- Home

- Views On News

- Apr 2, 2024 - Tourism Stocks are Booming. Here are 5 You Should Track Closely...

Tourism Stocks are Booming. Here are 5 You Should Track Closely...

The Indian travel and tourism industry is gearing up for robust growth in the coming years, driven by strong demand.

Travel and tourism are two of the largest industries in India, contributing significantly to the country's GDP with a total of over US$ 185 billion (bn).

According to IBEF, this number is poised to reach US$ 512 bn by 2028, implying a compounded annual growth of 22%.

The recent optimism among hoteliers and tourism companies is fuelled by sustained demand for domestic leisure travel, coupled with the revival of meetings, incentives, conferences & exhibitions, and business travel.

Adding to the positive sentiment, finance minister Nirmala Sitharaman announced in February this year that long-term interest-free loans will be given to states to develop tourist centres.

In the budget announcements, the tourism sector was given a special mention.

With an uptick seen across segments and more in the experiential travel segment, the outlook for the entire tourism sector looks positive.

Let's look at some of the companies that could be big beneficiaries of this tourism boom...

Please note, these companies are filtered using the Equitymaster Stock Screener.

#1 Easy Trip Planners

Among all the diversified companies involved in the tourism industry, one primary beneficiary is online travel aggregator (OTA) platform Easy Trip Planners.

Easy Trip Planners offers a comprehensive range of travel, related products and services under the flagship brand ''Ease My Trip''.

Shares of the company saw a sharp spike after the company posted a 13.5% growth in its revenue to Rs 1.6 billion (bn) in the December 2023 quarter.

In the quarter gone by, the company reported its highest profit after tax as it started charging convenience fees on some sectors in the air segment.

For the first nine months of the fiscal year, the company sold 83.7 lakh air tickets (net of cancellations), accompanied by 3.8 lakh hotel night bookings and 7.7 lakh in other bookings.

Apart from Q3 results, the other reason why shares of the company gained traction is because it announced opening a 5-star hotel in Ayodhya back in February 2024 when Ram Mandir became an investing theme.

The company's board in-principally approved the proposal to open a 5-star hotel in Ayodhya, strategically situated near the iconic Shree Ram Mandir.

Going forward, the company is aggressively looking to grow its air ticketing business and enhance presence in non-air segments such as hotels, holidays, and transportation on a global scale.

The company is open to both - organic and inorganic routes to expand domestically. In December 2023, it acquired a stake of approximately 13% in ECO Hotels and Resorts chain.

It also introduced EasyDarshan, offering pilgrimage packages, and launched 'Explore Bharat' to showcase India's rich heritage to international travellers.

The company's management has highlighted that they're projecting a profit before tax (PBT) of Rs 2.5 bn in FY24.

Note that Easy Trip Planners has not had a single year of loss in the last 12 years, and has managed to double its topline and grow its profits by 5x between FY17 and FY22 and has even started paying dividends FY21 onwards. Not to forget the company is almost debt free.

Besides, the company checks the quality mark when it comes to management.

#2 Rategain Travel Tech

A software solutions provider to the entire tourism industry, Rategain Travel Tech is a market leader.

The company plays a crucial role in helping the hospitality industry with dynamic pricing, a strategy that involves varying the price for a product or service to reflect changing market conditions.

Specializing in Software-as-a-Service (SaaS), it operates discreetly within the shadows of the hospitality industry.

Rategain uses its AI-powered tech platform to help clients like hotels, airlines and online travel sites attract guests, provide services, and boost engagement. The aim is to increase their share of customer spending.

While an airline will know your travel preferences or food choices during flights, or a hotel may be aware of your room preferences and late-night cravings, this information isn't made available to everyone in the industry.

Rategain addresses the information gap by gathering data about travellers, including their behavioural patterns, and packaging it into user-friendly software to share across the industry.

This empowers the company to provide vital market insights, such as the fact that 94% of travellers switch between devices while planning a trip, 73% prefer booking their entire trip on one website, and there's a 2X increase in the percentage of travellers booking due to deep discounts.

With a track record of successful integration, the company has acquired more than five different firms in the last five years.

This strategic move has solidified its dominance in the business, serving 23 of the top 30 hotel chains, 25 of the top 30 online travel agencies (OTAs), along with all major car rental companies and cruise lines.

