Godrej Group, is delegated with the responsibility to carry out development projects on behalf of the group.

Being the largest developer in terms of residential sales, the company has a pan India saleable area in tune of 186 m square feet as of December 2021.

For nine months ended 31st December 2021, the company sold 6.6 m square feet of area, a drop of 1% compared to previous year. However, it reported a 13% growth in booking value year-on-year (YoY).

The company had an unsold inventory (completed projects) worth Rs 53.5 bn as of December 2021. After accounting the impact, lockdowns had on the company's inventory; Godrej Properties takes around 900 days to sell off its inventory.

On the balance sheet side, the company is deleveraging its books as it reported a net debt to equity ratio of 0.04x compared to 0.64x reported in the corresponding period of the previous year.

Godrej Properties has a huge cash bank of which Rs 75 bn is to be invested over the course of the next 12-18 months to acquire and develop new real estate projects across four key markets - Mumbai, Delhi-NCR, Pune, Bengaluru - where the company has a strong footing.

For more details, check out the company's factsheet and quarterly results.

#2 DLF

Gurugram is to DLF, what Mumbai is to Godrej. DLF owns 104 m square feet of land in Gurugram also known as DLF city. Gurugram accounts for 56.2% of DLF's total land bank.

DLF is one the leading brands in the Indian real estate sector. It has a vast experience of 75 years in developing residential as well as commercial projects.

The company has developed more than 330 m square feet of underlying area across 150 projects since inception. It owns land units with development potential of more than 215 m square feet.

DLF's commercial projects are home to many top IT and Fortune 500 companies.

In December 2021, the company reported record sales with booking value growing 97% YoY. The company sold a total of 1.2 m square feet during the same period.

For nine months ended December 2021, DLF's revenue and net profit grew by 13% and 78% compared to the corresponding period of last year.

As of December 2021, DLF had a total inventory (completed projects) worth Rs 41 bn. The company takes an average of 1,311 days to clear off its inventory which is higher than the industry median.

As far as debt is concerned, the company had total net debt worth Rs 32.2 bn as on December 2021. This translates into a net debt to equity ratio of 0.09x.

The company is committed to reduce debt by focusing on premium residential projects and increasing the rental yields.

For more details, check out DLF's factsheet and quarterly results.

#3 Sobha Ltd

Sobha Ltd is an Indian multinational real estate developer headquartered in Bengaluru. Incorporated in 1995, the company develops and offers residential as well as commercial properties across major cities in India.

Moreover, it offers end to end engineering, procurement, and construction (EPC) solutions under its contract business. Its clients include some of the largest corporations of India such as Infosys, ITC, HCL Technologies, etc.

Sobha is the only backward integrated real estate developer in the country. What this means is that the company manufactures all the materials that goes into their projects be it furniture, concrete blocks, aluminium doors, and windows, even mattresses to that extent.

This helps the company to reduce their input costs to a significant extent. As a result, the company's gross margins expanded at a CAGR of 11% over the last five years.

Sobha Ltd Gross Margins (FY17-21)

| FY17 | FY18 | FY19 | FY20 | FY21 | |

|---|---|---|---|---|---|

| Gross margins (%) | 19 | 18.7 | 19.6 | 29.7 | 32 |

In a fiercely competitive market wherein developers take anywhere between 500-600 days to sell a property unit, Sobha sells a unit in just 136 days.

The developer does it by dispersing its projects across major IT hubs instead of concentrating on just one city.

As of December 2021, the company had unsold inventory (completed projects) worth Rs 3.2 bn which is one of the lowest in the industry.

Sobha Ltd Revenue & Net Profit (FY17-21)

| (Rs m, consolidated) | FY17 | FY18 | FY19 | FY20 | FY21 |

|---|---|---|---|---|---|

| Revenue | 22,120 | 27,791 | 34,421 | 37,539 | 21,098 |

| Net Profit | 1,478 | 2,169 | 2,970 | 2,817 | 623 |

The company had been reporting stable numbers until the pandemic broke out.