Rategain Financial Snapshot (2019-23)

| 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | |

|---|---|---|---|---|---|

| Revenue Growth (%) | 67.81% | -42.29% | 45.07% | 52.71% | |

| Operating Profit Margin (%) | 12.96% | 8.72% | 8.20% | 13.26% | 18.85% |

| Net Profit Margin (%) | 4.22% | -5.04% | -11.39% | 2.30% | 12.10% |

| Return on Capital Employed (%) | 8.15% | -3.76% | -5.02% | 3.61% | 10.65% |

| Return on Equity (%) | 7.65% | -14.60% | -16.90% | 2.09% | 10.54% |

The business has been recovering well since it was hit by covid. While the total revenue has been growing steadily, the company has managed to turn the business around, reporting a profit in FY 2022.

Rategain has been reporting steady growth in booking volumes on the back of healthy travel demand while driving the Return on Advertising Spend (RoAS) via its integrated digital marketing products.

Despite the acquisitions, the company boasts a healthy balance sheet with no debt on its books.

#3 Safari Industries

Next on this list is Safari Industries.

The company is engaged in the business of manufacturing and trading luggage and luggage accessories under the Safari brand.

The company manufactures its hard luggage using PolyPropylene (PP) and Polycarbonate (PC) at its manufacturing plant located in Halol, Gujarat.

The soft luggage is basically imported by the company and is made from a variety of fabrics.

Safari Industries, one of the favourite stocks of ace investor Ashish Kacholia, has turned around big-time since the Covid slump. Since its Covid-19 lows, the stock has given multibagger returns of over 500%.

For the September 2023 quarter, Safari Industries' revenue grew by 18% compared to last year's Rs 3.7 billion (bn), while it reported net profit growth of 53.7% year-on-year to Rs 398 m.

For FY23, the company recorded a total revenue of Rs 12.2 bn. Between FY19 and FY23, the company has posted a CAGR growth of 20.5% in its revenue.

The company is gearing up for a significant move, allocating funds of up to Rs 2.2 bn to establish an Integrated Greenfield Manufacturing unit.

Presently, the company is active in 80 stores. It had plans to extend its presence to nearly 140 stores by the end of financial year 2024. So we'll have to wait for the analyst call to see whether the management has lived up to expectations.

To increase profitability by streamlining operations, the company plans to open four new retail locations every month.

The company plans to expand its premium product line, which will help increase its margin in the next two to three years.

By catering to the discerning needs of premium customers, the company aims to attract higher-value sales, which can significantly improve its profit margins.

#4 BLS International Services

Next on this list is BLS International.

Part of the four-decade-old BLS Group, BLS International has a global presence and provides a diversified range of services.

It's one of the biggest global players in visa application outsourcing.

The company operates as a specialist provider for outsourcing visa, passport, and attestation services. It serves diplomatic missions by managing all administrative and non-judgmental tasks related to the entire life cycle of a visa application process.

In the past one year, BLS International share price has surged 89% while its 5-year gains stand at 789%!

Earlier this year, the company through its wholly owned subsidiary, entered into an into a definitive agreement to acquire 100% stake in iData Danismanlik Ve Hizmet Dis Ticaret Anonim Sirketi ("iDATA") and its wholly owned subsidiaries for Rs 4.5 bn.

According to industry experts, this acquisition is expected to have strong operational and financial synergies for the group.

Recently, the company also successfully completed an IPO for its subsidiary BLS E-Services.

Going forward, BLS International is expected to fare well, backed by steady growth in tourism industry and improved penetration in digital business through on-boarding of new customers.

#5 Thomas Cook (India)

Last on this list is Thomas Cook.

The company offers a broad spectrum of services, including foreign exchange, corporate travel, leisure travel, visa & passport services, and E-Business.

Thomas Cook is a solid brand and a solid company. Unfortunately, it was the biggest casualty of covid when travel, especially international, travel ceased.

People associate Thomas Cook as a tour operator but there is much more to the company. It also gets a decent amount of revenue from a subsidiary, Digiphoto Entertainment Imaging, which takes photos and videos of visitors at tourist attractions.

After posting losses in FY20, FY21 and FY22, the company finally became profitable and posted a PAT of Rs 100 m in FY23.

For the first two quarters of FY24, it has already posted good numbers, thereby taking its half year profit to Rs 1.3 bn, compared to a profit of Rs 65 m posted in FY23.

The company has had a remarkable turnaround over the past 3-4 quarters despite international travel not having fully resumed.

In terms of demand, most of the segments have recovered since Covid. Some segments like leisure, hospitality, and the digital imaging segment are doing better than pre-covid. In fact, most segments have reached 85-90% of pre-covid levels.

A pure analysis of the past 5-year numbers would tell you a different story and suggest to never invest in the stock. But in this case, the turnaround has happened since the past 2-3 quarters.

The company recently conducted an OFS of 40 million equity shares, its promoter Fairbridge Capital, being the seller.

In the next two quarters, the company is expecting even more growth. Thomas Cook's cruise business in particular is doing exceptionally well. The company is the highest seller for Cordelia cruises.

#6 Bonus Stock Pick!

Finally, we'll end the list of tourism related stocks to track, with none other than IRCTC.

Indian Railway Catering and Tourism Corporation of India (IRCTC) is a public sector company established to improve, manage, and professionalise the hospitality and catering services of Indian Railway stations.

It also promotes domestic and international tourism with exclusive tour packages and hotels.

IRCTC is the only entity authorised by Indian Railways to offer online railway tickets. The company charges convenience fees in the range of Rs 15-30 per ticket.

It's also the only entity authorised to manage catering services on trains and major static units at railway stations.

The company also enjoys a monopoly in packaged drinking water. It's the only entity authorised by the Ministry of Railways to manufacture and distribute packaged drinking water at all railway stations and trains under the 'Rail Neer' brand.

IRCTC has seen a sharp jump in online ticketing volumes over the past decade. Having a monopoly in railway ticketing, it fetches operating margins as high as 80% compared to barely 10% and 20% margins in the catering and packaged water businesses.

These are very few stocks like IRCTC that sport excellent fundamentals thanks to their unique positioning and strong government back. Above all, it is the lack of competition from the private sector that has kept their financials impressive.

For more, check out our detailed video on IRCTC where we talk about its near term growth triggers:

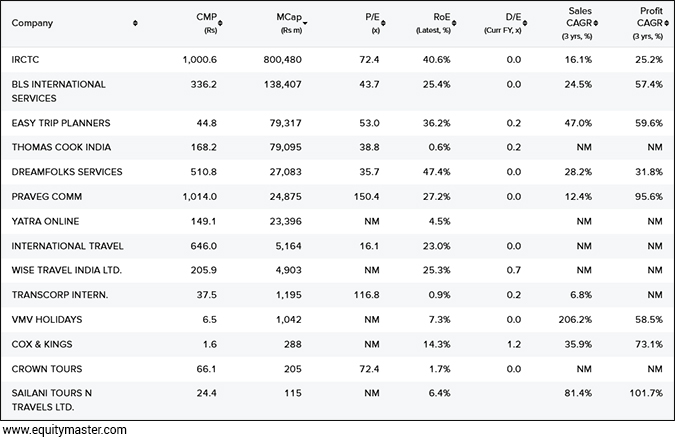

Snapshot of Top Tourism Stocks on Equitymaster Stock Screener

Here's a table comparing the above stocks on various parameters -

Please note that these parameters can be changed according to your selection criteria.

This will help you identify and eliminate stocks not meeting your requirements and emphasise those stocks well inside the metrics.

In Conclusion

We believe the tourism industry will be a huge growth industry in India's future.

For now, this is something that might seem like an alien concept to many investors. After all, we think only rich people go on luxury vacations. It's hard for most Indians to imagine a middle class family going on a luxury cruise.

But there is nothing unusual about this. It happens all the time in the developed world. One only needs to look at the spending patterns of people in richer countries to see how this will play out in India.

Of particular interest to investors should be companies that are going the extra mile to deliver customised experiences for travellers.

Plain vanilla tourism will soon be a thing of the past in India. That day will come sooner than you think.

If you're looking for a great 10-year investment, then take a hard look at customised travel and tourism. You might find a 100-bagger here.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Tourism Stocks are Booming. Here are 5 You Should Track Closely...". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!