The first two quarters was a total washout with sales plunging drastically due to nation-wide lockdowns.

However, demand came roaring back driven by low interest rates and the company saw a decent recovery.

Since then, the company has been reporting good numbers every quarter. In December 2021, its bottomline grew 51.4% compared to the corresponding period last year.

Owing to high debt, the net profit margin of the company is pretty low. Sobha's debt to equity ratio is more than 1.07x as of December 2021. However, going forward, the company is confident of bringing down the ratio below 1x.

The company has been rewarding its shareholders with dividends quite consistently.

Sobha Ltd Dividend Per Share (FY17-21)

| FY17 | FY18 | FY19 | FY20 | FY21 | |

|---|---|---|---|---|---|

| DPS (in Rs) | 2.54 | 7 | 7 | 7 | 3.5 |

For more details, check out Sobha's factsheet and quarterly results.

#4 Sunteck Realty

Sunteck Realty is one of the fastest growing real estate developers based out of Mumbai.

Though the company develops residential and commercial projects, it is largely focused on residential projects with 72% of its projects being residential projects.

Sunteck has a portfolio of 21 projects spread across Mumbai. This makes Sunteck a city centric developer focusing on a single market.

Sunteck's projects together have a floorspace of 50 m square feet.

The company had an unsold inventory worth Rs 17 bn as of December 2021 which it aims to clear off in the next 3-4 years.

Sunteck's inventory days are quite reasonable as per the industry standards. The company sells one unit of its property in 300 days (less than a year).

For nine months ended December 2021, the company saw its sales bookings grow 23% YoY.

Even though the industry is capital intensive, Sunteck is less leveraged when compared with its peers.

Its net debt to equity ratio stands at 0.16x as of December 2021. The company aims to clear off the remaining debt in the next 3-4 years.

For more details, check out the company's factsheet and quarterly results.

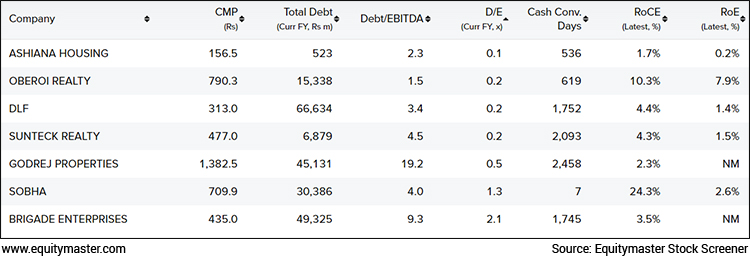

Snapshot of Top Real Estate Players in India from Equitymaster's stock screener

Here's a quick overview of these companies based on some crucial financials.

Please note these parameters can be changed according to your selection criteria.

This will help you in identifying and eliminating stocks that are not meeting your requirements and give emphasis on those stocks that are well inside the metrics.

Treading cautiously in tumultuous times

Though the Indian real estate sector is in an upbeat mood, a rate hike could dampen the mood quickly.

As the conflict between Russia and Ukraine intensifies, a rate hike is highly likely to tame the inflation monster.

In such a volatile environment, make sure that you invest in a company with robust cash flow along with minimal debt.

Here's what Tanushree Banerjee, Co-head of Research at Equitymaster, has to say about the realty sector.

- The biggest drag on real estate players is high debt and with interest rates moving up, investors need to be wary of realty companies with the tendency to pile up debt and dines with poor cash flows.

Also, this is a sector where investors have to be very careful about the management quality. Poor accounting and lack of corporate governance has been the reason for many large realty companies performing poorly in the past.

Make sure you analyse the fundamentals thoroughly before investing in any real estate company.

Also, investing in a staggered manner would help you tide over the volatility.

Happy investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Top 4 Real Estate Stocks to Add to Your Watchlist". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!